Financial Planning | Personal Finance | Article

CPF 101: An Introduction

by Sophia | 17 Jun 2019 | 5 mins read

Welp, there it goes again: 20% of the monthly paycheck disappearing into the CPF void. That money could’ve been used for other things, like fueling a latent avocado obsession!

Like it or not, CPF is probably going to stick around in one form or another. So, it’s wise to understand it and make the best out of it.

Here’s what CPF is, what its uses are, and how it factors into a fruitful future.

Salary, and every CPF member’s accounts

Everyone’s favourite day of the month is pay day. Here’s what happens when income gets credited into an employee’s bank account:

- 20% of one’s monthly salary is funnelled into CPF

- 17% (from one’s employer) will follow suit

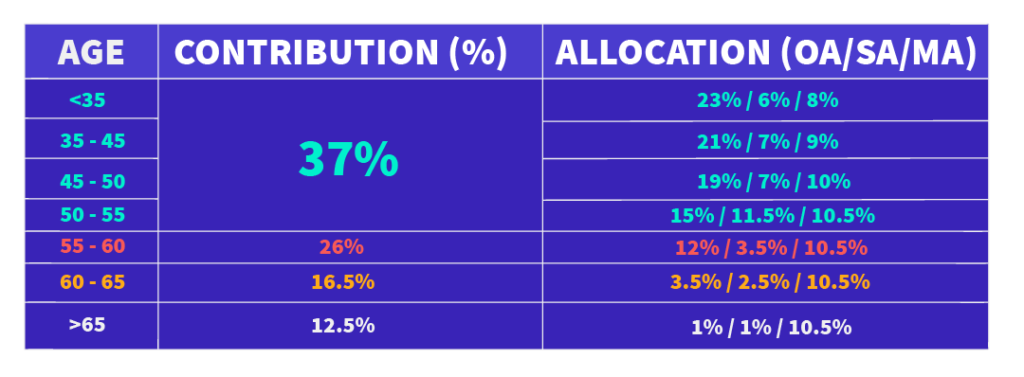

This total of 37% of one’s wages will be channeled into three different accounts:

- Ordinary Account (OA)

- Special Account (SA)

- MediSave Account (MA)

However, contribution and allocation rates adjust as one grows older to meet changing needs.

Contribution refers to how much of your salary is funnelled away to CPF, while allocation is the division of the contribution across your OA, SA, and MA accounts.

Pay attention to the shifts in allocation rates across different age ranges:

Up till age 50, allocation rates favour OA to account for housing needs, before steadily shifting over to SA and MA for retirement and healthcare needs as one gets older.

Past the age of 55, the contribution rates are lowered, for workers to remain competitive in the workforce (your employer has to pay less CPF for you). Beyond 65, the bulk of CPF allocation will go to MA, in order to meet healthcare needs in old age.

These accounts exist for specific reasons, but they mainly point towards a secure retirement for when a Singaporean turns the ripe, old age of 65.

What are CPF accounts used for?

It’s not all about retirement, there are a variety of uses that Singaporeans can tap on CPF savings right now!

Here’s the breakdown of different CPF accounts as well as their possible usages:

Ordinary Account:

- Retirement

- Education – Pay for school fees using the CPF Education Scheme for your children; this will be repaid to CPF upon graduation.

- Housing loan payments and Home Insurance

- Investments – You can open a CPF investment account or CPFIS – OA to invest in private investment products. Any profits will be paid back to your CPF account.

Special Account:

- Retirement

- Investments – CPFIS – SA

MediSave Account:

- Payments for MediShield Life: Medishield is a compulsory insurance plan that covers hospitalisation costs of B2 or C ward stays.

- Paying for private medical insurance to enhance Medishield Life: This covers whatever is not already covered by MediShield Life, which is private hospitalisation A/B1 ward types, surgical and post-surgical costs.

- Paying for healthcare: MA savings can be used cover health screenings, vaccinations, hospitalisation treatments, end-of-life care, and outpatient treatment for oneself, or his immediate family members.

Understanding CPF interest rates

Here’s the breakdown of CPF interest rates for each account.

Ordinary Account: 2.5 (+1%)* p.a.

Special Account: 4% (+1%)* p.a.

MediSave Account: 4% (+1%)* p.a.

*The bonus 1% interest above is given to the first $60,000 deposited in our CPF accounts. It is applied to the first $20,000 in our OA and the first $40,000 deposited in our SA or MA accounts.

CPF Returned

The government’s 55th birthday gift to the average Singaporean will be… another CPF account, called the Retirement Account (RA).

The RA is used to fund a retirement scheme under CPF LIFE, each scheme has a required minimum required sum, and a corresponding payout.

The RA is created by merging some of a CPF account holder’s OA and SA balances to achieve the chosen retirement scheme’s minimum sum.

The order of priority emptied to fund RA account:

- First with the SA account

- Then with the OA account.

Returned The government’s 55th birthday gift to the average Singaporean will be… another CPF account, called the Retirement Account (RA).

The RA is used to fund a retirement scheme under CPF LIFE, each scheme has a required minimum required sum, and a corresponding payout.

The RA is created by merging some of a CPF account holder’s OA and SA balances to achieve the chosen retirement scheme’s minimum sum.

The order of priority emptied to fund RA account:

- First with the SA account

- Then with the OA account.

In order to qualify for these schemes, one must meet the minimum retirement sum in their RA. Here’s what you need and the payout you’ll get, as of 2019:

At age 55, Singaporeans have the choice of withdrawing excess CPF money above the minimum retirement sum amounts. The minimum sum will continue to be kept within CPF.

Then at 65, we reach the withdrawal age where we receive the monthly payout based on the CPF LIFE retirement scheme we have chosen. This is guaranteed to be paid monthly till the day you leave this earth, even if you live to the over-ripe age of 120.

And that’s the end of that with CPF. It’s important to keep in mind that what we are contributing today might feel like a wormhole, but will bear fruit at 65! So keep hustling, friends!