Financial Planning | Personal Finance | Article

The Chances of Using Your Insurance, Part 2: Health Insurance

by En Ci | 10 Jan 2019 | 4 mins read

A couple of days ago, we started a conversation on whether or not you’ll really end up using your insurance.

After diving into statistics on term insurance, we’re back with the next part of our series this week. We know some of you may struggle with the countless insurance types and can’t get a grip on your premium calculation for nuts.

That, and you’re lowkey worried about getting into trouble (medically) after hearing about unfortunate stories of cancer, accidents.

That’s why this series exists.

Check out part one here if you’re curious as to what term insurance is. If not, let’s dive into health insurance and some good ol’ statistics.

Part 2: Health Insurance a.k.a., Medishield Integrated Plans

What is it?

An Integrated Shield Plan (IP) is an add-on to your Medishield Life (a compulsory CPF scheme for SG citizens and PRs) that covers hospitalization expenses.

Unlike Medishield Life, IPs are offered by various private insurers. But because the IP isn’t a standalone insurance, you can pay parts of it with your Medisave.

How much do I have to pay?

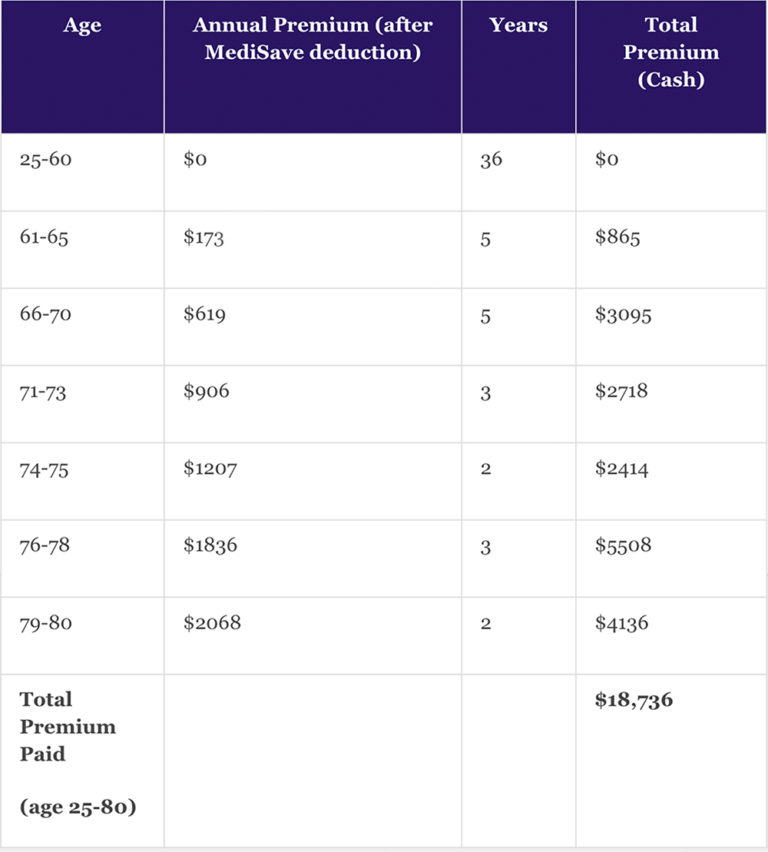

To provide some context, we’ve assumed the following persona:

- 25-year-old male

- Non-smoker

- Coverage till age 80 (Life expectancy of average Singaporean male)

- Full coverage of A Ward, Public Hospital*

With the above in mind, here are some ballpark amounts you can expect to pay:

What triggers the payout?

When you’re hospitalized.

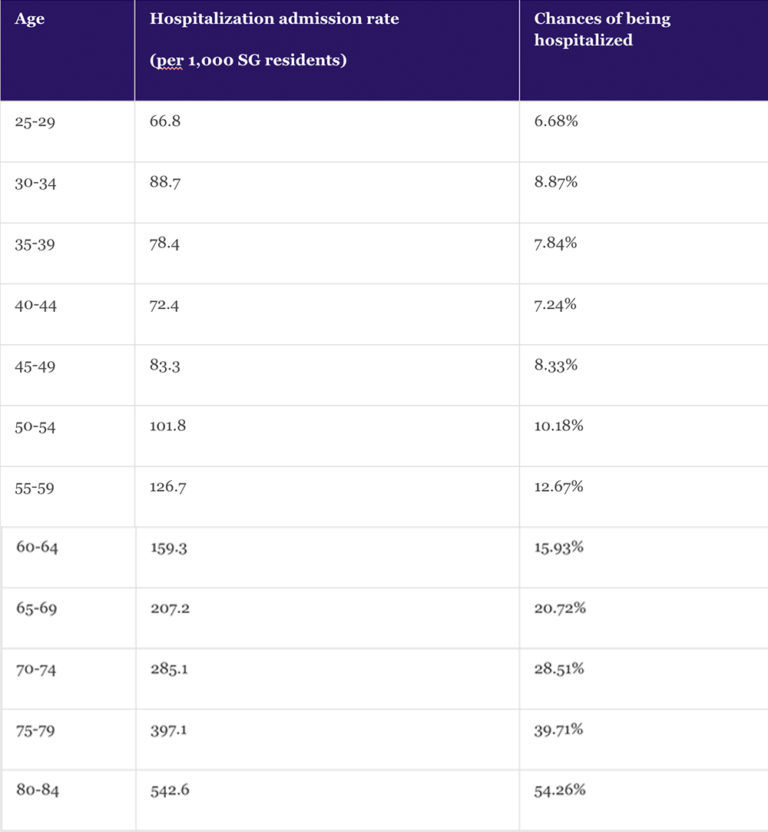

So, how likely will I need the Integrated Shield Plan, i.e., what are my chances of being hospitalized from age 25-80 in Singapore?

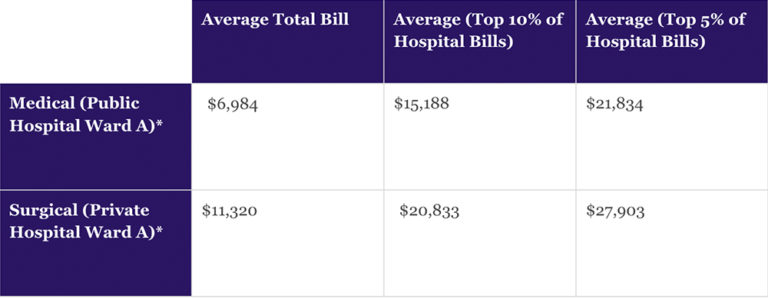

Another key set of statistics to consider will be the average inpatient bill size, i.e., how much the average Singaporean pays when they are hospitalized.

So…is it worth it?

From the above tables, one can infer the following:

- The probabilities of being hospitalized are quite low, but the odds increase from the 65-year mark (20.72%) where the average person has a 1 in 5 chance of being warded. Past 75 years of age, this chance becomes very high.

- This is also when the total payable premium in the same age range (from age 66) starts to look intimidating (>$3,095).

- For the actual hospital bill the average patient pays, there are some scary numbers. But these figures are mostly found in the top 5-10% of hospital bills.

The total insurance premium you’ll pay over 50 years? $18,736.

In a nutshell, the point of health insurance is to protect yourself against severe medical events, which could be debilitating to your financial health and stability.

And though the risk of getting warded is low (in your years of youth and good health), health insurance exists as a safety net in the event that something does happen to you – and you incur high medical bills. It literally pays to be safe.

Do note

- IP plans purchased past 1 April 2019 require you to pay 5% of your hospital bills, capped at $3,000.

- Full coverage (no 5% payment) IP plans purchased after 8 March 2018 will be subjected to the same 5% payment rule rule by 2021.

Disclaimer

Throughout this series, we found that the chances of utilising some policies look surprisingly small. But before you rage-call your insurance agent and demand a policy cancelation, you have to ask yourself.

“What if I’m the unlucky one?”

For some, having the peace of mind is worth its price tag.

With these statistics we hope to provide you with additional information to a usually fear-driven decision.

Do Also Consider

Do you have:

- A family history of illnesses?

- A smoking habit?

- An existing health condition, such as high blood pressure?

These factors may increase your chances of early mortality, and the cost of your insurance policy.

The figures used in the article are the latest available to us. When we cross-reference datasets from various sources, the data period is standardised to the best of our ability to ensure consistency.

*Excluded KK hospital, as bills there might be skewed towards childbirth-related procedures, not covered by IP plans.