Investing | Article

Don’t Sleep On Investing: Why You Should Invest Now And Not Later

by The Simple Sum | 29 Apr 2024 | 11 mins read

Investments are subject to investment risks, including the possible loss of the principal amount invested.

Sponsored content by FRANK by OCBC, written by The Simple Sum.

Investing is the ultimate life hack – it can morph your hard-earned dollars into a wealth-generating machine.

That’s right, investing potentially makes you more money by making your money work harder and smarter.

And the two ingredients that are crucial to optimising your investments are time and compounding. That’s why it’s always better to invest sooner, rather than later in life.

The magic of compound interest

When you invest, you earn returns or interest. It may be tempting to cash out or to take that money as “free money” that you can spend freely. But doing that makes you miss out on a huge component of investing.

If you choose to reinvest the money instead and if your investments and the market continues to do well, what it does is earn even more money. And when you consistently reinvest your returns, it creates a snowball effect where your gains make more gains for you. That’s called compounding.

Imagine your investment as a snowball at the top of a snowy hill. Your initial capital is like the small snowball you start with.

As time passes, the snowball begins to roll down the hill, picking up more and more snow along the way. The longer it rolls, the larger it becomes, thanks to the accumulating snow. In this analogy, time is like the slope of the hill, allowing your investment to grow and compound.

Similarly, even if you start with a small amount of money, the longer you allow your investment to compound, the more it can grow.

Time also plays a crucial role in the compounding process, just as the slope of the hill is essential for the snowball to gain size and momentum. You can think of the length of the slope as the passage of time, and the longer the “time” it has, the larger the snowball will grow.

Hence, over time compounding effect can turn a small amount of money into a significant financial snowball.

Related

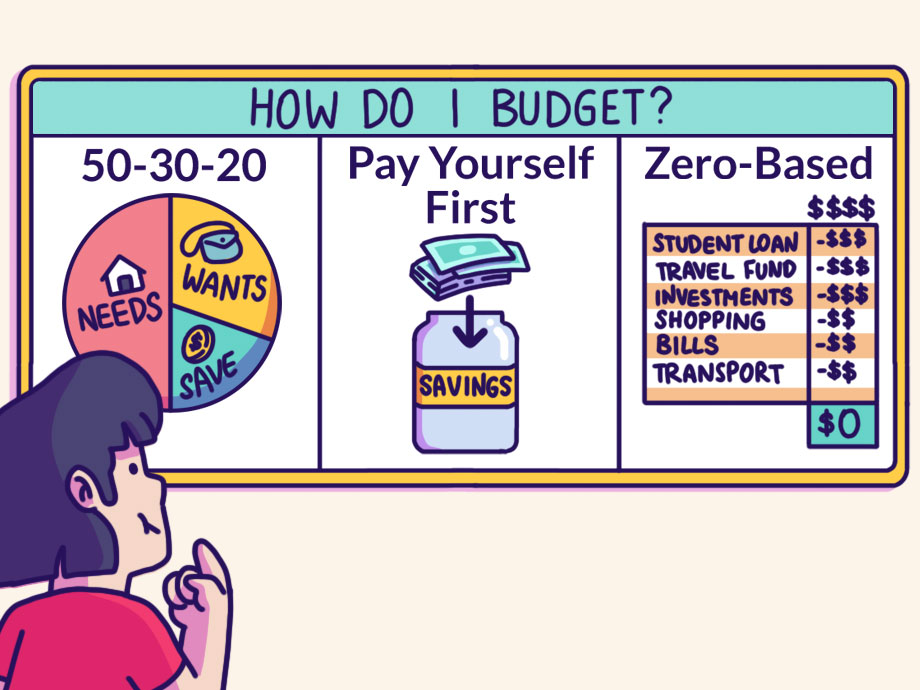

The benefits of starting early

Now, let’s debunk a common thought that most people have: “I’ll start investing when I have more to spare.” However, if let’s do some number-crunching to help illustrate why this line of thinking might cost you more than you realise.

Meet Sarah and Alex. Sarah started investing $500 a month at the age of 25 and stopped after just 10 years. Alex, on the other hand, waits until 35 to begin investing and diligently puts in $500 a month for 30 years. Fast forward to age 65, and you’d be surprised – Sarah, the early bird, actually has caught up with slightly more money.

Case study of Sarah and Alex

|

Person |

Sarah |

Alex |

|

Age they started investing |

25 |

35 |

|

Starting investment |

$500 |

$500 |

|

Monthly investment |

$500 |

$500 |

|

Contribution period (years to grow in TSS Investment Calculator) |

10 years |

30 years |

|

Investment horizon |

40 years |

30 years |

|

Total investment contribution |

$60,500 |

$180,500 |

|

Assumed Annual Average Return |

7%1 |

7%1 |

|

Amount at 65 years old |

$666,431.842 |

$614,043.753 |

| Computation Notes:

*Using MSCI World Index as the benchmark for the global stock market, its average annualised return over the last 20 years is 7.9%. **Amount is an estimation based on The Simple Sum’s Investment Calculator for the first 10 years of investment ($87,547.23) with the following input:

Followed by applying 7% rate of return on $87,547.23 for the next 30 years using the following formula: $87,547.23 x (1 + 7%) ^ 30 years = $666,431.84 ***Amount is an estimation based on The Simple Sum’s Investment Calculator with the following input:

Past performance figures do not reflect future performance. Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way. |

The moral of the story? Starting early has a compounding advantage that can outshine contributions that are larger in size but made later. It’s not just about the size of the nest egg; it’s about the time it is given to incubate and grow.

Learn valuable lessons when you are younger instead of older

While investing is about amassing wealth; it’s a journey of self-discovery and financial education. Even if you’re starting with small amounts, you’ll learn invaluable lessons that will serve you well throughout your life.

Think of it as a financial apprenticeship. You’re not just growing your money; you’re growing as an investor. These early experiences help you understand your risk tolerance, investment preferences, and financial goals. It’s like learning to ride a bike – the wobbles and falls teach you how to navigate the twists and turns.

As you invest, you’re not just accumulating dollars; you’re accumulating wisdom. And the insights gained from your early investment endeavours can be the compass guiding you through the complexities of the financial landscape in the years to come.

Related

Time is your best friend

In investing, time is a formidable ally. It’s not just about the money you put in; it’s about the time you give it to flourish and learn investing lessons that will serve you well in the future. So, if you’re pondering when to start investing, the answer is clear – now.

The earlier you begin, the more time your money has to work its magic. Remember, it’s not just an investment; it’s an investment in your future self. Start now and thank yourself later.

Content sponsored by FRANK by OCBC

Ready to begin investing? Start small and start early with OCBC’s Unit Trust from just S$100/month. Enjoy hassle-free investing, gain diversified exposure to global markets and benefit from professional fund managers actively managing your portfolio.

DISCLAIMER

This is for general information and does not take into account your particular investment and protection aims, financial situation or needs. You may wish to seek advice from a financial adviser before making a commitment to purchase an investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the investment in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

GRAPHS, CHARTS, FORMULAE AND OTHER DEVICES

Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment.

IMPORTANT NOTICES

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

- There are links or hyperlinks which link you to websites of other third parties (the “Third Parties”). OCBC Bank hereby disclaims liability for any information, materials, products or services posted or offered on the website of the Third Parties.

COLLECTIVE INVESTMENT SCHEMES

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The indicative distribution rate may not be achieved and is not an indication, forecast, or projection of the future performance of the Fund.

- For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

GLOBAL EQUITIES DISCLAIMER

- Dividend growth is not guaranteed, nor are companies in which you invest obliged to pay dividends;

- Companies may go bankrupt rendering the original investment valueless;

- Equity markets may decline in value;

- Corporate earnings and financial markets may be volatile;

- If there is no recognised market for equities, then these may be difficult to sell and accurate information about their value may be hard to obtain;

- Smaller company investments may be difficult to sell if there is little liquidity in the market for such equities and there may be substantial differences between the buying price and the selling price;

- Equities on overseas markets may involve different risks to equities issued in Singapore;

- With regards to investments in overseas companies, foreign exchange rates may move in an unfavourable direction affecting adversely the valuation of investments in base currency terms.