Financial Planning | Personal Finance | Article

Your First BTO Could Make You Money

by Sophia | 10 Sep 2019 | 7 mins read

Home is where the heart is, but only after we sell off our first BTO.

In Singapore, most couples have the opportunity to live in government-subsidised Build-To-Order (BTO) flats. So because they’re subsidised, does the process of flipping our first BTO go like this?

Step 1: Buy BTO

Step 2 : Sell BTO

Step 3: ???

Step 4: Profit!

It does seem to make sense. Also, if you used CPF to pay for your mortgage, it’s one way to unlock some real cash from your CPF funds upon a sale, right?

Let’s explore past data to see if this plan comes together.

How does one get into flipping his first BTO?

In essence, this is how it works: After a five-year Minimum Occupancy Period (MOP), BTO flat owners will be able to sell off their homes on the open market – presumably, at a much higher market price.

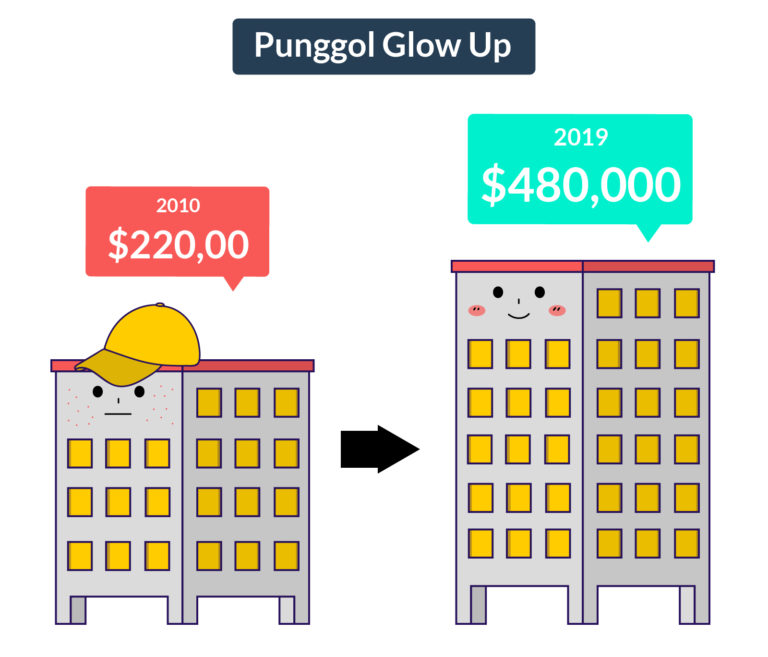

Punggol: a case study

One particular estate has been fairly popular over the last few years – Punggol. It’s gone from non-mature to a fairly popular and well-developed estate, especially after being transformed into a cool waterfront town.

Let’s take a look at the price of a high-floored 4-room BTO that just cleared its MOP, and was sold at $480,000 this year (according to URA’s online tool). With some digging, we found that the flat was in Punggol Coralinus BTO phase 2, where the upper range of its 4-room flats was originally priced at $220,000 upon BTO launch back in 2007.

And it isn’t the only one to be sold. According to HDB, 13% of BTO flats located in Punggol (and Sengkang) had been sold after their MOP ended.

But was there a profit for these sellers after flipping BTOs? Let’s speculate.

Breaking down the costs

Let’s assume this: A hypothetical couple had a total household income of $4,000 when they purchased their first BTO, the Punggol Coralinus 4-room flat, 13 years ago, with its construction completed in 2010.

Under the old AHG scheme, before it got enhanced in 2009, they would have been entitled to $5,000 in CPF grants.

Here’s a breakdown of how much they paid after staying there for nine years:

| BTO purchase price (2010) | $220,000 |

| Downpayment in CPF (10% of the purchase price) |

$22,000 |

| Additional housing grant | $5,000 |

| Remaining mortgage | $193,000 ($875.58/month) |

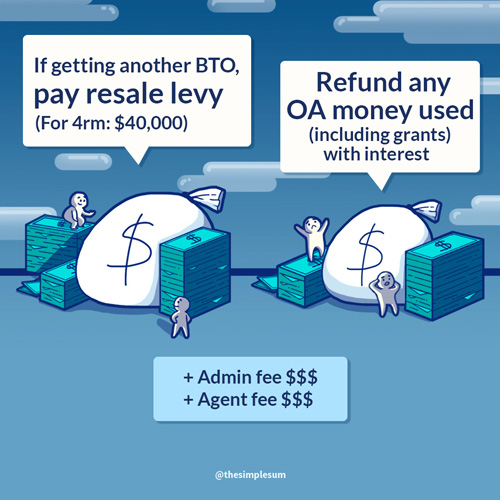

To figure out how much they earned from selling their home, we first have to consider the resale levy that has to be paid. This levy applies when a couple decides to purchase another BTO.

The cost of the resale levy depends on the current size of their flat:

| 2-room | $15,000 |

| 3-room | $30,000 |

| 4-room | $40,000 |

| 5-room | $45,000 |

| Executive | $50,000 |

| Executive Condominium | $55,000 |

Source: HDB

This amount will be deducted from their sales proceeds, so if they sold their 4-room BTO at $480,000. $40,000 will be subtracted, leaving them with $440,000.

Next, they have to work out how they had used from their CPF to pay off their first BTO. They will have to refund this amount, with accrued interest, back to their CPF accounts.

Accrued interest is any interest the money would have generated if left untouched in their CPF OA accounts. As CPF is primarily for retirement, this is in place to ensure retirement needs can be met.

So this includes money for the downpayment, any housing grants, as well as mortgage payments thus far, compounded monthly for nine years at the OA’s interest rate of 2.5%.

| CPF money owed (before interest) | $22,000 (downpayment) + $5,000 (CPF grant) + $94,562 (mortgage paid) = $121,562 |

| CPF money to be returned (after 2.5% interest, compounded till year of sale) | $27,475 + $6,244 + $106,003 = $139,752 |

| Remaining mortgage | $98,438 |

So let’s see how much the couple earns in cash, after subtracting the remaining mortgage, as well as their dues to CPF.

$440,000 – $98,438 – $139,752 = $201,810. Wow, a huge profit!

Additional costs for selling one’s first BTO

But the subtraction doesn’t stop here. There are additional costs to bear – mainly, agent commission fees when they sell their first BTO.

Agent fees for sale are typically 2% of the flat selling price: $9,600.

This leaves them with $192,010.

We haven’t included the myriad of additional miscellaneous administrative fees for the sale and purchase of both flats, nor the moving costs. We are also assuming this is a frictionless move between houses – that is, they do not need to make rental arrangements while waiting for their next home to be ready.

But still, not too shabby.

But wait…

So far, it does look like a nice profit coming out of the first BTO. But we are forgetting a big cash-sink.

We should factor in that the couple might have spent a big amount on renovation on their first home (BTOs come bare) – which according to Qanvast, averages $48,000 today.

If accounting for an inflation rate of 2%, that would be roughly $40,000 back when they first moved into their Punggol BTO flat. After all, they still need to make it livable for the nine years they reside there.

Then, let’s assume our couple moves into another BTO and they have to spend another $48,000 on renovation costs.

This potentially brings the total cost of renovation sunk into both homes up to $88,000.

In the end, this leaves us with $104,010 in cash profit. Of course, your mileage may vary depending on the renovation costs.

Still pretty good! A 6-figure sum in profits.

But what about the CPF side of the equation?

So far, the cash portion of the transaction looks great, but what about the CPF side of the equation?

After all, the couple will have to purchase a new BTO at today’s more expensive prices, requiring them to service a larger mortgage.

Perhaps the couple picks their next BTO as a high-floored unit in Tengah (that launched earlier in May this year). The upper range of 4-room flats there would cost $309,000.

If they fully utilise the CPF refund of $139,752 to offset the new mortgage, it leaves them with $169,248 in balance, $70,810 more compared to what was remaining on their original BTO.

So if we subtract the increase of the mortgage from their cash profits (hey, CPF is money too), in total, the couple’s total net profits are: $33,200.

Still, not too bad.

Other factors when selling one’s first BTO

However for this to work, there are many assumptions at play. Firstly, the couple has to be eligible to apply for another BTO. Mainly, they have to be below the required income ceiling of $14,000 a month to be eligible. If not, they would have to spend more on the purchase and renovation of mature resale flats. That could easily wipe away any remaining profits.

Even if they are still within the income ceiling, they will also have to go through another anxiety-inducing round of BTO roulette – with lower chances of getting a good queue number when applying as second-timers.

Not so flippin’ good right now

If you are currently waiting out your MOP for a sale, there are some developments in the current housing market that might put a wrench in flipping BTOs as a money-making plan.

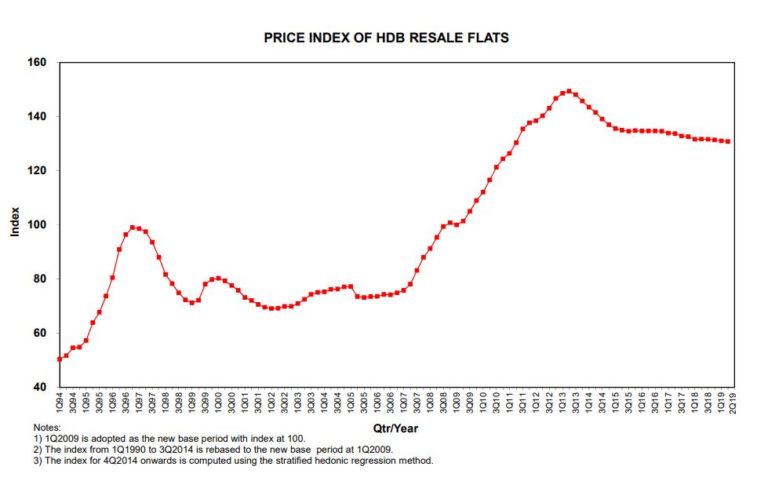

Observe the boom of property appreciation from 2007 to 2012. The Punggol BTO which we used above as an illustration almost perfectly rode this wave.

But from 2013 till today, it seems that resale flat appreciation has flatlined. If this trend continues, it might mean that any BTO purchased from 2012 onward might not experience the same astronomical growth in resale prices. Flipping BTOs might not be as lucrative as before, then.

This flatline has been due to property cooling measures that the government implemented to control property prices.

These measures, coupled with the recent changes to CPF usage rules that encourage owners to buy flats with leases that can last them till age 95, it indicates the government wants us to look hard at choosing a forever home from the outset – and not treat HDB flats as an investment vehicle.

And let’s not forget the surge of BTO projects springing up every other year. The number of projects in recent years easily trumps earlier years like 2008 and 2009. With a higher supply of flats at the ready for couples, the demand for resale flats might drop, creating downward pressure on the selling prices.

Unless you are a lucky outlier that can sell your BTO for a million dollars, you should do your sums carefully and observe the current resale market conditions before committing to flipping BTOs and selling your home.