Budgeting | Personal Finance | Article

Change Your Girl Math to Good Math for Your Wallet

by The Simple Sum Team | 19 Jan 2024 | 7 mins read

This article is brought to you by Standard Chartered’s Bonus$aver Account

Any avid social media user would have heard about the “girl math” trend that emerged a few months ago.

For those unfamiliar with the trend, girl math is a TikTok trend where users playfully poke fun at the creative justifications to rationalise their spending decisions.

Spoiler alert: The spending decisions are not good ones for your wallet.

While the trend itself is innocent and amusing, it’s crucial to recognise that taking girl math too far – and too literally – could inadvertently impact our financial well-being.

Here, we’ll explore some common girl math scenarios, dissect why they may not align with good personal finance habits, and share actionable tips to empower you on your journey to building wealth.

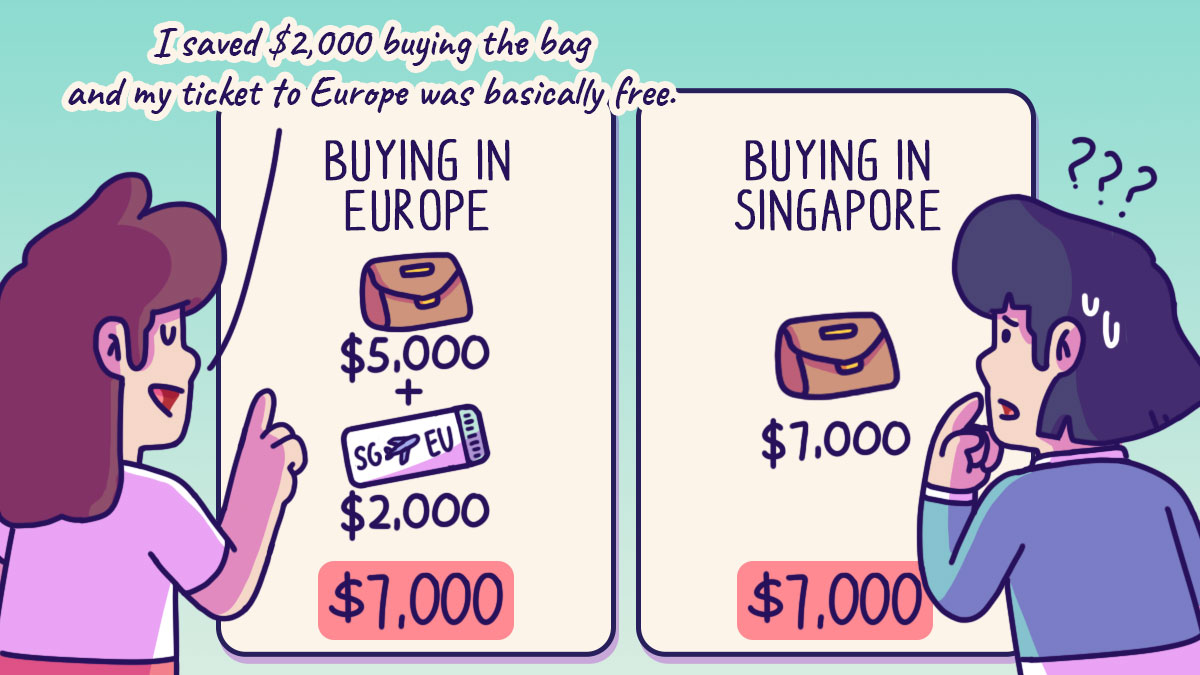

Girl math 1: If I buy a branded bag for S$5,000 in Europe when it retails for S$7,000 in Singapore, I saved S$2,000! This means that my round trip tickets to Europe were technically free. I saved so much by buying the bag in Europe instead of in Singapore!

Actual math: You spent S$5,000 on one bag and $2,000 on your air tickets. And it’s a problem if you didn’t budget for it.

In the world of girl math, the scenario sounds like a win – getting a bag at nearly 30% cheaper than what you would pay in Singapore and spending $2,000 less than you would have.

The math of saving money here does work out correctly, but you also have to apply a dose of practical personal finance wisdom: before succumbing to the allure of a new luxury purchase, assess whether the purchase aligns with your budget and needs, before putting down your money.

Related

And if the expense fits comfortably within your financial plan, consider using a credit card for the transaction. You can maximise on earning credit card reward points or cashback, effectively turning your spending into a potential source of savings. But most importantly, diligently pay your credit card bills on time.

It would also not be right to consider your air tickets to Europe free, even if it may have cost you $2,000 or less. This is a cost that you paid even before your trip and is considered a sunk cost, even if you did save $2,000 on the branded bag you bought on your trip. And your bank account would reflect this: you would have seen a deduction of $5,000 for your bag and a deduction of how much your air tickets cost.

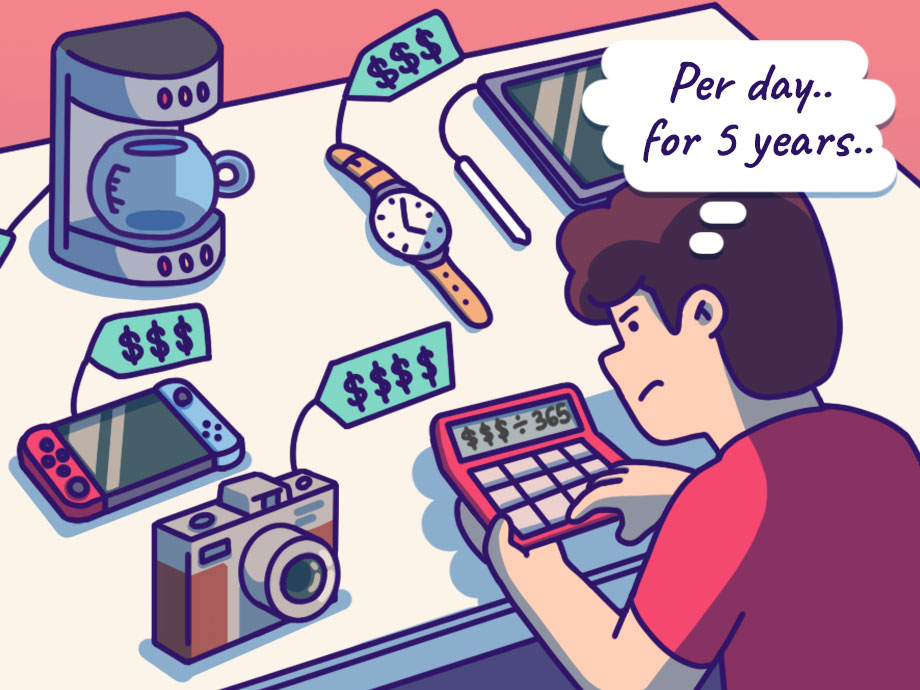

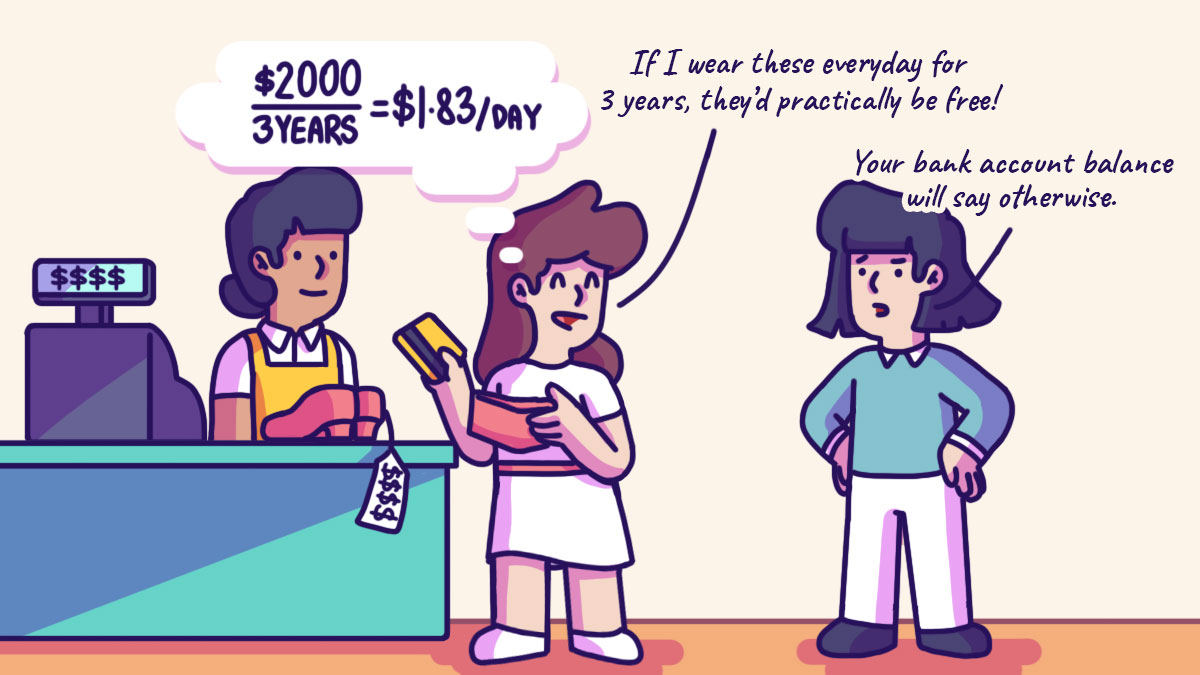

Girl math: If I purchase a pair of branded shoes for $2,000 but wear it every day for the next 3 years, it only costs me $1.83 a day, which is almost free!

Actual math: The pair of shoes cost you S$2,000 from your savings, regardless of the number of times it is worn.

The good news is that thinking about how often you would wear or use an item is actually useful personal finance advice. This is otherwise known as calculating the cost-per-use of the item. You consider how many times you’ll actually wear a pair of shoes, and see if it’s a justifiable cost each time you put it on. And $1.83 per wear is a decent cost-per-wear.

However, where it goes wrong with girl math is if you look at $1.83 as an amount that is “almost free” and consider the shoes to be free. This is because your bank account or card would reflect a deficit of $2,000 and that’s not a small sum of money – it could probably cover your living expenses for a few months.

The other thing to consider is if you would actually wear the same pair for shoes every day for the next three years. Most of us rotate between a few pairs as different occasions call for a different shoes. For example, branded shoes aren’t the best option if you’re headed to the beach or doing a nature hike. Even if you could wear it every day, your shoes may not last for three years under such frequent use.

Related

So, do use cost-per-wear the next time you are considering buying an item, especially if it’s on the pricier side. Just remember to be realistic about the number of times you will wear or use the item, and not discount the damage it will cause to your bank account.

Girl Math 3: Whatever I earn in interest from my bank is free money for me to spend! Yes to more shopping sprees!

Actual Math: Earning interest on the money in your savings account is meant to help combat inflation and preserve your money’s purchasing power.

Who doesn’t like getting free money, right? Interest earned in a savings account can seem like a windfall of free spending money. But let’s not forget the real purpose of putting your money in a savings account: accruing interest to safeguard against the devaluation caused by inflation.

Rather than viewing earned interest as an immediate ticket to a shopping spree, interest is a way to help you preserve your wealth as you grow it to battle inflation.

Related

For those looking to maximise their interest earnings to combat inflation and preserve your wealth, explore high interest savings accounts like Standard Chartered Bonus$aver Account, which offers potential annual interest earnings of up to $7,880.

It’s a win-win – your money grows, and you get to enjoy the perks of disciplined savings. So, instead of letting interest evaporate into everyday spending, leverage it strategically to help you gain financial resilience.

Sponsored content with Standard Chartered’s Bonus$aver Account

Make your money work harder for you by getting up to 4.88% p.a. bonus interest (maximum interest of S$4,880 earn each year) from your very first dollar in your Bonus$aver Account through transactions that you will do on a daily basis! Here’s how:

- 2.5% p.a. bonus interest when you credit your monthly salary via GIRO to your SC Bonus$aver Account

- 2.05% p.a. bonus interest when you spend at least S$2,000 on eligible transactions with your Bonus$aver Credit or Debit Card each month (inclusive of prevailing interest of 0.05% p.a.)

- 0.33% p.a. when you make at least 3 bill payments of S$50 each month with your SC Bonus$aver account either through GIRO or SC Online Banking

If you also invest and insure with Standard Chartered, you can get an additional 3% p,a, bonus interest too!

- 1.5% p.a. bonus interest when you purchase an eligible insurance policy with a minimum annualised premium amount of S$12,000

- 1.5% p.a. bonus interest when you purchase an eligible unit trust with a minimum single subscription amount of S$30,000

Bonus interest is paid up till the first S$100,000. This means that you can get up to 7.88% p.a. bonus interest, which totals up to a maximum of $7,880 in interest each year!

Get up to S$368 cashback when you sign up for a Bonus$aver account now! Enjoy S$288 cashback when you successfully apply for a Bonus$aver Account and a Bonus$aver World Mastercard Credit Card and deposit and maintain S$50,000 in fresh funds, and additional S$80 cashback when you credit your salary within the first 2 months of account opening. Promotion ends 29 February 2024.

Apply for your Standard Chartered Bonus$aver Account now here.

Terms & conditions apply. Insured up to S$75k by SDIC.