Financial Planning | Personal Finance | Article

Prepare For Unpleasant Surprises With An Emergency Fund: A Step-by-Step Guide

by Bryan Lim | 2 May 2023 | 7 mins read

This article is brought to you by Singlife

When it comes to surprises, people seem to be split down the middle on whether they like them or not.

However, the one thing most can agree on is that no one likes an unpleasant surprise in the form of unexpected expenses or loss of income.

That’s where an emergency fund comes in — it’s a pool of money to tap on for ‘rainy days’. It saves you from busting your budget, putting a pause on your longer-term goals, or having to take on more debt just because something unexpected cropped up.

Some real-life situations that require an emergency fund include the sudden loss of jobs, unforeseen medical emergencies or replacing broken or older models of electronics and appliances.

Generally, it’s recommended to have at least three to six months’ worth of living expenses saved up in your emergency fund, but this amount can vary depending on your financial situation. For example, if you have kids or are self-employed, you may need more savings to tide you over.

Starting an emergency fund can be daunting, regardless of how much you need, so we’ve broken down the process step-by-step to help you get started.

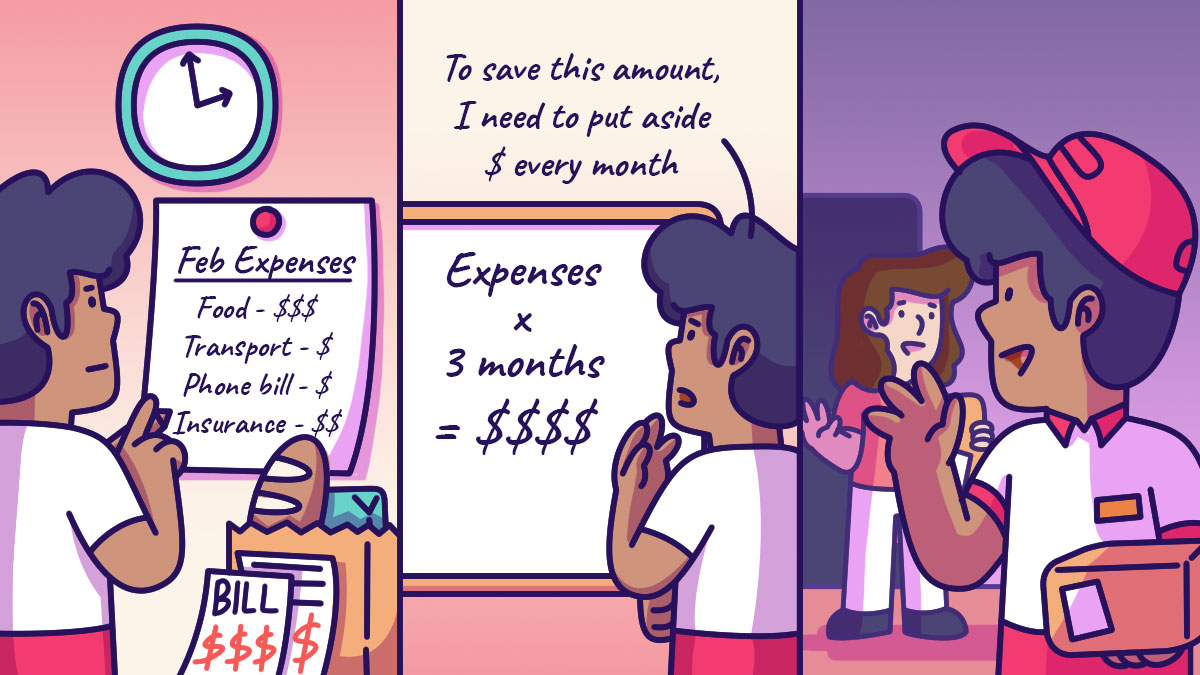

Step 1: Figure out your monthly living expenses

If ever there was an opportunity to take stock of your expenditure, this is the time.

You’ll have to calculate your monthly expenses — such as food, transport, bills, insurance payments and rent (if applicable). Of course, the older you are and the more financial responsibilities you have, the more complicated this list becomes. It’s always best to start planning early.

For a young adult who is living with their parents rent-free, this is how their monthly expenses might look.

| Expenses | Amount |

| Food | $500 |

| Transport | $150 |

| Phone bill | $50 |

| Insurance payment | $300 |

| TOTAL | $1000 |

As the emergency fund is strictly meant for ‘rainy days’, we’re not including things like entertainment expenses or your monthly subscription to streaming platforms. After all, these are things that can be cut to save money.

Step 2: Multiply that amount by three

Once you’ve figured out the monthly ‘damage’ to your wallet, the next step is to determine how big your emergency fund should be.

As mentioned, conventional wisdom dictates putting aside at least three months’ worth of living expenses, so you’ll need at least $3,000 ($1,000 X 3) in your emergency fund.

However, you might want to put aside more money, according to your personal circumstances.

For instance, if you are providing for your family, are self-employed with variable income, or want to be prepared in case you lose your job during an economic downturn, you might want to buffer for a longer duration.

In this case, it might be prudent to budget up to 12 months’ worth of living expenses.

Step 3: Set an amount to save each month

Now that you’ve got a goal to save towards, you need to actually start saving.

Start by figuring out how much of your monthly income can be set aside for your emergency fund, so you’ll know how long it’ll take to save.

This will sound like a primary school problem sum, but assuming you need around $6,000 in your emergency fund (and you’re starting from scratch) and can only save about $300 a month, it’ll take you about 20 months to get your fund ready.

Of course, the amount you can save also depends on how much you make and other financial responsibilities, but the recommended amount is 20% of your monthly income.

Step 4: Find ways to grow your emergency fund faster

Put funds into a liquid, interest-bearing stable product account

Instead of letting your money sit in the bank with a measly annual interest rate, why not let it work for you?

When deciding where to put your money, bear in mind that your emergency fund needs to be placed in a product that has ultra-low risk and is easily accessible.

You’ll also want to ensure there are no additional fees incurred (for example, a penalty for falling below a certain account balance) when you need to withdraw money.

Cut expenses or hustle on the side

Aside from setting aside a portion of your monthly income or choosing to put your funds into a suitable financial instrument, you should also look at other ways to speed up your savings.

The most direct way is to cut down on unnecessary expenses — ask yourself, do you really need to eat at a restaurant every week or have a Starbucks coffee every morning? Remember, the faster you build your emergency fund, the more secure you’ll feel spending on your wants knowing that you have a backup plan if life decides to throw you some curveballs.

You could also consider starting some side hustles to get more income or put more of your bonus towards building your emergency fund quicker.

Planning for your emergency fund isn’t an easy process – we get it.

Firstly, it’s tough to evaluate your monthly expenditure and feel the shame and regret when you realise that you could have saved hundreds on cab fares or your daily artisanal coffee, or both.

Secondly, forced savings is always hard because it means we have to sacrifice the finer things in life, which may include cutting back spending on our hobbies or adjusting our lifestyle.

However, the sooner you start on it, the faster you can protect yourself against unexpected expenses and have peace of mind with your finances.

Content sponsored by Singlife

Sign up for the Singlife Account here and get a S$10 sign-up bonus today!

You can make your emergency fund work harder for you by putting it in a stable ultra-liquid insurance savings plan that is capital guaranteed. That’s where Singlife Account will be most helpful to you.

This insurance savings plan lets users have flexibility and liquidity in their savings, all while offering a competitive base return of 2% p.a.

Being an insurance plan also means it provides life insurance cover in the event of death and terminal illness, up to 105% of your account value.

The Singlife Account has a low point of entry too (you can start your emergency fund with just S$100) and lets users earn daily interest on their savings with no lock-in period or fees — perfect for those who don’t have a large capital to start with.

Users can also make top-ups and withdrawals whenever they want without any fees or penalties, so it’s the perfect option for anyone looking to build their emergency fund.

Instead of having your money sit idly in the bank as a typical emergency fund would, Singlife Account helps you grow your money to counter inflation.

Start your Singlife Account today to get a promotional base return of 2% p.a. on your first S$10,000. For amounts above S$10,000, up to S$100,000, you can enjoy promotional base return of 1.4% p.a.

You can also earn more with their bonus campaigns:

- 0.5% p.a. Bonus Return from Singlife Account Top-up Campaign, on your first S$10K

- 0.5% p.a. Bonus Return from Singlife Sure Invest Bonus Return Campaign, on your first S$10K

- Up to S$810 Cash Bonus from Singlife Account Special Incentive Campaign

Available from now until such time as updated by Singlife.

Disclaimer: This policy is underwritten by Singapore Life Ltd. Terms and conditions apply. This article is published for general information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person.

Please refer here for more information on Singlife Account.

Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore. The information is accurate as of 2 May 2023.