Investing | Article

DCA Is Not What You Think It Is

by Sophia | 13 Nov 2019 | 4 mins read

As an investor, you might come across the term dollar-cost averaging (DCA) a lot. And it’s increasingly common for people to use it interchangeably with periodic investing.

Understandably so, as both DCA and periodic investing involves investing at intervals. But the difference is that with DCA, you have a lump-sum of money (think inheritance or a super nice year-end bonus) that you decide to average it into investments over a set period of time. For example, when you have a $12,000 bonus and decide to invest it over the next 6 months on a monthly interval.

With periodic investing you invest the money as soon as you have it – much like when you invest a portion of your salary every month.

Periodic Investing

It’s helpful to know the difference because you can easily come across articles that state “Lump-Sum Investing Beats DCA”. But it’s important not to misread these articles as “Lump-Sum Investing Beats Periodic Investing“, and think it might be a better idea to save up a lump-sum first, and then invest it at a later date – rather than investing monthly, as soon as you can.

To illustrate this, the average closing price of the S&P 500 index (top 500 companies in the US) grew from $1,220 in 2008 to $2,746 to 2018, which means an average increase of 41¢ each day, so by investing as soon as possible you are more likely to expose your investments to these gains — and come out ahead in the long run, because ultimately, prices tend to be higher in the future.

“Time in the market beats timing the market” coupled with “stocks go down faster than they go up, but go up more than they go down.”

But it is important to note that this method is only suitable for investing towards a long-term goal, as a rule of thumb, one that is 10 or more years down the road (such as retiring).

Benefits of Periodic Investing

Accessible to all

Periodic investing doesn’t require a huge sum from you to start with, meaning you’ll be able to start investing with as little as $100 a month. Perfect for those just starting their careers, yet saddled with paying off student loans or saving for home renovations.

You can sleep at night

One of the biggest mistakes of investing is letting emotions dominate decision making. It’s a common tale, the market crashes, the investor panics and hits the eject button, in the end, the investor loses money.

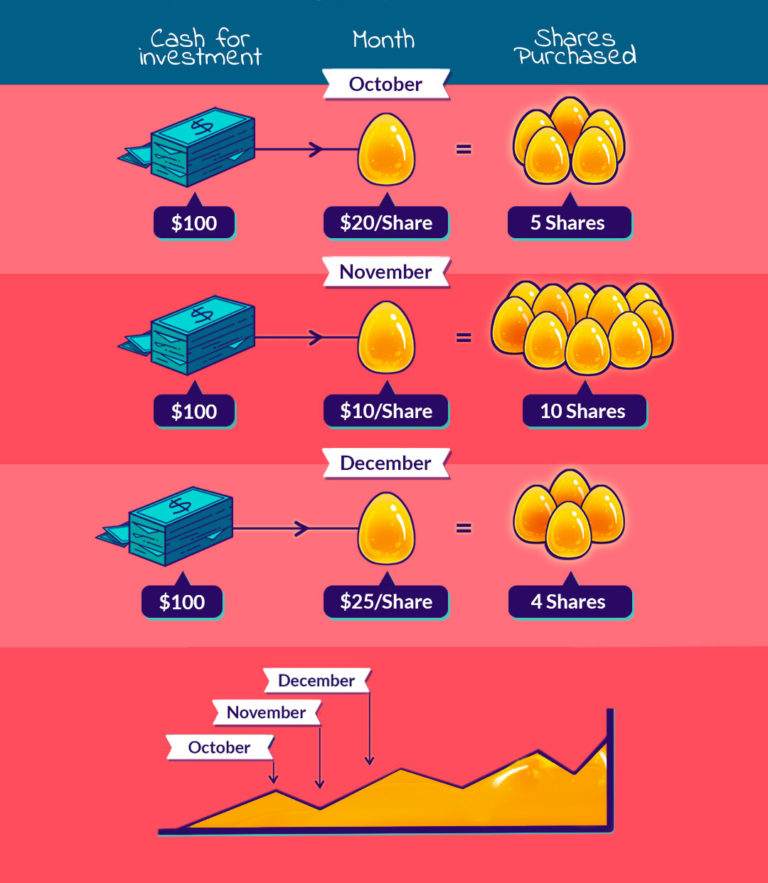

Periodic investing provides a mental model to keep your head clear and focus on steadily purchasing, and not becoming distracted by the short-term movements of the market.

Another Thing to Note

Periodic investing does not address the risk of a bad investment pick, while the market has always trended upwards, but individual companies within the market can crash and burn.

So If you picked a wrong investment instrument to periodically invest into, you could just be throwing your money into a hole.

So periodic investing can be coupled with other strategies, such as diversification; for example, investing in an index ETF that tracks the performance of many companies, or an entire market. We go through more detail in our series the bo chup way to invest.

How to Start Investing Periodically

Regular Savings Plans (RSPs)

Offered by all the big banks in Singapore. RSPs are plans that invest a fixed amount of money every month into designated unit trusts and Exchange Traded Funds (ETFs), directly from your bank account.

Robo Advisors

Robo advisors are similar to RSPs, however, they usually provide additional tools, such as portfolio construction adjusted to your risk profile, portfolio rebalancing and access to global ETFs. However, this comes at the cost of higher long-term costs compared to RSPs.