Budgeting | Personal Finance | Article

Guilt-Free Expenses for the Average Singaporean

by Sophia | 20 Jul 2020 | 5 mins read

Spending a huge amount of money can feel like you’re committing a grave act, and more often than not the guilt will stay with you long after you’ve hit the ‘buy’ button. But let’s put things into perspective here: there are guilt-free expenses out there. It just depends on your lifestyle and what’s essential to you.

This is even more crucial in a time of quarantine and WFH; the stress of the situation (as well as staying home for such a long period of time) may be eating away at our mental health. So, to alleviate the guilt, here’s a list of expenses one shouldn’t scrimp and save on.

Mental Health

To protect one’s mental wellbeing and overall health, there are a few things a person can spend on:

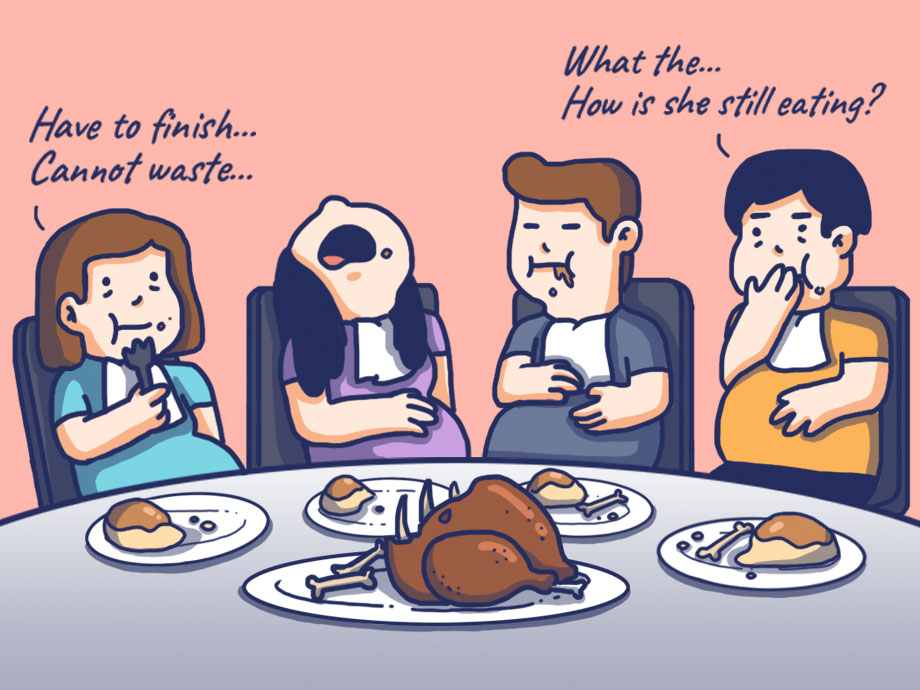

- That coffee with a friend. Or even dinner. A little bit of human contact (with masks) never hurt nobody. Sometimes what a person needs may just be a listening ear or someone to hang out with regularly to stay grounded – so if that’s what you need, don’t feel guilty about spending on a hearty meal or two.

- Therapy. Mental health services in Singapore don’t come cheap, so the thought of hiring a therapist might be guilt-inducing because of the exorbitant cost involved. However, if things are dire and you know you need professional help, then it’s better not to hold back from getting a good therapist.

- While therapists typically charge about $80 to $200 per session, cheaper alternatives are out there. Online counselling services include the following:

- 7 Cups of Tea ($150/month)

- BetterHelp ($35 to $70/week)

- Talkspace ($32/week)

- While therapists typically charge about $80 to $200 per session, cheaper alternatives are out there. Online counselling services include the following:

Physical Health and Hygiene

Physical health and hygiene is more than just seeing your dentist twice a year. Here’s what you can spend on (minus the guilt):

- Dental visits. Oral hygiene is king… or it should be, in all our lives. Dental services may not come cheap, but they’re essential.

- Electric toothbrushes. To supplement your efforts towards ace oral hygiene and reducing the cost of your dental visits, electric toothbrushes will help upkeep that super shiny smile. A worthy investment in our books!

- Ergonomic furniture: chairs, mattresses, and pillows. Having back pains before 30? Investing in ergonomic chairs and the like will help immensely in the long run. More likely than not, they’ll prevent physical issues later on in life.

- You don’t have to buy an ergonomic chair if it’s too exorbitant for your wallet. However, check out add-ons like ergonomic seat cushions as an alternative.

- Vaccinations. In a similar vein to “preventive spending” like for ergonomic furniture, vaccinations are vital to our lives. Don’t wince from the needle or the cost that comes with it. All in the name of good health! (Polyclinics offer vaccinations with subsidies, so be sure to explore that option.)

- Exercise equipment for home workouts! For those looking to cut out exorbitant gym memberships but still serious about keeping fit, buying good, durable exercise equipment for your home setup is a sensible choice. (Psst, Don Don Donki sells affordable exercise equipment for your home setup.)

Financial Essentials

These may not come cheap, but they’re essential:

- Investing a monthly amount. For the sake of a happy, smooth retirement, investing is going to be a recurring cost for those looking to build their retirement nest eggs. There’s no reason to feel guilty about it, since you’re investing for the sake of future you!(Not anyhowly though! Read our intro to investing series here.)

- Adequate insurance and protection. This is an essential part of one’s personal finance, especially if one has dependents like aging parents or children. Insurance is there to protect you in the event that you lose the ability to make a stable income, after all.(To compare the cost of different insurance policies and make a better decision, use CompareFirst!)

Self-Improvement and Education

Some people might feel totally fine with spending on friends (buying gifts, treating meals), but when it comes to spending on themselves, they freeze up and think really hard on whether that $20 is worth spending on. But investing in oneself is the best thing to do, more often than not. Here’s what you could be spending on:

- Going back to school. For those looking to further their education, whether it be for the sake of your career progression or because you want to switch fields, going back to school shouldn’t be seen as an indulgent move.

- Online courses. If full-time or part-time study for the next couple of years isn’t quite your thing, or you’re looking for specific skills to learn, then online courses are your next best bet. If you know you’ll put these new skills to good use, then spending on online courses shouldn’t be lumping guilt on your shoulders.(Check out our list of online courses to make use of!)

- Books. Whether it’s about learning how to invest or how to improve your confidence as a speaker, books offer a wealth of knowledge (or source of entertainment). As long as you’re not buying out a whole bookstore, spending on books is also a form of investment unto yourself.

- Cheaper alternatives include using the NLB app and borrowing e-books for free!

At the end of the day, your spending is determined by your personal lifestyle and what you really need at this moment. That’s why spending to protect your mental health or upkeep your personal hygiene shouldn’t come with a whole bag of guilt. You’re spending on yourself now to prevent a whole slew of problems from incurring a larger bill in the future, so accept these guilt-free expenses with open arms (if they’re for you)!

You know yourself best – and that includes every need you have. Once you figure that out, then saving for retirement will be that much easier, and way less guilt-inducing.