Managing Debt | Personal Finance | Article

Do Credit Scores Even Matter?

by Marcus Lee | 19 Feb 2021 | 6 mins read

Type “credit score” into your YouTube search bar and you’ll find numerous videos with topics like “How to increase your credit score in 30 days” or “Do this one trick to score 800 or more on your credit score!”

If you’re wondering who’s scoring you and you don’t know why, read on to find out just what a credit score is and find out why credit scores should matter to you.

What is a credit score?

Let’s start by defining credit. When you buy things on credit, like with a credit card, you complete your purchase without paying with your own cash upfront. Other forms of credit include loans like car loans, personal loans, or house loans.

Now, unlike your best friend, when a bank gives you a loan, it needs to know if you’re going to pay back that loan. But how will the bank know? After all, they don’t know you like your best friend does.

That’s where credit scores come in. Your credit score tells lenders whether you’re likely to repay your debt. It’s a measure of how much they can trust you to pay back the money that you’ve borrowed from them. This is called “creditworthiness”.

Why does having a good credit score matter?

As having a good credit score means that people trust that you will pay back your loan in a timely manner, they would be more willing to lend you a larger sum of money. This means being able to get bigger home or car loans, and having a higher limit for your credit cards.

With a bad credit score, you will get smaller loans and potentially be charged higher interest rates, compared to someone with a good credit score. You will likely have a lower credit card limit too. Or your loan or credit card applications will simply be rejected.

That said, approval, conditional approval, or rejection is totally up to the lenders and if one lender rejects your application, another might accept it.

How to check your credit score in Malaysia

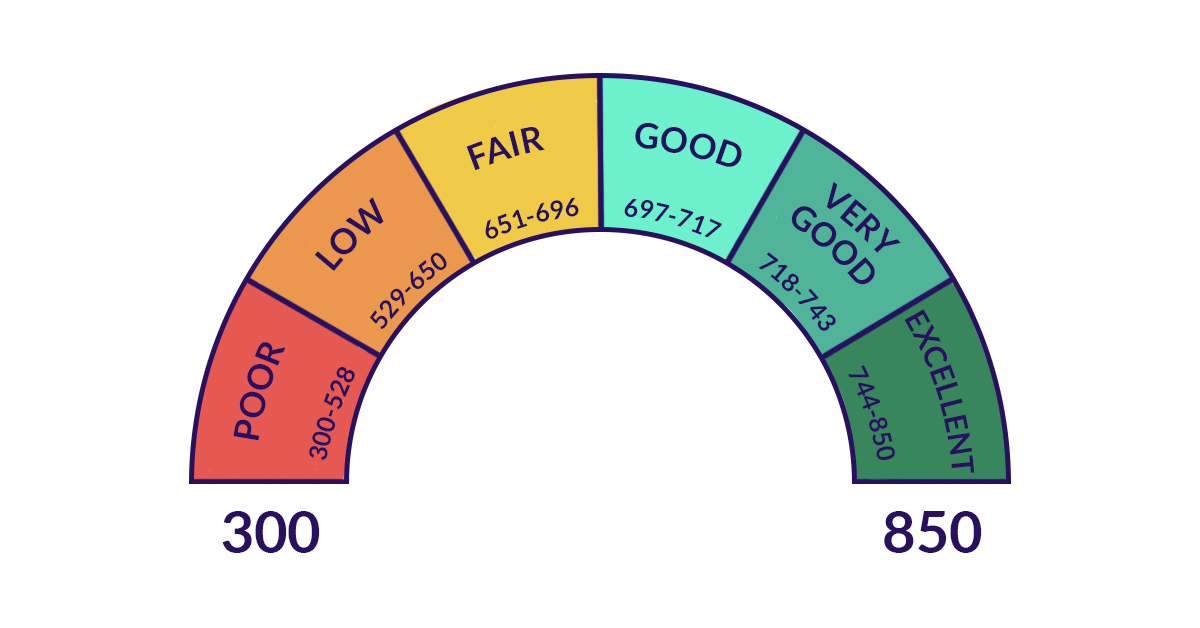

Credit scores are usually calculated based on the credit score system created by the Fair Isaac Corporation (FICO). In this system, your credit score is usually measured on a numerical scale and starts at 300 at the lowest to 850 at the highest – higher scores are better.

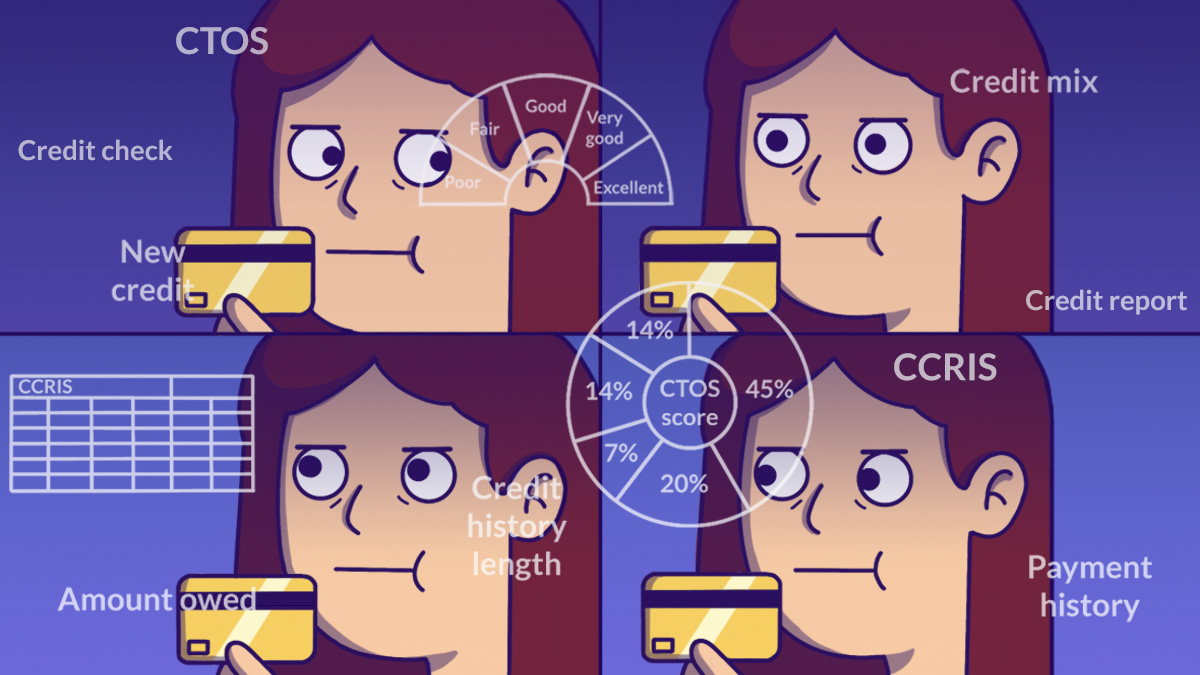

In Malaysia, independent agencies like CTOS offer numeric credit scores using the FICO Scores range. Alternatively, you can also receive a credit report from Bank Negara Malaysia via its Central Credit Reference Information System (CCRIS) that outlines your repayment history in the past 12 months.

Reading your credit score is easy, according to CTOS’s scale for example, a score of 697 and above is good and will increase your chances of obtaining good credit.

Your CCRIS report on the other hand, is different in that you will not receive a grading of your credit history. The report will instead, outline the following:

- Outstanding loans and any missed payments

- Special attention accounts that are under close supervision by financial institutions (usually accounts that are under threat of non-payment or payment terms of which have been negotiated with the Malaysian credit counsellors, AKPK)

- Applications for new credit accounts in the past 12 months

Too many outstanding payments, special accounts, and applications for new credits will signal a red flag to lenders and your chances of getting a loan decreases.

What factors impact your credit score?

There are five major factors that are used in the FICO score calculations and they’re weighted differently depending on the credit score provider. Generally, they’re weighted as below in decreasing order of importance:

- Payment history: Don’t miss any payments on your loan to get a higher score

- Amounts owed: The lesser the amount of money you owe, the higher your score.

- Length of credit history: The longer you’ve had some form of credit, the higher your score

- Credit mix: The more type of of loans (mortgages, installments, car loans, etc.) you have, the higher your score

- New credit: Opening many accounts recently makes it riskier to lend you money. The smaller number of new account applications you have, the higher your score

TL;DR: Pay your bills on time, don’t owe too much money, apply early for a credit card, add on other loans slowly over time, and don’t go applying to many different credit accounts at once.

How your credit score impacts your personal finance journey

Having a good credit score doesn’t automatically equate to good financial health. Your credit score can be good even if you have no savings — all you need to do is pay your credit card debt in full and on time every month. It simply makes you a responsible borrower, but not necessarily a financially responsible individual.

Other than for loans and credit card applications, your credit score or credit report can be used to view the amount of debt that you’ve taken up and identify patterns that may have emerged in your spending.

With a CCRIS report, you’re able to have an overview of the loans that you’ve taken up over the last 12 months and you’re able to see if you’ve been relying too heavily on debt for your purchases.

Does your credit score even matter?

Yes, especially because most of us rely on loans to purchase a house or a car and a good credit score is crucial to getting approvals for your loans.

And also, no, because a credit score only measures your success as a borrower. If you’re financially healthy and don’t buy things on credit, you might not even have a credit score and that’s okay.

Lenders also consider other factors like your salary, how much you have in the bank, and how long you’ve been working, among other things.

Most of these credit checks are free so you might as well get one to see how you score.