Financial Planning | Personal Finance | Article

Do You Have a Bad Relationship with Money?

by Annie | 12 Dec 2019 | 5 mins read

Think about the state of your finances right now. Imagine the cash in your bank and any debt that you have. Your investment portfolio. The credit cards that need to be paid off at the end of the month. The funds in your CPF account. Think about all of it.

How does it make you feel?

Does it make you feel safe and secure? Or does it induce gut-wrenching anxiety?

Chances are if you have borrowed, spent, saved, and earned money in some capacity, your relationship with money seesaws between positive and negative emotions. How that may differ from the next person is the level of emotional volatility you experience. Are you constantly swinging from one extreme to another, or is your anxiety just an occasional pin prick that can be easily assuaged?

You may be thinking, “If someone doesn’t have anxiety about money, they must be RICH.” That could be true, yet not. How we feel about money is not related to how much of it we have. How many times have you met someone ‘worse off’ than you, but they seemed far more content with life?

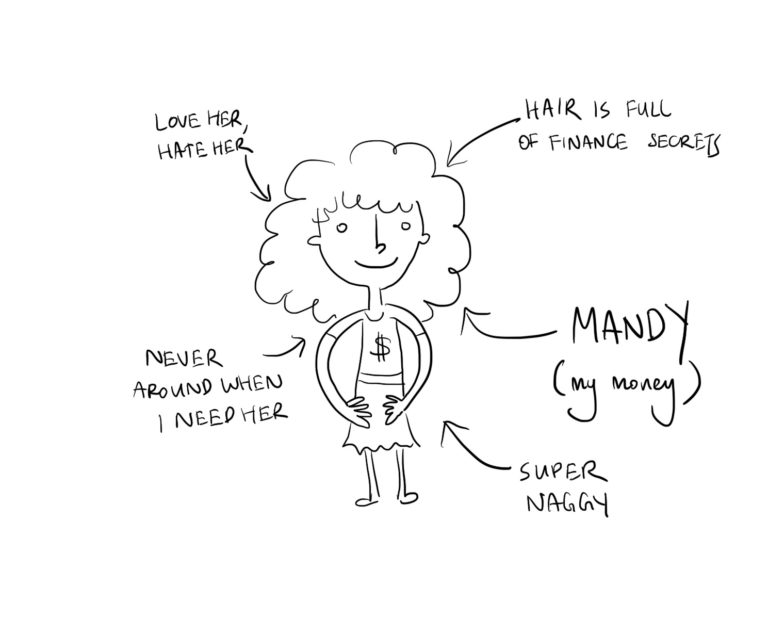

Meet Mandy.

Mandy is the personification of my money.

When she’s around, she is fun to be with. Heck, she makes ME fun to be with. She can also be a huge source of stress. She’s a frenemy, whom I both love and hate.

My relationship with Mandy is complicated. And chances are, so is your relationship with your money. Our relationship with money is formed in the same way as our human relationships — through our natural human instincts, our personal experiences, and everything else that makes us who are.

What do I mean? Let me break it down.

First of all, as much as we’d like to think that we are an advanced species, we are still controlled by our biology. Take spending. When you buy something that seems like a reward, the neurotransmitter dopamine spikes, producing a feeling of instant gratification. Ingrained into our brains are very simple instructions: if something makes us feel good, we want to keep doing it. If it doesn’t, we’d rather avoid it. Acquiring more stuff makes us feel good, but paying bills makes us feel bad. Yet, the logical part of our brain recognises the dangers of leaving bills unpaid. It is that conflict of logic versus biological instinct that elicits a sense of anxiety.

These natural associations of positivity and negativity are also shaped by our personal experiences. The way we learned about money from a young age becomes a cornerstone for the way we deal with money as adults.

Try this exercise.

Think back to your childhood, and write down three memories that centred around money.

Next, write down the emotion you felt in each of those memories. It could be the first time you saved enough to buy yourself a toy, which brought you joy, or the first time you saw your parents struggle with the bills, which brought you sadness.

How have these experiences influenced your relationship with money today?

Once you’re aware of the state of the relationship, what do you want to change about it? Whether the relationship is positive or negative, healthy or unhealthy, being aware shows us what we can change about our situation, and makes it easier for us to make actionable steps.

What are those actionable steps? Well, that depends on who you are.

We’ve heard plenty of success stories about people who founded startups that were acquired for millions, or those who managed to save $100,000 by the age of 25 by being aggressively thrifty. But comparing yourself to ‘Forbes 30 under 30’ millionaires will do you no favours, especially when you don’t know anything about who they are as people. Your friends may find joy in spending all night researching about the best credit cards or betting everything on a risky investment, but if you force yourself to do the same, you might find yourself slightly richer but ultimately miserable.

Your relationship with Mandy is just that — your relationship. It doesn’t involve your family, your friends, salespeople, or MLM agents. You should never feel obligated to involve anyone else in this relationship of two.

If you want to give money to your parents monthly, do it because it’s important to you and not because you feel pressured to do so. And if you love your expensive watches and or want to spend most of your paycheck traveling, go for it! At the same time, when you read up on other ‘Forbes 30 under 30’ millionaires or talk to your friends about what stocks they’re buying, only make decisions that make sense for you. As long as you respect your relationship with your money, you can do what your heart desires.

You see where I’m going with this? The way you treat your money shouldn’t be any different from the way you treat your partner, or your close friends, or family. Just like the way that you show care and concern in your relationships with other people, the way you choose to manage your money should be an informed, but personal, decision.

Unlike many relationships, this one isn’t fleeting. It’s one that you get to have for the rest of your life, so why not make it a good one?