Financial Planning | Personal Finance | Article

What is the Home Protection Scheme and Why Do I Need It?

by Sophia | 6 Aug 2019

With a shiny, new BTO key comes unavoidable baggage: paying off that HDB housing loan or bank loan. But when one is suddenly unable to pay off the remainder of the mortgage, what happens then?

Some scenarios involve total permanent disability or even death, both of which render it impossible for one to continue earning a steady income (for, er, obvious reasons) and risk losing one’s new home.

After slogging so hard to afford that dream BTO, what can be done to protect that home from being taken away?

Enter CPF’s Home Protection Scheme, here to save the day.

What is the Home Protection Scheme (HPS)?

Essentially, Home Protection Scheme coverage exists to reduce mortgage or pay it off entirely in the event of death, terminal illness, or total permanent disability for any flat owner.

Should one or both co-owners be rendered unable to earn an income, whether due to death or otherwise, HPS coverage ensures that the remainder of one’s housing loan will be paid off with the sum assured.

This coverage is available to HDB flat co-owners and couples who are servicing necessary housing loans, via CPF or otherwise.

How does it work?

Home Protection Scheme coverage will last a person until they reach 65 years of age or until the housing loan is fully settled, whichever comes earlier.

HPS annual premiums will be deducted from one’s Ordinary Account (OA) for 90% of one’s cover period. For example, if one is 35, their cover period will last for 30 years till age 65. Thus, they only pay premiums for 27 years.

If one chooses to use his CPF to pay off the housing loan, it should be noted that HPS premium deductions take priority over the housing installment deductions, so as to keep one insured under HPS.

Annual premiums are calculated differently for everyone, based on the following:

- Outstanding housing loan amount

- Loan repayment period

- Type of loan

- Age and gender of flat owner/co-owner

Upon death or total permanent disability, the sum assured will be used to settle outstanding housing loans, either with HDB or a mortgagee.

If one’s sum assured is higher than his outstanding loan, the excess amount will be paid into his OA.

How much is the sum assured?

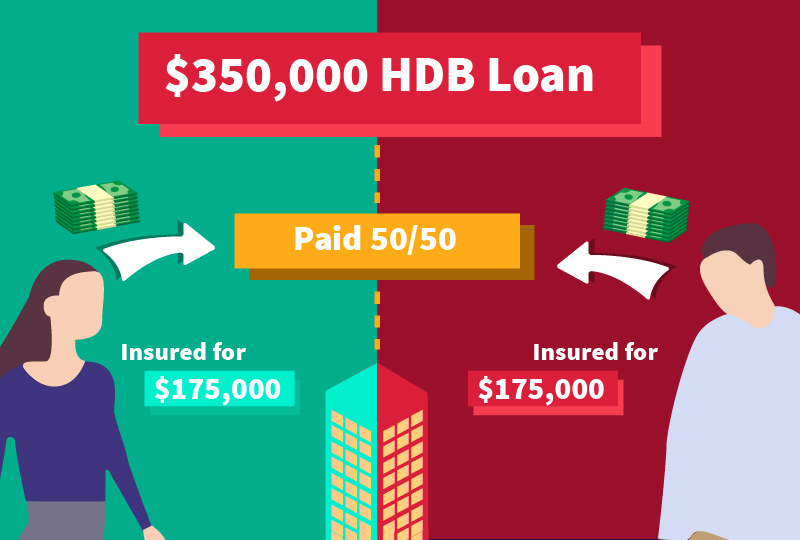

Between two flat co-owners or married couples, the responsibility for servicing housing loans will often be split up differently. One could be bearing 75% of the loan while Bae settles the remaining 25%, or it could be a simple 50-50 arrangement. HPS insures a flat owner of an amount proportionate to what they’re paying each month.

In the event that a spouse paying 75% of the loan passes away, their HPS coverage will provide the sum assured to cover the remainder of their repayment AKA 75% of the entire loan in total.

How to apply for HPS coverage

For couples or co-owners using HDB loans:

- HDB Hub or any HDB branch office will accept applications

For those taking bank loans:

For those who aren’t using CPF withdrawals for HDB loans:

- Apply using my cpf via My Requests

- Apply via mail by downloading the HPS application form and sending it to the HPS department of the CPF Board

To any hopeful or current homeowner, applying for HPS coverage means paying for some much-needed security while one works hard to service his or her housing loan.

It would be a huge waste to lose the flat on top of any personal mishap – which is why we feel that added layer of security will be worth it in the long run.