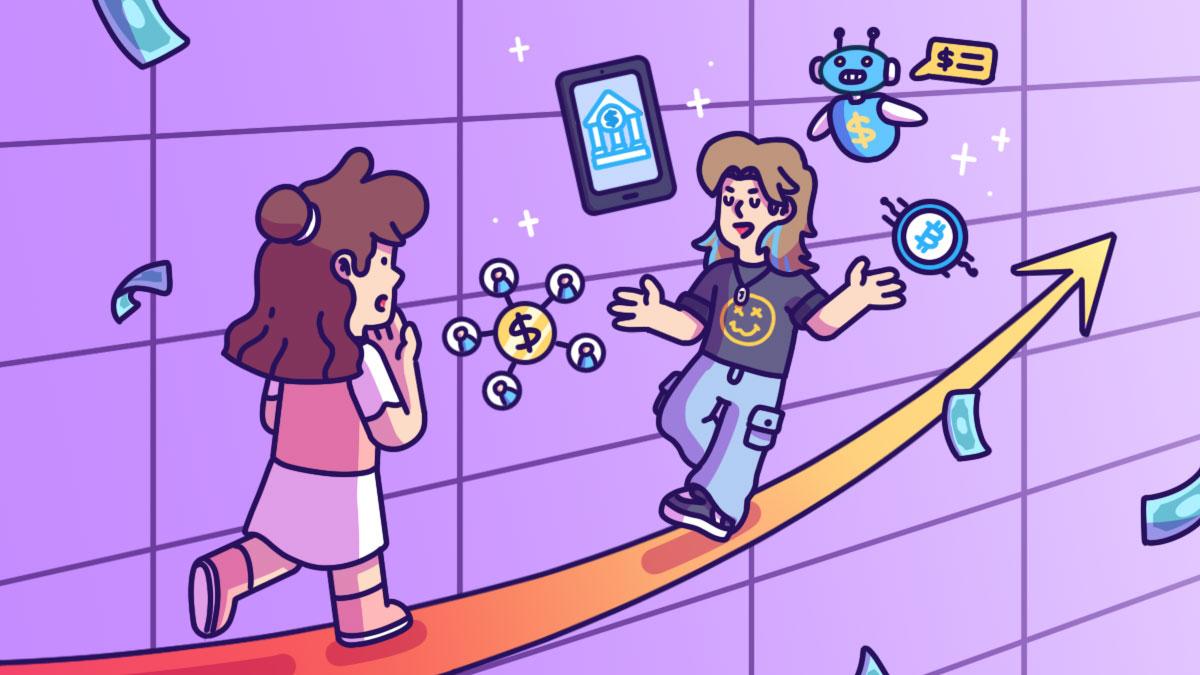

P2P lending explained

P2P lending directly connects people with money to lend to people in need of credit, giving businesses another means of securing cash flow other than turning to a bank. This is done through P2P platforms, which are mostly online. Lenders usually earn a return from the money they loan out, while borrowers get to access loans at a lower cost than with a bank. For instance, you can choose to loan $1,000 to a borrower for 12 months on a P2P lending platform in return for an interest of 10% a year. Every month, you’ll receive part of your principal plus interest until the end of the loan tenure. In this case, you would have ideally got back your initial $1000 and another $100 on top of it by the end of 12 months. In Singapore, there are P2P lending platforms that give you access to SME loans where you can earn a return for lending money to Singaporean small businesses such as restaurants, preschools, construction companies, retail businesses, and more.Earning income with SME loans through P2P lending platforms

When it comes to investing in SME loans, you don’t even need to have a lot of money to start with. Many P2P lending platforms allow you to start from as little as S$100. You’ll also know how much you’re earning from the start, as these platforms show the interest rates on these SME loans upfront, ranging from 3.5% to 24%. However, as with all types of investments, there are still risks involved with P2P lending.

The risks of investing in SME loans

Since your principal and interest are directly tied to the borrower’s ability to pay, you could potentially lose your money if the borrower can’t pay what they owe or if the SME goes bust. To help mitigate the risk of default, P2P lending platforms assess the borrower’s creditworthiness by conducting due diligence practices such as assessing the company’s financial health, visiting the business location, and interviewing the management even before the loans are made available on the platform. Some even secure collateral to help investors recoup some of their money in case an SME defaults on its loan. Seeing as your money will be tied up with the business for a period of time, depending on the tenure of the SME loan, it doesn’t hurt to look into the business’ fundamentals and the industry landscape too. Alternatively, you can reduce the business risks of a particular industry by putting your money with more than one SME, or more than one industry through the variety of SME loans offered by P2P lending platforms.SME loans: A way to diversify your income

If you have extra cash to spare, it’s worth exploring P2P lending as an additional income stream in your existing portfolio alongside other traditional income-generating investments such as bonds, REITs, and blue-chip dividend stocks. A diversification strategy that some investors use is balancing SME loans with other investment products such as bonds, blue-chip stocks, and REITs in their portfolio. Say you have $7,000, you can choose to put 70% ($4,900) in bonds, REITs, blue-chip dividend stocks and the remaining 30% ($2,100) in SME loans. Of course, you can vary the percentage according to your preference. Keep in mind that unlike REITs, bonds, or stocks where you can cash out immediately by selling your stake, your funds are tied up for as long as the loan tenure with SME loans. So, make sure that you invest money that you don’t plan to use for that loan period. And as with all investments, only invest money that you’re willing to put at risk. Investing in SME loans is one way to diversify your portfolio and income into sectors like local restaurants, preschools, and boutique stores that you may not be able to get exposure to through stocks and bonds. Moreover, you will get to support local entrepreneurs while you’re at it too!Content sponsored by SmartFunding A message from our sponsor SmartFunding is a Singaporean fintech platform licensed and regulated by the Monetary Authority of Singapore (MAS) that allows you to finance SMEs you care about, and grow your money at the same time. It offers two financing options for SMEs, namely Term Financing and Buy-Now-Pay-Later (BNPL), with which you, as an investor, can earn an interest of up to 24% (effective interest rate) by investing in these SME loans of your choice. To mitigate risks for investors, SmartFunding assesses the creditworthiness of each SME borrower before their loans or projects are made available on the platform. Checklist for the internal credit assessment team include:- Financial analysis on the Borrower’s financials, with an emphasis on the Borrower’s capability to generate cash flow and their existing debt obligations;

- Site visits for physical verification of the Borrower’s business plan;

- Interviewing the Borrower and its management to understand the purpose of borrowing and assessing the viability of their business plan;

- Conducting credit bureau checks on the Borrower and their shareholders/directors/guarantors to understand their credit history and repayment record, as well as whether there are any outstanding litigations; and

- KYC and AML checks on the Borrower and their shareholders/directors/guarantors.