Investing | Article

What to Consider Before Investing in REITs

by YuanDuan | 31 Dec 2019 | 8 mins read

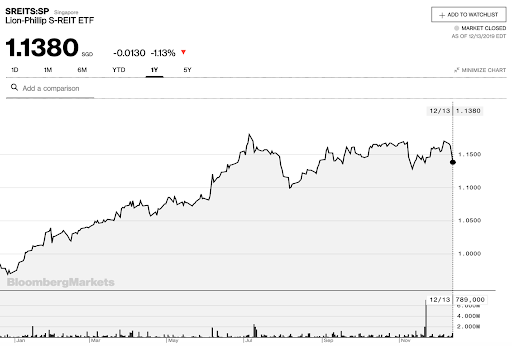

REITs in Singapore have managed to post an average total asset return of 23% in 2019 alone, far outstripping inflation, which sat at sub 1%.

To Recap:

REITs are investment vehicles that buy and manage properties on your behalf. Each of the property in the REIT’s portfolio earns rental income by leasing the space within the building to tenants, 90% of the profits is divested to you, the investor.

But if you consider that Singaporean REITs, on average, have grown at 23% this year, you might be thinking, wait, that growth can’t be entirely from rental income!

And you would be right, if you were a tenant and the landlord just told you the rent would be raised by 23% — you would simply pack up and leave, after some choice expletives.

So the other than increasing rental yields, the other path to growth for REITs is capital appreciation — or the growth of its share price.

When it comes to REITs, sometimes investors can discount capital appreciation, and simply just hunt for REITs with the highest dividend yields. But in doing so, an investor could be missing the forest for the trees.

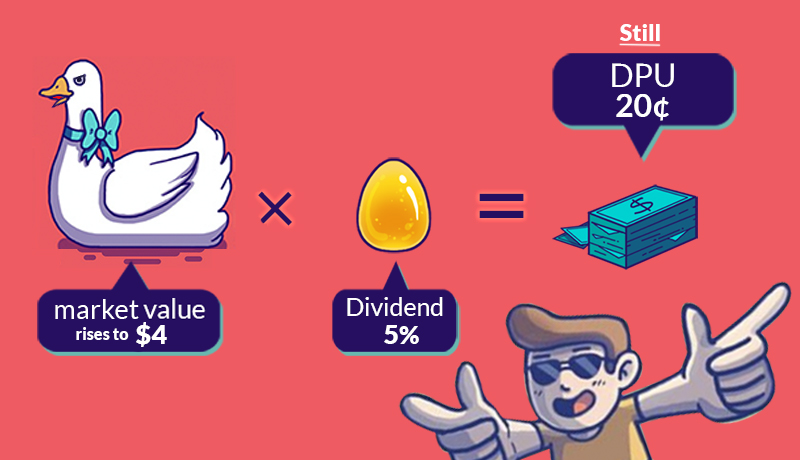

This is because dividend payouts for REITs are determined by a REIT’s share price. This is called distributions per unit (DPU), for example, if you purchased a REIT share that is worth $2, and if the dividend is 10%, you will earn a DPU of 20 cents annually.

Great right? So if you invested $200,000, you would get a yearly income of $20,000!

But let’s say you made this investment, and immediately, the REITs share price drops by 50 cents to $1.50.

You will still get that same attractive 10% yield, but that now translates to a DPU of just 15 cents per share — you would have made a loss for the year, as your share price with dividend collection now only totals $165,000 — lower than the $200,000 you spent to purchase the REIT.

Yes, you could sit tight and wait for the next year’s dividend payouts to recoup your losses. But till then, you have to hope that the share price does not tumble further.

So an important question to consider before buying a REIT: Are the current share prices sustainable, or even better, can it grow?

How do REITs grow?

In order for a REIT to grow, it has to enhance it’s income.

So one way that REITs grow is to either optimise their properties by upgrading. Successfully doing so, they can enhance their rental yield, which in turn allows it to increase its dividend payouts to investors.

If dividend payouts increase, this gives headroom for investors to sell their shares to the market at a higher price, while maintaining the same nominal dividend yield, before the share price increase

But there’s only so much a REIT can renovate and optimize their space to enhance dividend yields.

So the other option that REIT managers can choose to grow the REIT is by spotting potential properties — at the right price — that can have better yields than its current stable of real estate. This again boosts dividend yields.

But at this point you might be wondering, if REITs can only retain 10% of their profits — remember 90% has to be distributed to you — how do they raise the money to literally purchase buildings?

Well to do this, REITs can:

1. Take loans

2. Sell additional shares to raise funds.

So a REIT manager has to be savvy in taking out cheap loans to fund expansion, however, this is just one aspect of fund-raising REIT managers have to consider. Because when it comes to debt, REITs are required, by law, to maintain a 45% asset-to-debt ratio — or in simple terms, the value of their properties must be correspondingly higher than any debt they have.

Debt from interest payments also act as a drag on the profits of a REIT, so skillful finance management — that can source for effective loans — can play a part in enhancing DPU.

So it is undesirable for REITs to a high debt-to-asset ratio, or gearing, which limits headroom to fund future expansionary plans, high-interest payments could also drag on the profitability of the REIT.

The second way REITs can raise funds for expansion is by selling additional shares. New shares could be sold to institutions, or to existing shareholders, at a discount, called rights issues.

So What Does This All Mean for You?

As a potential investor that is eyeing a REIT in the stock market, you want to invest in a REIT, at a good (read: fair or cheap) price.

The price has to be right in order to maintain the current DPU and give the REIT headroom for potential capital appreciation if the dividend yield grows. On the flip side, you want to avoid the situation where the REIT is overvalued, and its price might fall in the future.

But what determines a good price?

A popular metric investors look at to determine if a REIT is expensive is the Price-to-Book ratio (P/B ratio). If the P/B ratio is below one, this means the share prices are cheaper than the assets and liabilities the REIT owns.

P/B ratio, is calculated by dividing a company’s stock price by its total assets minus any liabilities.

So is buying any REIT with a P/B ratio below one a safe bet? Sadly, it’s just not that simple.

P/B ratios could be high (above 1) because Investors could be bidding the share prices up, because they believe that the REIT can support future expansionary prospects.

Or… they could just be throwing money into brand-name REITs and the prices could come crashing back to earth back to earth eventually.

On the other hand, a low P/B ratio isn’t everything, while a REIT could be cheap, but it could be because investors are uncertain of the REIT’s ability to maintain its dividend yield.

So a rule of thumb is to find a REIT with the P/B ratio close to 1, and reference that against a REIT manager’s track record of:

- Finding attractive property to acquire

- Source effective financing to acquire property

- Maintaining a high occupancy rate

- Improve on the properties to command higher rents

- Market their success to make the REIT attractive to potential investors — supporting the share prices.

If you think that the manager had done a fine job in performing all of the above — and if the price is right — perhaps a REIT could be a buy.

So as you can see, good REIT management is important, thus, it is important to find a REIT with good stewardship — the role is akin to spinning many plates and dancing at the same time.

The Economy

But like other investments, REITs depend heavily on prevailing economic conditions. If the economy is bad, tenants will be downsizing or cutting costs. They might not need as much space after laying people off, or they might move to cheaper rental areas.

In this scenario, REITs might run into the problem of maintaining the occupancy, or at the very least, rental yields can fall where tenants negotiate down the rent.

This results in a fall in DPU, which would have knock-on effects on the REITs share prices.

A prudent REIT manager with a forward outlook can mitigate these issues with quality tenants with longer lease lengths — to lock them in during the bad times — but yet maintain the flexibility in their contracts to raise rents, for example when there is a sudden property or inflation surge in the market.

This can be verified by checking a REITs weighted average lease expiry (WALE).

And because a REIT has to manage debt, in the period of rising interest rates, a REIT’s debt obligations might rise with it. Which becomes a cost drag on the income of a REIT. A good REIT manager may be able to access better financing terms to mitigate such issues.

REITs will be exposed to the risks that are specific to the property market. As such, it would be prudent for an investor to not have an investment portfolio that is too heavy in REITs.

Conclusion

This is a very general overview of some of the things an investor should consider when evaluating a REIT.

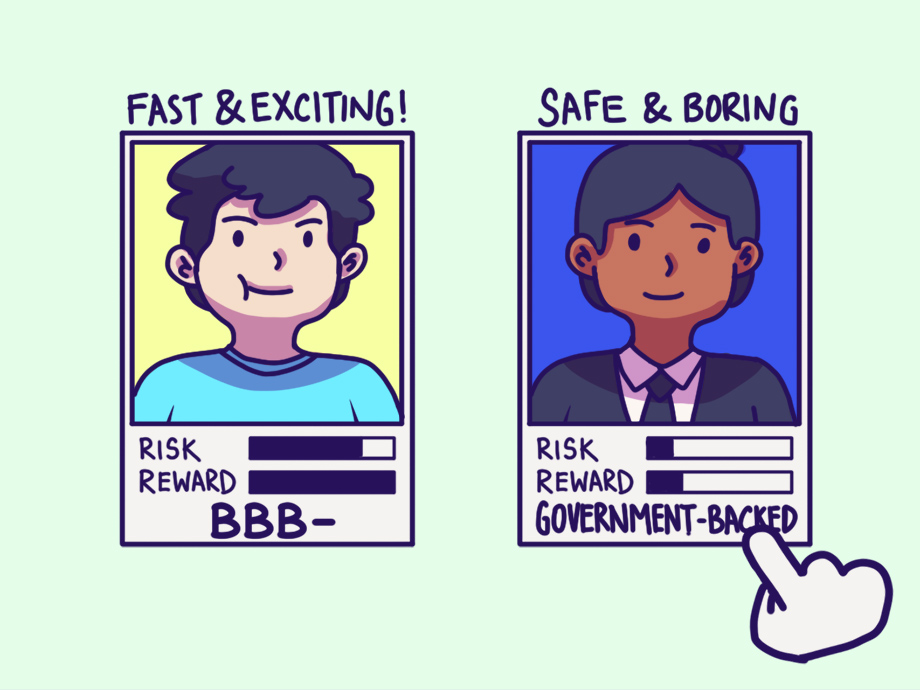

This might have scared you slightly, but at the end of the day, REITs are still a relatively simpler investment instrument compared to traditional stocks. This is because of the rules REITs have to adhere to:

- To payout 90% of their income as dividends. While for some stocks you could be scratching your head wondering when the company’s management would issue dividends.

- REITs are limited to 45% gearing, which prevents them from taking on too much debt and risking the health of the business.

- Are backed by quality assets, in the form of properties.

So REITs can be considered a somewhat safer form of investing compared to traditional stocks — that after some study — can be a great addition to newer investors to start on the road towards financial freedom.