Budgeting | Personal Finance | Article

Effective Budgeting for the Lazy

by YuanDuan | 4 Aug 2020 | 6 mins read

We’ve all heard of the 50/30/20 savings rule, divvying your cash towards needs/wants/savings.

If this budgeting methods work for you, great. But if you’re struggling to get through your transaction history to categorise your expenses, toss the rule away.

Let’s go back to the basics and focus on what’s important here: building savings.

The key point of this rule — and every other budgeting method — is to nudge you towards consistently saving money. We cannot stress how important this is, it’s pretty much the foundation of all financial planning.

But between going through transactions and spreadsheets, managing a budget is tough — many give up halfway or lose track of it. If this is you, perhaps you could give the average-you budget a shot.

What’s That?

Simply take your take-home pay and minus your average monthly expenditure. What’s left over is how much you can aim to save consistently.

It seems imprecise and way too simplistic, but hear us out.

We are habitual creatures, with regular routes to work, we eat at the same places, even our “occasional” splurges are more like once-every-two-week endeavors (if we’re honest). So, while there are fluctuations in our monthly expenses, a rough pattern emerges.

So an average spending profile is a good and fast way to approximate how much you tend to spend each month. So how do we get this average figure?

Make It Easy With Tech

Today, banking and budgeting apps make figuring this out simple —although we have to preface that this only works if your spending accounts are within a single bank.

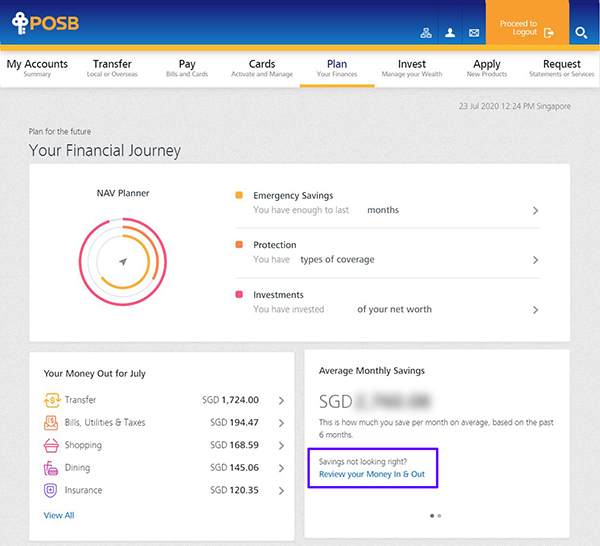

We will use POSB/DBS’s NAV planner within their iBanking website as an example. To access the NAV planner, click ‘plan’, in the top navigation bar on the iBanking homepage.

This is not a sponsored post, but we focused on DBS/POSB as most Singaporeans (and myself) bank with DBS/POSB.

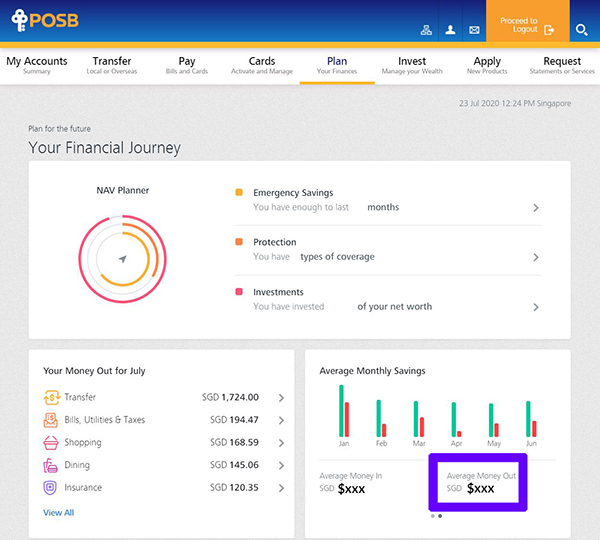

The NAV planner goes through all your transactions and spits out an “Average Money Out” figure of your expenses, averaged over the last 6 months. Tah dah!

However, you might notice my transfers are exceedingly high at $1,724. It was artificially inflating my “Average Money Out” figure — as a bulk of these transfers were between my two DBS/POSB bank accounts.

But you can clean up the transactions to get a more accurate picture. To do this click “Review your Money In & Out”.

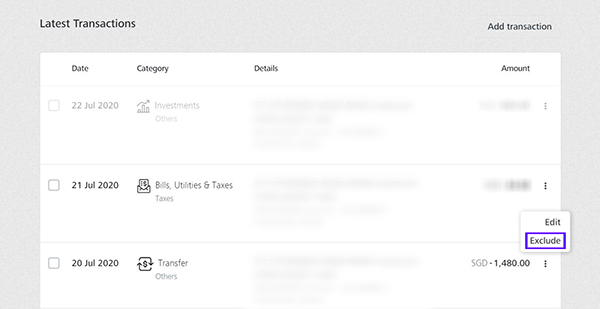

After you click on this, you will see a list of monthly categorised transactions which you can opt to exclude.

After a quick cleanup for each month, you should arrive at a good picture of your average expenses over 6-months.

Take some time to process the shock of a higher than expected figure — and yes, I can relate.

Summing it Up

So what’s next is to simply take your take-home income and minus the “Average Money Out” figure and voila! You now have the amount you can target to consistently save each month.

If the figure that emerges is low, zero, or negative. You’ll then have to go into the weeds of figuring out the expenses you can cut back on, or how to increase your income. This part is up to you.

But if you are in the green? Please proceed.

Creating a Savings Machine

So now you have a savings goal, you have to ensure that you stick to it. Once again, tech can step in here to help make this easy.

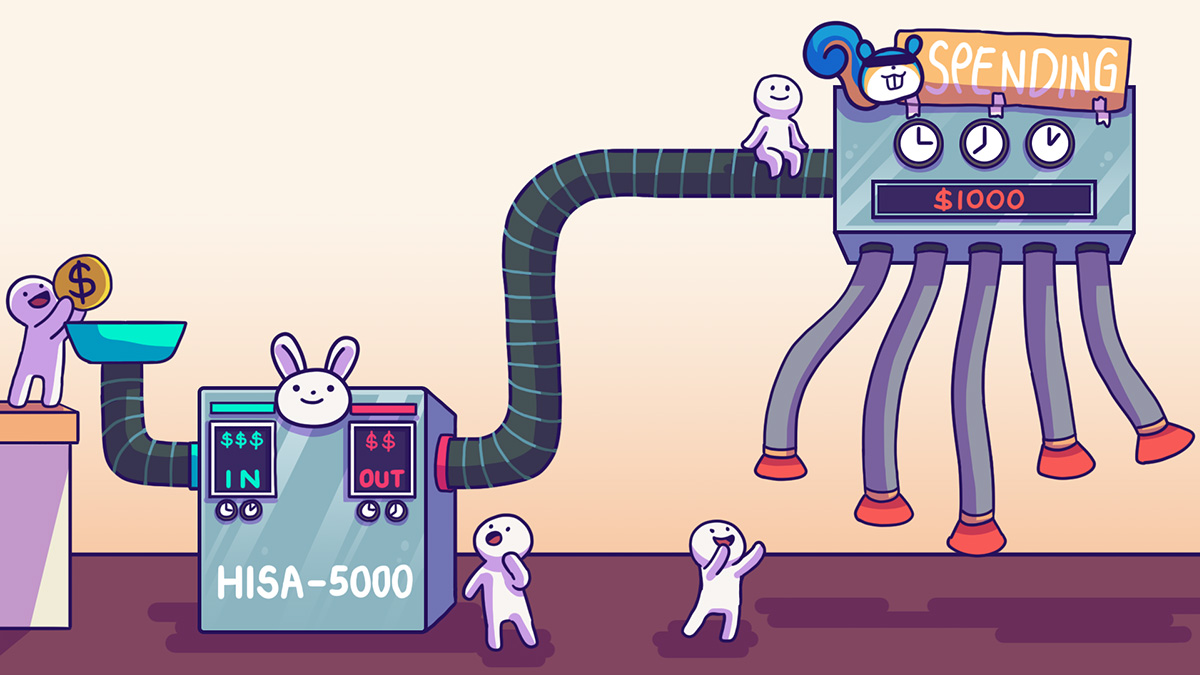

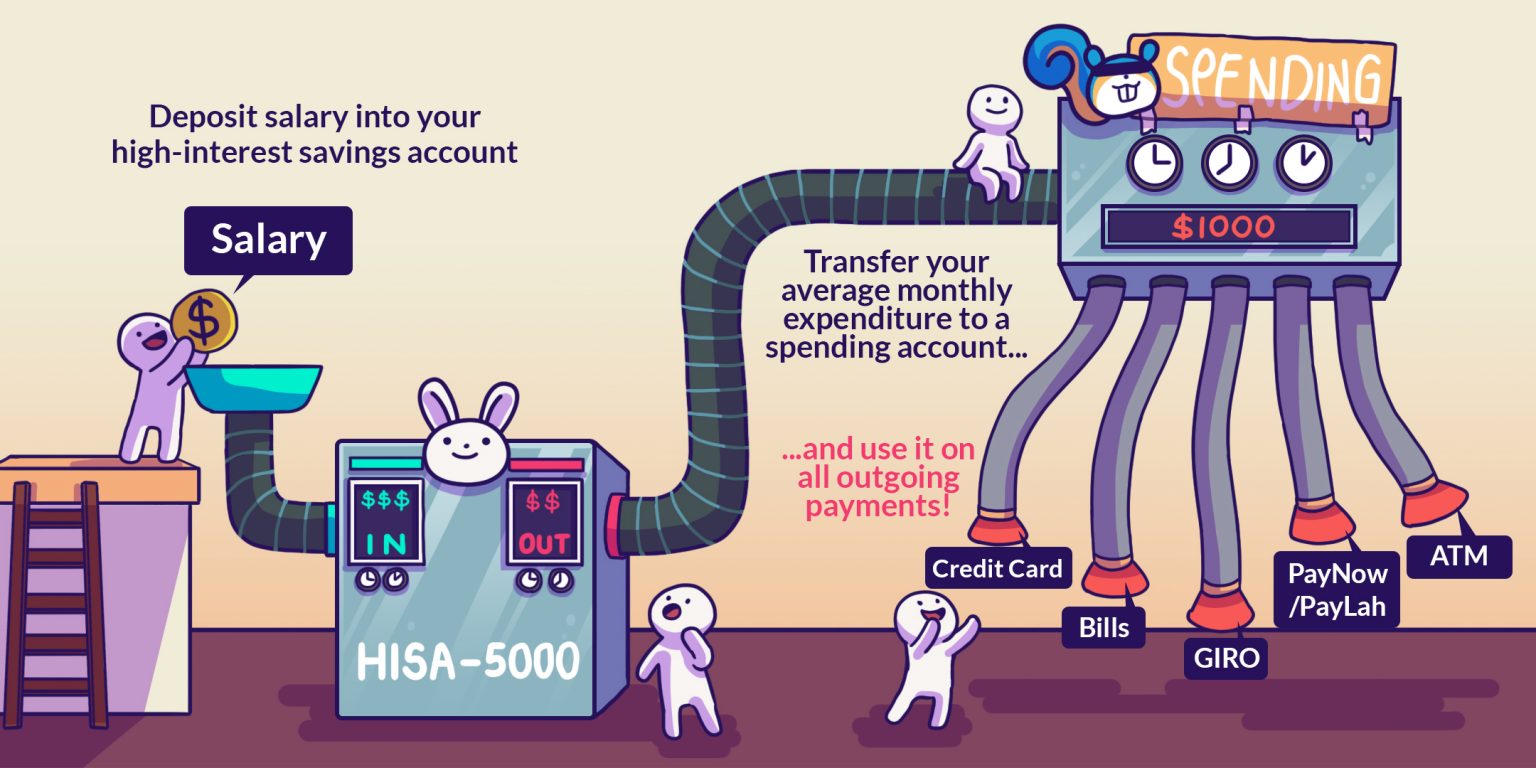

Most of us already have 2 bank accounts, one old and lousy relic from our youth, and a new high-interest savings account (HISA) — like DBS multiplier.

But don’t close that old bank account. It can be converted to become a spending account, forming an essential part of an automated machine that keeps your savings and spending on track.

Yes, you read right, an automated machine. There are a few things you need to do to set the machine up, but we promise you it’s easy — the best part is you just have to do it once, and it will keep going on its own.

Setting Up The Machine

- Have your salary deposited to your HISA each month

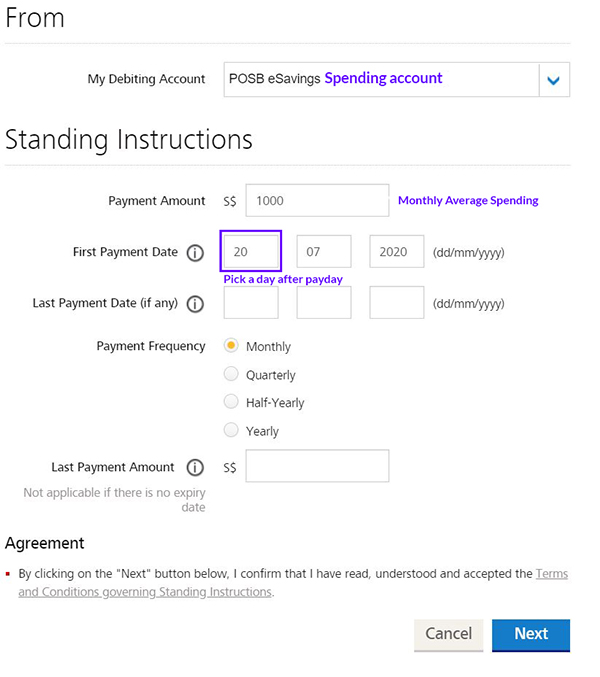

- Set up a standing instruction two days after payday — in case of admin issues or payday falling on the weekends — to transfer your “Average Money Out” figure from your HISA to your spending account automatically each month.

- Link all outgoing payments to your spending account

- Pay credit card bills with it

- Link ATM withdrawals / NETS transactions to it

- Link GIRO/Bill payments to it

- Link PayNow transactions to it

This ensures any outgoing money expenditures is purely coming from your spending account, not dipping into your savings.

How This Works

This is paying yourself first in action. This allows your savings goal to slowly accumulate in your HISA, earning better interest.

Your old account is now a spending account. Which you pre-pay, and spend from.

If you find yourself having a little extra pooling within your spending account? Congrats! you know that you are within budget and on track. You can lower your “Average Money Out” to save harder — or give yourself a treat the next month.

But if you find that you have to top-up your spending account before the end of the month, it’s time to relook your “Average Money Out”, you might be underestimating it. This account-level segmentation makes it easy for you to track your spending and savings each month.

You Can Upgrade The Machine

Once you are ready to invest, you can add modules to your machine. For example, you can set up a standing instruction to transfer a portion of your HISA savings to an investment brokerage account. This ensures that you are consistently setting aside money for investing.

You can even have investment dividends to be credited to your HISA, ensuring that dividend transactions are not buried within daily spending transactions, making it easier for you to reinvest and make your money work harder.

But, this method has some drawbacks, you will be losing out on earning some interest you could be earning when you transfer your “Average Money Out” away from your higher interest HISA. (But personally, I see it as a subscription fee for convenience).

Admittedly, this method isn’t as granular as a proper budget, where one plans specific amounts to be allocated towards specific spending categories.

But this method is definitely a way easier for one start and maintain their savings momentum — and easy is good! Easy wins get you started, motivated, and in control of your finances as early as possible — something we think is essential at the Simple Sum!