Investing | Article

ETF Crisis: Time to Panic?

by Si Jie Lim | 8 Nov 2019 | 7 mins read

For most beginner investors, the most recommended investing tool nowadays is probably an exchange-traded fund (ETF). Most robo-investment platforms and banks in Singapore offer a regular savings plan, that lets you invest in ETFs every month.

But recently, there have been talks of an ETF “liquidity-crisis” by Michael Burry, the guy who famously predicted the 2008 financial crisis (and pretty much had a movie made about him).

Now, he thinks the next market bubble will stem from the ETF “liquidity-crisis”.

But, before you panic and sell off all the ETFs you have been passively accumulating, let’s understand what exactly is an ETF “liquidity-crisis”? What should you know about it and more importantly, how to deal with it when it happens?

In order to fully understand the potential disaster scenario, you’ll need to know what goes behind the creation (and redemption) of ETFs.

Every financial instrument is a monetary contract between two (or more) parties. Thus, it needs to come from somewhere. The same applies to an ETF.

You might think that if you purchased a unit of a Straits Times Index (STI) ETF, it would be a simple matter of passing your money to the sponsor (in STI’s case, either Nikko or SPDR) and they will then take that money to purchase the shares of the top 30 listed companies in Singapore (STI’s underlying shares).

Well, that’s about right, but not exactly.

How ETFs are Made

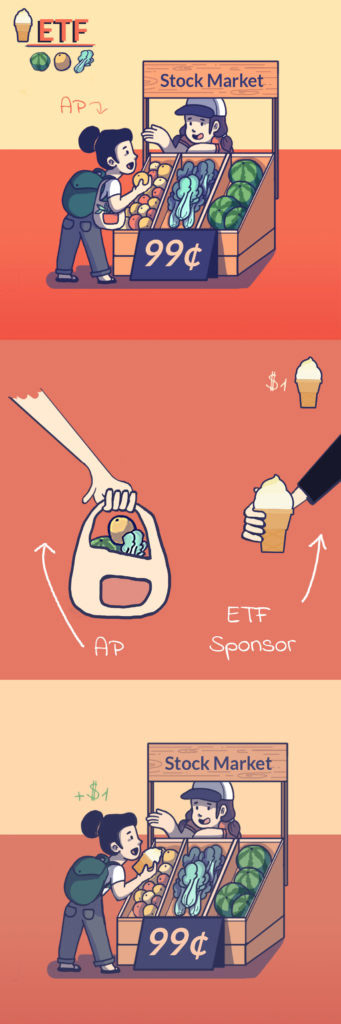

Like most instances within the finance sector, there are middlemen. In the case of ETFs, the ones that stand between the ETF sponsor and us (the investor) are Authorised Participants or APs.

An ETF is created when an AP (e.g. A financial institution, institutional investor or market specialist) transfers the basket of securities (bonds or shares) that an ETF tracks to an ETF sponsor (e.g. BlackRock or Nikko). In return, the AP receives ETF units, which they sell (to us) on the secondary market.

ETF redemptions occur in a reverse process. ETF units are purchased by APs from the market, before transferring them to ETF sponsors in exchange for the same basket of bonds or shares.

Role Of AP In The ETF Market: Creating Balance Using Arbitrage

The AP plays a very important role in the ETF market. Because of its authority and ability to create and redeem ETF units, APs keep the supply and demand of ETFs in balance by creating or redeeming them depending on the demand and supply in the market.

For example, if the demand of an ETF spikes and a price premium develops, APs step in to create more ETF units to push the ETF price down. Similarly, when there is a rush to sell, APs will buy ETF units on the open market at a discounted price, and redeem them – for the underlying shares/bonds – with the ETF sponsor to reduce the supply.

Hence APs play a key role to ensure market index ETFs fulfil their function of ‘following’ the market or tracking their index.

APs make money off micro price mismatches throughout the trading day – aka arbitrage – by either selling more ETFs (when there is demand) or buying discounted-price ETF units (when there is a lack of demand).

This ‘arbitrage mechanism’ is a way to ensure that ETF prices in the secondary market align with the net asset value (NAV) of the underlying basket of securities/bonds held by the ETF sponsor.

You might be thinking that all that complexity of how ETFs are created and redeemed is good to know. But why does it matter to you as an ETF investor? As an ETF investor, all you need to do is to put your money into an ETF and wait to make passive returns, right?

This is probably the right time to introduce the term “ETF Death Spiral”.

ETF Death Spiral

Because of the nature of how ETFs are traded, there are potential risks. This can happen during a market sell-off or market panic such as the 2008 financial crisis where everyone was trying to get out the door.

During a market sell-off, some ETF unitholders might sell off ETF units in a panic. The sell-off can lead to a situation of overselling by ETF investors.

What Happens When The Underlying Asset Is Illiquid?

When many people are rushing out, the underlying assets (e.g. index, share or bond) experience a large drop, creating additional selling pressure in the market. Eventually, underlying assets might not be easily converted into cash since there’ll be only sellers and no buyers to catch the falling knife.

This is worse when weaker components within an index night have already thinly traded volumes. For example, bonds generally see less trading vs. shares – the average trading volume of the local ABF bond ETF is 5 times less than the ES3 share ETF – and even within the bond ETF, there might be underlying constituents that are less liquid than others.

So when many people suddenly try to leave an already illiquid bond/share, it will experience a huge downward price pressure extremely quickly – as there was never was a large pool of waiting buyers to begin with.

At this point, the APs should step in to buy the cheap ETFs units, right? However, the APs, also uncertain of the market conditions, might also want to only purchase on the cheap to protect themselves – which adds more fuel to the flames.

So what happens in a total lack of liquidity is that the drop of the underlying bond/share prices will cycle back and impact the ETFs price. Which might cause even more panic among ETF unitholders, leading to a further market sell-off. The underlying assets spin further out of control, pulling the ETF down with it.

Again, triggering more sell-offs, etc. Hence, a death spiral.

In fact, the APs themselves might even exit the market and stop providing any liquidity for ETF units since they do not have a legal duty to do so, creating more liquidity shocks (though other APs might step in to take its place).

What To Do About The ETF Death Spiral If You Are A Long-Term ETF Investor?

Don’t Panic

Whenever a market sell-off happens, people will be shaken psychologically. Headlines will scream “The End is Nigh”. Everyone around you will be selling. It will make you worried and wonder whether you should be selling your ETFs too.

But these market sell-offs are temporary. While the economy might enter into a recession in the short-term, it will recover in the medium to long-term. Since the performance of assets is correlated with economic growth, popular ETF prices will likely recover. Instead of panic selling, you might even want to consider investing more at cheap prices.

Perhaps another thing to consider is to pause portfolio rebalancing – especially when red is the only colour you see on your stock screener – as you want to avoid selling at artificially low prices.

It Might Not Even Happen To You

The ETF death spiral scenario applies mostly to illiquid assets like high-yield bonds (or junk bonds), which are more speculative in nature. In deep liquid markets such as large-cap shares, the problem will likely unwind itself, once cooler heads prevail. Also, the underlying fundamentals of established institutions and businesses have higher chances of riding out a recession.

So unless you are investing in really speculative ETFs, you should be able to put your mind at ease.

It Requires A Major Market Sell-Off To Trigger The ETF Death Spiral

In order for the ETF death spiral to be triggered, it requires a major market sell-off similar to the one we saw in 2008. Historically, such a major sell-offs occur very sparsely. That being said, it doesn’t mean that a similar market sell-off won’t happen in the future.