Budgeting | Personal Finance | Article

5 Smart Tips To Manage Your Monthly Expenses

by The Simple Sum | 10 Jul 2024

Sponsored content by Standard Chartered Bank Singapore.

It’s almost payday.

With your funds running low, you look forward to your next paycheck for much needed respite as there are plenty of things to pay for.

Sounds familiar?

Many of us deal with the same problem of not having enough money to last us each salary cycle. This is normal, especially now with rising inflation as things are getting more expensive. Our ability to afford normal goods such as groceries and food is shrinking because we haven’t gotten the salary increments to match that inflation.

So, knowing how to manage your finances effectively becomes even more important. If you struggle with your finances every month, you might want to try these five tips.

Tip 1: Track your expenses to find out where all your money is going

Tracking your income and expenses gives you invaluable insights into your financial behaviours, which enables you to make more informed decisions on how you can allocate your money better.

You can start by outlining all your income and expenses such as rent, utilities, groceries, transportation, debt repayment, savings and discretionary spending.

Once you have this comprehensive overview, you can budget and pinpoint areas where you can cut back on. Identifying areas where you can reduce spending helps you allocate your money better.

Related

Tip 2: Plan for irregular and discretionary expenses

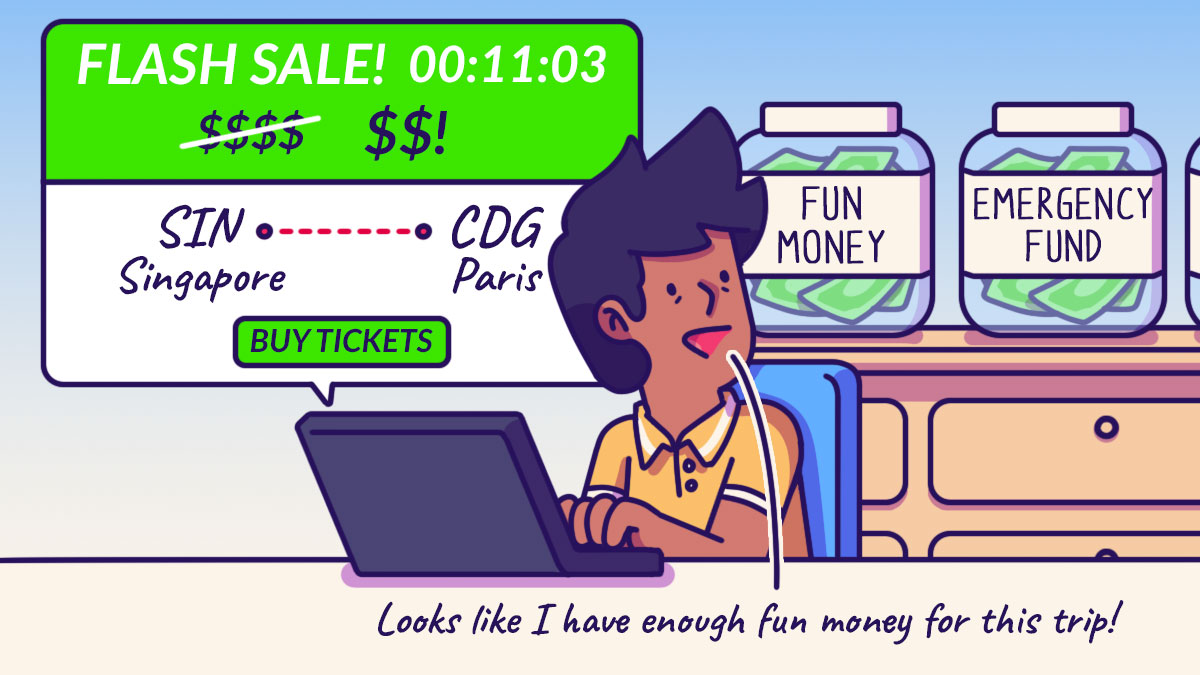

Despite the common advice not to spend unnecessarily, it is important to allocate some money towards an irregular or discretionary fund. This fund allows you to pay for irregular expenses such as home maintenance costs and indulge in hobbies, travel and dining out without compromising on your savings or financial goals.

Whether you’re jumping on a half-price ticket to Europe for precious family bonding time, planning to propose to your partner but haven’t saved enough for a ring, or needing to buy a new washing machine and dryer, these expenses can enhance your quality of life and overall happiness. After all, life is about the small moments that make it worthwhile, so while we advocate being prudent with your money, you also shouldn’t miss out on enjoying life moments or conveniences that matter.

Many retailers and financial institutions these days offer flexible instalment plans that allow you to spread the costs of a purchase over several payments with little to no interest. These allow you to afford larger purchases as you don’t have to pay a huge lump sum for it upfront.

However, you should approach instalments practically and evaluate whether you can afford the payments without overextending yourself financially before you opt in.

Tip 3: Avoid living paycheck to paycheck by setting up an emergency fund

The feeling of living paycheck to paycheck is not great. Getting out of that cycle is crucial for financial stability and peace of mind. One way is by setting up an emergency fund, a financial safety net to pay for unexpected expenses, so you don’t have to dip into your savings.

To build your emergency fund, set aside a small portion of your income every month. While the amount may look small at first, over time, these contributions will grow into a substantial amount. However, it is important that you treat your emergency fund with discipline and restraint and avoid dipping into it unless there is a genuine emergency, such as an unexpected illness or job loss. This differs from irregular expenses that are more predictable

Tip 4: Pay your bills on time and keep track of your subscriptions

Always ensure that you pay your bills on time to avoid incurring late fees and penalties as the money spent could be put to better use. Prompt payments also prevent you from getting a negative credit score, which is needed if you plan to secure car, housing, or education loans in the future.

If you need help staying on track, set up reminders or automatic transfers to ensure that you don’t miss any payments.

Tip 5: Take advantage of promotions, discounts and cashback

Shop like a pro and time your purchases to coincide with sales periods. By doing so, you can take advantage of discounted prices to maximise your savings.

A useful tool that can help you maximise your savings is a credit card. Not only do you get rewards such as cashback, discounts, points or miles, you can also manage your finances by splitting purchases on your credit card into instalments!

If you don’t own a credit card, shop for one that matches your spending habits and offers rewards tailored to your lifestyle.

Content sponsored by Standard Chartered Bank Singapore.

Pay smarter and choose to convert your retail purchases into 3- to 12-month instalments with Standard Chartered EasyPay, when you spend on your SC Credit Card.

From now till 19 July, pay for your purchases in instalments with EasyPay and get 100% cashback on the processing fee for your first EasyPay. Simply register for the Spend & Win promotion via SC Mobile.

Find out more here.

Don’t have a SC Credit Card? Apply today.