Budgeting | Personal Finance | Article

Are You Really Getting Good Bargain? Perhaps Not, Because of Shrinkflation

by Cherry Wong | 16 Aug 2022 | 5 mins read

With prices of things on the rise, most of us are trying to find ways to cut down on our spending. Everything from chicken to toilet paper cost more than before at the supermarket.

And when we spot our favourite brand of toilet paper and it’s still the same price. We think to ourselves: “This is great. My expenses won’t be as greatly affected.”

But does has it really stayed exactly the same? Perhaps not quite and this could be because the brand has chosen shrinkflation, instead of raising prices. And it’s not just toilet paper. Candy bars, potato chips, detergent brands and more have all been known to practice shrinkflation.

Understanding shrinkflation

With the cost of things going up, production costs for goods also rise. To offset the increased cost, manufacturers would pass on the cost to consumers either by raising prices or they can choose to reduce the amount but sell it at the same price so that consumers can still afford to buy. This results in smaller candy bars, fewer potato chips in a bag and lesser detergent in a bottle than before.

Shrinkflation is a fairly common marketing strategy used by manufacturers during times of high inflation when the cost of raw materials and production goes up. This method of downsizing is also often used as a way to avoid raising prices and losing customers, especially during slow economic times.

Related

Both inflation and shrinkflation means that we consumers end up getting less bang for our buck

With inflation, things become more expensive and you can buy lesser items with the same amount of money as before.

With shrinkflation, prices look like they are maintained. So, while you could buy the same amount of items as before, if you break it down to the unit price of the item, you would still be getting lesser than before.

Here’s an example to help illustrate this:

Brand XYZ sells a can of 100 potato chips that retails for $10.

With $60 you can purchase 6 cans and have 600 potato chips.

Inflation

Brand XYZ increases their price to $12.

With $60 you can only purchase 5 cans and have 500 potato chips.

Shrinkflation

Brand XYZ keeps their price at $10, but reduces the number of potato chips in each box to 80.

With $60 you can still purchase 6 cans (and probably think that you are getting the same thing as before), but you’ll only really have 480 potato chips.

As most of us often focus only on the price tag, shrinkflation (also known as stealth inflation) that shrinks your wallet often occurs without you noticing. Unless you pay more attention to the information on the labels it is difficult to realise that there is a size or quantity difference.

Related

Beat shrinkflation by looking at more than just the price tag

There is only one way you can spot shrinkflation is to shift your focus from the price only and instead calculate the unit cost of the product, which is derived by dividing the price of item with the weight or the number of items.

When you compare unit prices, you will know exactly how much you’re getting for your money and how it is calculated.

Example:

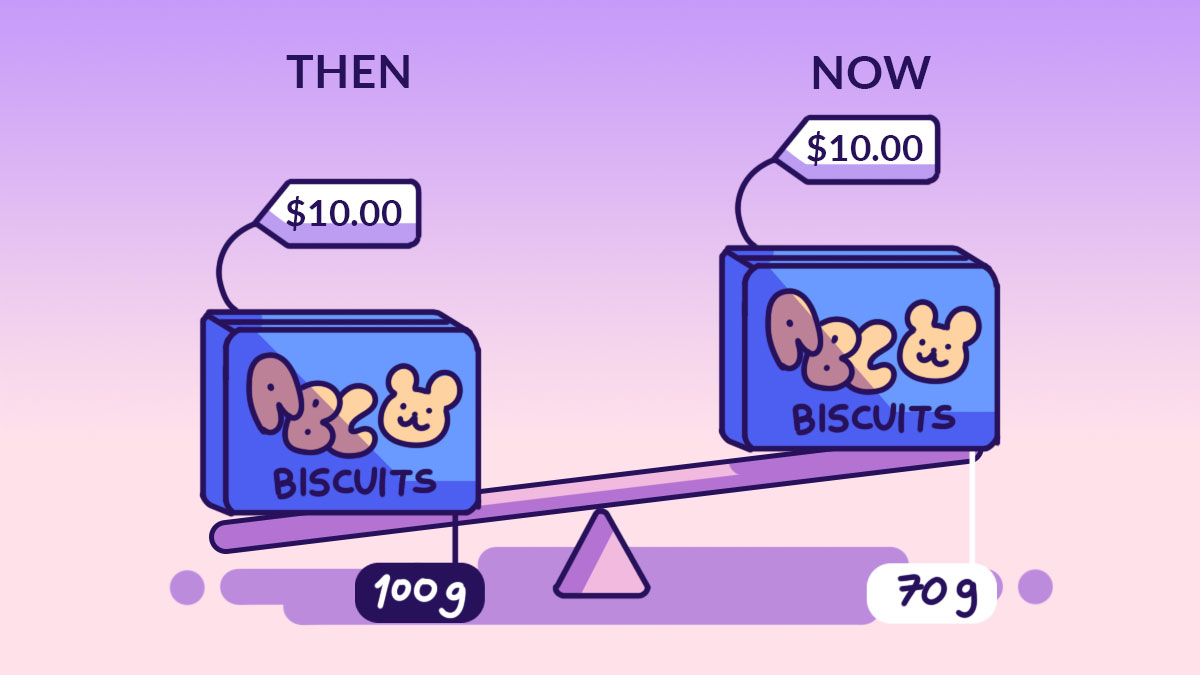

| ABC biscuit | Before | Now | ||

| Product price | Unit price | Product price | Unit price | |

| Inflation | $10 = 1 box (100g) | $10/100 =

$0.10 per gram |

$12 = 1 box (100g) | $12/100 =

$0.12 per gram |

| Shrinkflation | $10 = 1 box (100g) | $10/100 =

$0.10 per gram |

$10 = 1 box (70g) | $10/70 =

$0.143 per gram |

Because of inflation, for the same 100g box of biscuits you are paying $2 or 20% more.

| Before | $10/100 = $0.10 per gram |

| After | $12/100 = $0.12 per gram |

| Unit price difference | ($0.12 – $0.10)/$0.10 = 20% |

Because of shrinkflation the packaging shrunk from 100g to 70g, but the price has remained the same and this may not be clear to most shoppers. But you are actually paying 43% more.

| Before | $10/100 = $0.10 per gram |

| After | $10/70 = $0.143 per gram |

| Unit price difference | ($0.143 – $0.10)/$0.10 = 43% |

When the prices of goods and services are rising, people always look for the ‘cheapest deal’ on the shelves to save money. But buying the cheapest isn’t always the best value for money because the ‘hidden’ price can easily go unnoticeable. Shrinkflation has quietly crept into our shopping carts without us noticing how it is shrinking our wallets.

Always use the unit cost to compare prices before you buy them. It is the best way to compare past and present prices and also the prices of alternative brands.

For some items that you use regularly, a reduction in the quantity may mean that you need to buy more because it is not enough. This means that you will need to spend more and will need to adjust your budget for the added expenses.

Related

Examples of shrinkflation from around the world

| Year | Item | Reduction |

| 2010 | Kraft – Toblerone bar | 200g to 170g |

| Nestlé – After Eight Mint Chocolate Thins box | 200g to 170g | |

| 2011 | Cadbury Heroes | 975g to 695g |

| 2017 | Mcvitties – Jaffa Cakes | 12 pcs to 10 pcs |

| 2021 | Sainsbury – Spicy Thai Crackers |

|

| 2022 | Procter & Gamble – 18-count mega package number of double-ply sheets per roll |

|

Source: Wikipedia

With shrinkflation just as prevalent as inflation, don’t be deceived the next time you go supermarket shopping as it’s important to know what exactly you’re getting when you hand your money over.