Investing | Article

5 Things To Look At Before Buying Any Stock For The Savvy Investor

by Nicole Ng | 9 Sep 2022 | 9 mins read

This article was brought to you by HSBC Personal Banking.

Most of us know that investing in the stock market is the most common way to build long-term wealth. And if you don’t have the time or know-how to pick stocks, you can buy into a basket of stocks through a stock exchange-traded fund (ETF).

Anything beyond that though, which is basically stock picking, can seem like a mysterious incomprehensible superpower that is exclusive to a few people. After all, there are thousands of stocks in the market, anyone who can pick the ones that will soar in value must have some special intuition or superpower that most of us don’t.

Well, the good news is that most long-term (this is key) investors who invest in individual stocks don’t rely on gut feeling. Rather they rely on a set framework to assess whether a stock can earn them returns in the long run, and this framework essentially answers the question “Is this a good business to put my money in?”

Whether the company is a good business is essential knowledge because buying a stock makes you part owner of a very real business. And you should consider the factors that would make a business successful and ask yourself these questions before investing in any particular stock.

1. How does the company make money?

The aim of every business is to generate money, and they commonly do this by selling a product or a service to a customer. When thinking about buying a stock, it helps to know what the business does and who its customers are. This will clue you into how the business makes money.

For instance, a consumer technology company makes money by selling phones, TVs, and computers to consumers, online social media platforms make money by selling advertising space to businesses, and semiconductor companies make money by selling computer chips to computer manufacturers.

There are also businesses with multiple revenue streams, sometimes known as conglomerates, that generate revenue from multiple sources. Entertainment conglomerates can earn from online subscriptions, movie ticket sales, licenses to TV channels, and merchandise sales. This could be a bigger opportunity to make more money than businesses with just one revenue stream at times.

When you have a better understanding of how a company makes money, and who its customers are, you can better evaluate the company’s earnings potential.

2. Is the company profitable? And can they continue to be profitable in the future?

When you buy stock, you should have a business owner mindset, and think of buying a stock as if you were running a business yourself. As a business owner, you would usually want your business to make profits, and use these profits to grow your business or distribute them to other owners as a reward.

But not all companies that offer stocks are profitable businesses. A company can have high sales and still be loss-making if its expenses exceed its sales. In other words, if a $1 million dollar business requires $1.1 million dollars to operate, that business is losing $100,000, and hence, isn’t profitable.

So, before buying a stock, here are a few questions you can ask:

- Is the company currently profitable?

- If it isn’t, do you think the company will be profitable in the future and why?

- If the company is currently profitable, are its profits growing, declining, or stagnant each year?

If you’re looking to buy a stock that isn’t profitable right now, don’t just write it off immediately. You might want to evaluate the likelihood that it will make profits in the future and make decisions based on how long the company will take to do so according to what you’ve researched about the business.

Another thing to look out for is if a company’s profits are declining each year. This could be due to reduced demand for the company’s products or an increase in the company’s operating costs. By knowing the cause, you can determine if the business has the longevity you need it to have for it to make sense for you to invest.

3. How much debt has the company taken on?

Another important aspect when assessing any company is looking into its debt.

Most companies take on debt to fund the business. But how much debt a company has relative to the capital invested by the shareholders, otherwise known as the debt-to-equity ratio, will tell you more about the company’s financial health.

Just because a company has a high debt-to-equity ratio doesn’t necessarily mean that buying its stock is a bad investment. It merely means that the company is a riskier investment because the chances that it will have issues paying back the debt in the event of a crisis are higher.

Such companies are also more sensitive to economic changes. When interest rates go up, the company will have to set aside more money to pay for the interest payments on its loans, and this puts pressure on the company’s profits.

Related

4. What is the company doing to stand out from its competitors?

Nearly every business has rivals that sell similar products and are competing for the same group of customers. Part of your research before buying any stock would include comparing its business with others in the same industry.

This includes evaluating how a company fares against its competitors in terms of profits — is it more profitable than the others? You can also look at the company’s market share, or see how much of its potential customer base the company has already captured compared to its competitors.

When a company you’re thinking of investing in has only captured 20% of the market, while its competitor has 80% of the market share, it will have a harder time growing its revenue because most of its potential customers are buying from its competitor.

Besides profits and market share, assess the company’s competitive advantage. Does the company have a unique edge that makes it difficult for a competitor to swoop in to steal its customers? Having a healthy demand powered by unique offerings and few competitors is a more attractive option than a company with many others that sell the same product.

5. Who are the people leading the company?

While buying a stock makes you part owner of a company, you won’t need to be hands on in running the business. That’s the beauty of being a stock investor — you can own a company without needing to get your hands dirty as the company already has a management team that runs it.

But while you don’t need to touch anything, as part owner of the business, you’ll still want to make sure it’s in good hands. So, take some time to look up the leadership in the company. Who is the CEO, CFO and other C-suite members? How long have they been with the company and do they have a strong, credible, and relevant background that inspires confidence that they can lead the company to greater profits?

It’s not too difficult to find most of this information. Annual reports usually contain information about the company’s leadership and they will pop up in the news too. Some leaders are also public figures who have an online presence and may also communicate company decisions directly to the public through their public platforms like social media, events, and videos.

At the heart of any successful business is a good leadership team that is steering the company, and you would want to put your money in the hands of people you think you can trust.

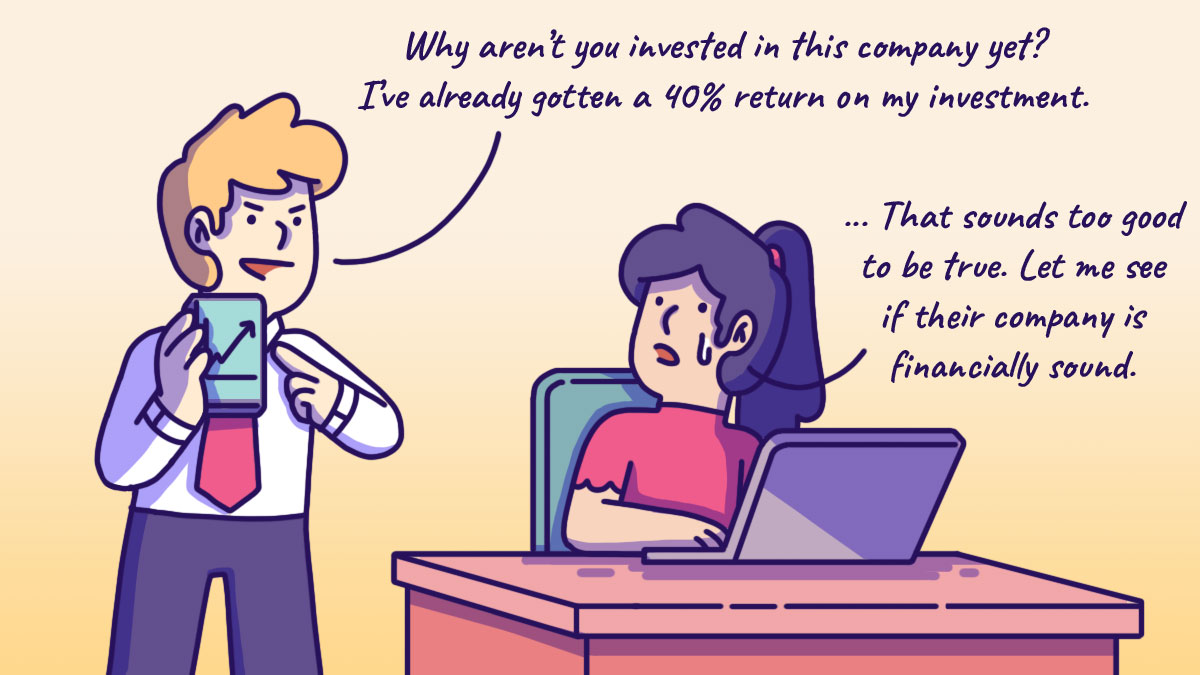

Don’t buy based on hype or feeling, always do your research

There will always be trends in the stock market and stocks everyone talks about. And just because a stock’s price goes up doesn’t mean that a company is financially viable — prices can go up just because of hype.

Making a quick buck may be possible with hype, but these companies may not be sustainable over the long run. As a long-term investor, you want to look for financially healthy companies that not only do well during a bull market but can also survive a downturn.

Thus, investing in individual stocks is more about having a methodical approach to determine whether the company is a good investment, and less to do with what other people say about the stock.

As the most renowned individual stock investor, Warren Buffet, puts it, “All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies”.

Content sponsored by HSBC Personal Banking.

Start your investment journey with HSBC Personal Banking. Open an HSBC Everyday Global Account and start investing with an HSBC Investment Account to receive S$200 in cash rewards*. Offer valid till end Sep 2022.

Plus access these benefits when you invest with HSBC:

– Multi-currency account plus up to S$600 cashback and bonus interest each month with HSBC Investment Account

– Competitive equities brokerage fees with same day buy and sell capability

– Trade on the go and manage your investments in one view via the HSBC Singapore app.

*Terms and conditions apply. SGD deposits are insured up to S$75k by SDIC.

Disclaimer

You should not use or rely on this material in making any investment decision. This material is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment nor shall it or any part of it form the basis of, or be relied on in connection with, any contract or commitment whatsoever. Before you make any investment decision, you may wish to consult a financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. The value of investments and units may go down and up, and the investor may not get back the original sum invested. Past performance is not necessarily indicative of future performance. Investors and potential investors should read the relevant prospectus or product information before investing.