Financial Planning | Personal Finance | Article

Does Adulting Really Need To Be That Hard? How To Simplify Your Finances To Sail Through Adulthood

by The Simple Sum Team | 15 Mar 2024 | 9 mins read

This article is brought to you by Dobin.

Adulthood can sometimes feel like navigating a maze blindfolded.

One minute you’re in school with teachers and parents telling you what to do.

The next, you’ve tossed your cap, graduated, and suddenly you’ve got all these unfamiliar responsibilities and decisions to make.

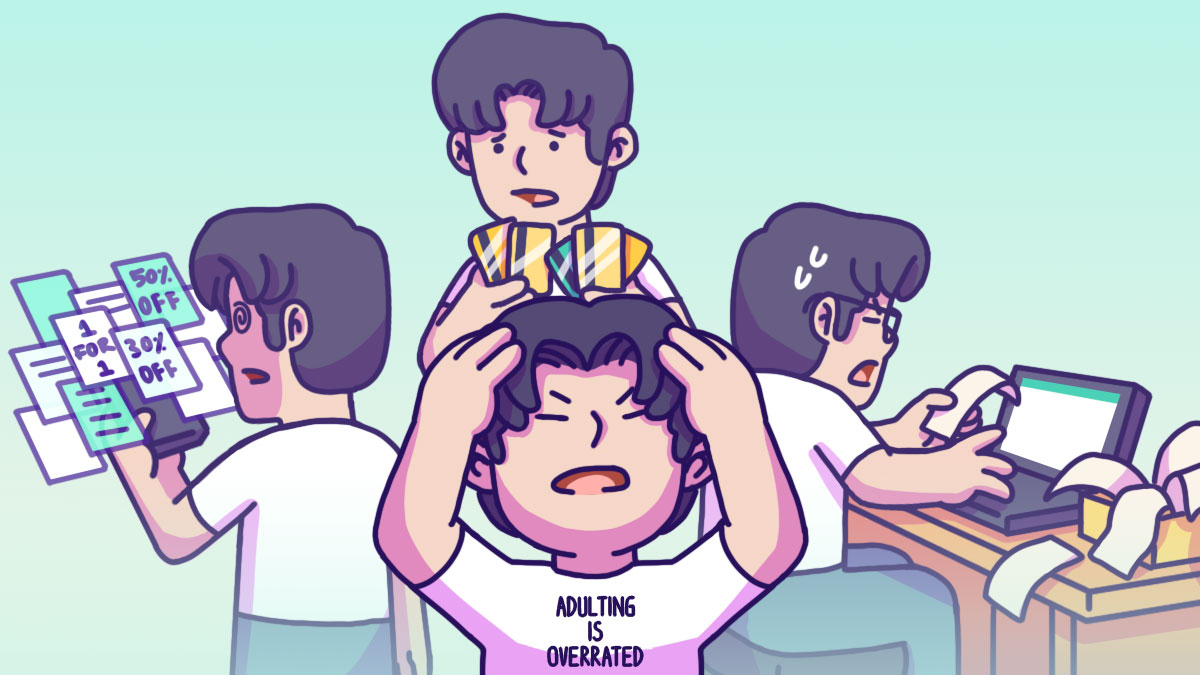

Society seems to expect you to have it all figured out overnight too. From managing your budget and bills to taking care of yourself, your career and your relationships (and not to mention your chores!), you’re in a constant juggling act as an adult, hoping that you don’t drop any of the balls.

So it comes as no surprise that people often feel overwhelmed and find adulthood difficult.

One particular aspect of adulthood that many struggle with is their finances. The mere thought of talking about money, sifting through complex jargon, and making critical money decisions could drive the best of us to bury our heads in the sand.

Related

But as we’ve often said – personal finance doesn’t have to be difficult.

It’s all a matter of finding ways to simplify your money management. By automating and streamlining your personal finance basics, you’ll have one less thing about your adult life to think and worry about.

Here are some easy ways to simplify your finances.

Automate your expense tracking

The foundation of personal finance (and adulthood) is knowing where your money is going. To do that, you’ll need to track your expenses.

But in the digital age, expense tracking can be a headache-inducing task even for the most organised person.

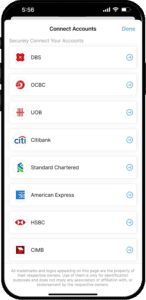

Gone are the days of a single bank account and cash transactions. Now, we juggle multiple bank accounts and payment methods. Hence, keeping track of your expenses would mean going into every single account and manually logging every expense you’ve made.

This exercise might take at least a couple of hours on a weekend. And, let’s be real, who wants to be spending their precious weekend hours looking at an Excel spreadsheet?

What’s more, if you’re already uncomfortable dealing with money, manually logging expenses is about as appealing as going to the dentist.

But sidestepping this crucial personal finance habit and putting your financial well-being on the back burner could spell trouble down the line for your financial health.

Because if you can’t nail down the basics of managing your spending, how will you cope when things get trickier? It’s like building a Jenga tower on a wobbly table – sooner or later, it’s going to come crashing down.

So, while tracking your expenses might seem like a pain, it’s the foundation holding your financial Jenga together, so to speak.

The good news is that you can automate your expense tracking with a platform like Dobin, which automatically consolidates all your expenses across your bank accounts and credit cards in one place.

All screenshots in this article are for illustration purposes.

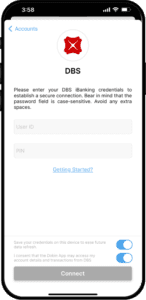

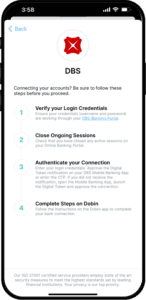

Once you securely link your accounts, the app retrieves your transaction data and using AI and advanced data analytics, it seamlessly categorises your transactions for you. No more manual tracking expenses! All connections will follow the same authentication process as when you log into online banking (i.e. for most, a two-factor authentication / SMS OTP is triggered).

All screenshots in this article are for illustration purposes.

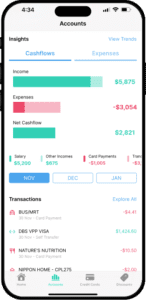

The app also provides insightful breakdowns of your spending habits. Under the “Accounts” tab, you can see a detailed breakdown of your expenses and cash flow over the last three months.

All screenshots in this article are for illustration purposes.

This is especially useful to help you budget and control your spending because you have an overview of your spending and you can estimate how much you’ll need for each expense category in any given month.

These updates also give you the ability to take quick action like cutting unnecessary expenses that could bust your budget.

Aside from helping you proactively control your spending, you can look back at spending trends to find your “money leaks”.

Perhaps you’ve signed up for one too many subscriptions and forgot about these recurring expenses. Or you didn’t realise you’ve been paying a higher utility bill as the months go by. Maybe you missed out on hidden fees that you could easily waive by calling the bank.

With Dobin, you gain more visibility into your finances to help you optimise your spending and plug those money leakages.

Reduce the hassle of scouring for deals and discounts

At some point in our adult lives, we’ll realise that earning a living isn’t easy.

Back when our parents gave us an allowance, we might have been more carefree with our spending. Now, with bills to pay and responsibilities mounting, every hard-earned dollar carries a newfound weight.

Related

Adulting now means that we need to be mindful of where our money goes and make sure we’re maximising every single dollar.

For many of us, maximising our spending translates to hunting for deals and discounts on purchases we’re intending to make. But there is one problem – with every store throwing discounts our way, finding the right deal is like trying to find a needle in a haystack.

Even for merchants that we do spend money with, we’ll have to give up our email addresses and deal with an inbox clogged with promos every day for the chance of spotting a deal that works for us.

Time is a much more precious commodity as an adult so you don’t want to squander it sifting through endless deals and deleting spammy promo emails.

Why not find a smarter way to save without sacrificing your sanity? Dobin takes the hassle out of deal-hunting by curating discounts and deals tailored to your spending habits.

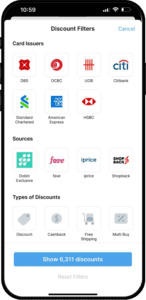

Say you’ve recently purchased some groceries on your credit card. Dobin detects this transaction and recommends deals from grocers like Giant or FairPrice.

Every day Dobin analyses more than 30,000 offers and brings the most valuable 6,000 offers into their platform. Dobin matches the ones that might benefit you most by using the spending data from your bank accounts and cards. Save time and money at the same time! We call that smart savings.

All screenshots in this article are for illustration purposes.

Besides recommending discounts based on your connected accounts, Dobin also sources exclusive deals and discounts with merchants, offering higher percentage discounts than what you might find elsewhere.

In essence, Dobin does the heavy lifting for you when it comes to deal-hunting, ensuring you make the most of every cent without sacrificing your time.

Optimise your credit cards without the headache

Ah, the milestone of adulthood – getting your first credit card. That shiny new plastic opens up a whole new world of opportunities; credit cards could offer you cashback, rewards, or air miles.

But of course, with great rewards comes great responsibility. Credit cards have their own set of rules, and you have to play by those rules to reap the benefits of your card.

First, you have to ensure that you research and apply for a card that suits your lifestyle and needs.

And let’s not forget the golden rule – pay your bills on time, or risk getting hit with late fees and interest charges. Trust us, those late fees can add up really quickly.

Beyond these two rules, however, things can get tricky.

If you’re juggling multiple credit cards, it can be hard to keep track of balances, transactions, reward points, and payment due dates. And that’s not even accounting for the effort expended figuring out where and how to use each card to maximise your cashback or rewards.

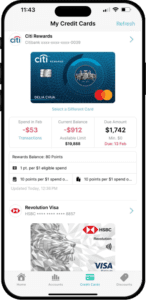

This is where Dobin can come in to solve your credit card woes. With a bird’s eye view of your expenses, balances and due dates all in one place, the app takes the headache out of credit card management.

You can see how much you’ve spent in your Credit Cards page. You can also keep track of your credit card limits and your bill payment dates.

All screenshots in this article are for illustration purposes.

On top of that, Dobin scours the web for those elusive card-specific discounts, bringing them straight to your mobile phone. No more chasing after scattered offers or drowning in fine print – Dobin puts all the info you need right at your fingertips, so you can make the most of your plastic without breaking a sweat.

Adulting doesn’t have to be difficult

Yes, adulting has its challenges but not every aspect of it needs to be an uphill battle.

Sure, monumental life decisions like whether to quit your job and pivot to a new career, where to buy a house, or when to get married can feel like uncharted territory. But simplicity should be the name of the game when it comes to the tedious aspects of personal finance.

By leveraging tools like Dobin to automate and streamline expense tracking, budgeting, and credit card management, you can free yourself from burdensome financial micromanagement. Rather than fret over every cent or agonise over which card to use, you can direct your energy and time to the bigger decisions of adulthood.

Why make life harder than it needs to be? With the right tools in your financial toolkit, navigating adulthood becomes a whole lot more manageable – and, dare we say, maybe even a little bit enjoyable.

Sponsored content by Dobin

View all your credit card transactions, due dates and transactions in one place and explore discounts related to your credit card by Dobin.

Reduce the hassle of scouring for deals and discounts manually and explore this one-stop app that keeps track of balances and transactions, reward points and payment due dates at your fingertips.