Investing | Article

Is This A Safe Investment? Here’s What To Watch Out For When Investing In Products

by The Simple Sum | 28 Aug 2024

The rise of online investing platforms in recent years has disrupted the once secured and tightly protected industry. Many new investing platforms and product offerings are not regulated, leaving consumers vulnerable to losing their investments.

When the markets went south in recent months, many investors who invested with unregulated online platforms lost their investments. These investment platforms failed in their business and couldn’t pay investors back.

The financial industry is traditionally tightly regulated by the authorities because it deals with trillions of dollars of public money.

There are guidelines, rules and regulations on how financial institutions such as stockbroking firms, insurance companies and banks work and handle customers’ money. Regulations are a way to protect investors’ money from being mismanaged and scammed.

Before you invest, here are some tips to understand and assess the risk differences between regulated and unregulated investment platforms.

Related

With the ‘Uber’ moment in the financial industry, came new challenges to investors’ protection

In recent years, leveraging technology, many alternative online investing platforms have mushroomed globally and disrupted traditional financial businesses.

They have made investing more accessible, cheaper and convenient.

Using these online investing platforms, it takes a new investor less than thirty minutes to set up an investment account, transfer money and start investing. This is how easy and convenient investing has become.

But because they are unregulated and trade in unregulated products, investors are vulnerable to losing their investments.

Although not all unregulated investment products and online trading platforms are unsafe, they are more prone to fraud and losses. They carry a higher risk because they are not subjected to any rules or regulations in their product offerings and business operations.

How to Protect Yourself?

If you are just starting your investing journey, you may not know what to do to protect your investments. Here is a simple guideline of things to look out for before you start investing.

The three critical things you need to check before you invest are; whether they are regulated and how your money and investments are protected.

Checklist 1: Deal only with licensed financial institutions and authorised dealers

To protect your investments, it is advised that you deal only with licensed and authorised companies and their representatives.

Check the licenses, registration and authorisation of financial institutions before dealing with them. Although regulations do not alleviate all the investment risks, investors are safeguarded by the proper due diligence process mandated by the regulators.

When you deal with licensed financial agents, you are assured that they are qualified by the regulator’s stringent licensing process to give you investment advice and also handle your monies and investments according to a proper set of regulations.

But investors have to be cautious that sometimes licensed agents can turn fraudulent.

There have been many cases of investors’ money going unaccounted for. So, never deposit your money into any personal bank accounts. All payments should only be made to the official bank accounts of companies authorised by authorities.

Check for financial regulationsFinancial regulations are rules and laws that companies and individuals in the financial industry, such as banks, stockbroking firms, insurance companies, financial brokers and asset managers must follow. Financial regulators licence and subject financial intermediaries (companies and individuals) to certain requirements, restrictions and guidelines to ensure the safety and soundness of the financial system and protect consumers. Regulators set the criteria for investment products such as stocks and mutual funds before they can be sold to investors. These oversights by the financial regulators give a layer of protection to investors when investing. |

Checklist 2: Are your investments in your name?

When investing, always check if your asset purchases are stored in a depository custodian or designated account in your name.

Regulated financial institutions must safely keep investors’ investments in a depository account.

However, there are instances when unregulated brokers may keep your investments in a third-party account. In this case, if the broker runs into financial problems, you risk losing all your assets.

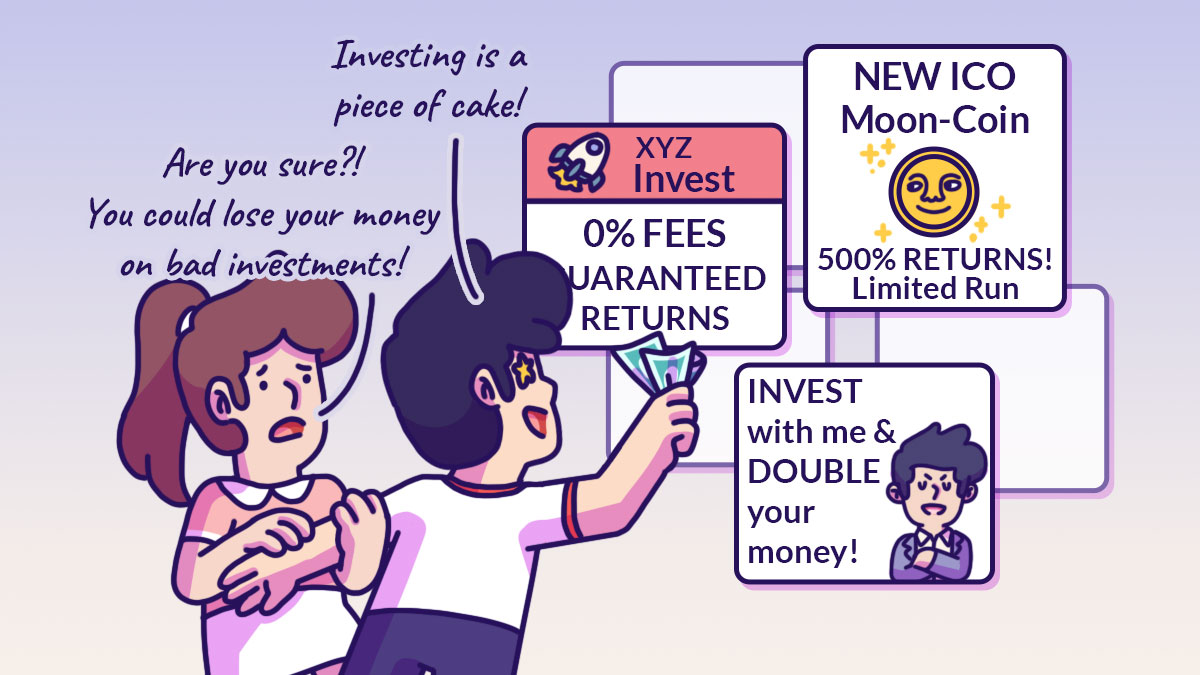

Checklist 3: If you feel suspicious, take time to do your due diligence

Don’t be pressured or rushed into making an investment decision. Don’t invest in financial instruments or products if you do not understand them.

If there are things that don’t make sense, take your time to ask questions and understand them. You can always request more information and check with people within the financial industry for a second opinion.

Also, take your time to read the terms and conditions of the investment agreement carefully before signing.

When investing, always keep in mind the general rule of thumb – If it seems too good to be true…it probably is!