Investing | Article

How to Live Off Investment Returns Forever

by Sophia | 18 Dec 2019 | 6 mins read

Upon retirement, it seems intuitive to fully cash out your investment portfolio to enjoy your years of hard work. After all, it’s time to sit back and relax!

Here’s some bad news for you, this is a quick way to run out of money at the worst possible time — when you are at the most unemployable stage of your life. Long story short, inflation keeps growing, and if your stash stops growing alongside it, you’re going to run out real quick.

But think about it, why should your money enjoy retirement with you? It should stay working to fight inflation! So the solution is simple, only withdraw the amounts you need for use — keep the rest of your money in investments to fight inflation and regenerate your nest egg.

But this begs the question, how do we figure out how much we need in savings to be safe?

The Four Percent Rule

There is a simple rule of thumb that many adhere to — the four percent withdrawal rule.

This rule states that every year, a retiree would ideally withdraw only four percent of their retirement funds, leaving the rest to continue generating future income in investment returns.

This four percent rule is known as the safe withdrawal rate (SWR), the amount you can safely withdraw from your nest egg each year and not risk premature depletion.

So if your annual expenses are $18,000, or $1,500 a month, working in reverse, we can figure out how much your total retirement sum has to be.

$18,000 x 25, or $450,000.

25 because four percent x25 = 100%

Also, this rule takes into account the effects of inflation, so say inflation jumps by 1% the next year, this rule allows you to withdraw $18000+1% to make up for it.

Magic!

But how the heck does the four percent rule predict inflation? How was this rule even decided upon? Can we trust our retirement security to this seemingly random number?

Origin Story of The Four Percent Rule

In 1994, a man named William Bengen published the report Determining Withdrawal Rates Using Historical Data in The Journal of Financial Planning.

In this report, he poured through the historical US stock market performance, economic conditions and inflation rates to figure out what was the most sustainable SWR.

Using rolling 30-year periods in the US from 1926 to 1994, Bengen identified the worst possible time periods to retire.

The worst period occurred in 1973. A period plagued by the double-whammy of a prolonged stock market crash and astronomical inflation rates.

But even then, he found that a withdrawal rate of 4.5% ensured the sum lasted 30 years. Furthermore, he found that in most scenarios, a four percent SWR ensured a retirement fund would last forever!

(this is sexier, hence why we hear about the four percent rule, but not the 4.5% rule)

Does it Really Work?

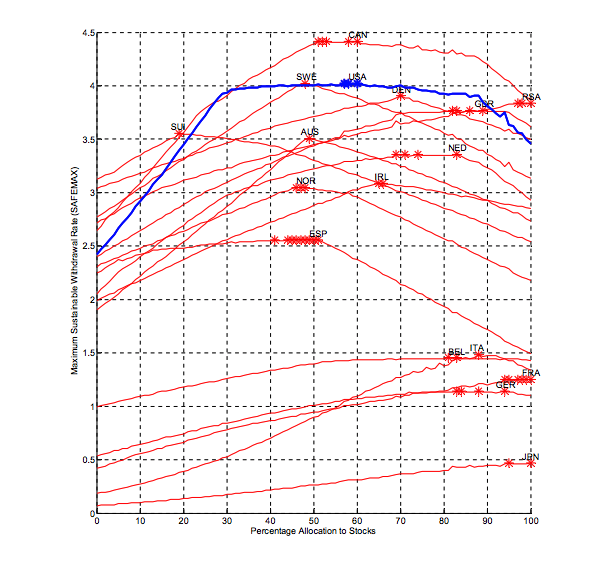

Great! So we can just use the four percent rule can call it a day? Not so fast, there is one point of criticism of the study to consider, that the four percent rule is too US-centric.

Some argue the four percent rule works only in the US, because of the country’s amazing sustained investment return performance — with an average of 10.2% in stock returns since 1926, and a 5.2% return on bonds.

William Pfau — another retirement researcher — conducted research to verify this, and found that due to lower investment returns, or higher inflation, the rule failed when simulated in many other developed countries.

Only Canada and Sweden’s investment market generated enough returns for the four percent rule to work.

So, the solution seems to be by simply investing in the US stock market. After all, in a digital world, there’s nothing stopping us from investing across borders. So why not tap into that American exceptionalism, problem solved right?

But before you do that, also consider that many experts predict that US stocks outperformance has been an anomaly across this century, and has to eventually come down to earth.

And many predict that the time will come soon; investing performance has simply outpaced the slower GDP growth of the US for far too long.

If that really happens, the four percent rule might stop working in the US too.

This serves to underscore why being globally diversified is important in investing, you just won’t know where the next winner, or loser, would be.

So what kind of SWR can we expect if we replace the US investment portfolio with one a Singaporean might own? For example, a portfolio with a mix of a global stock fund and a local bond fund — as we outlined in our bo-chup way to invest series.

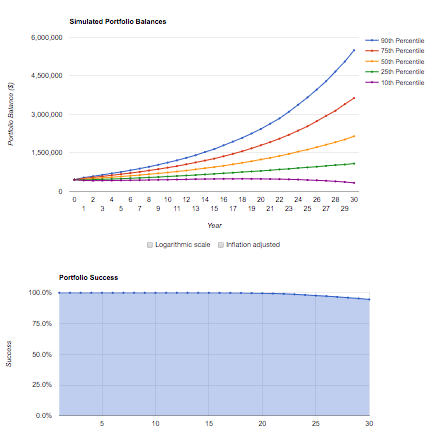

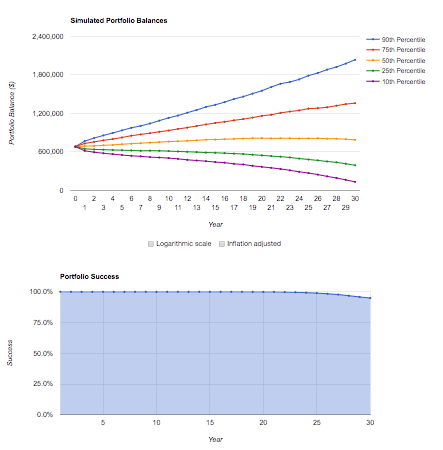

Because historical data is available, we can benchmark Bengen’s original portfolio (made up of the returns of US stocks and intermediate bonds) with Monte Carlo simulations.

Monte Carlo simulations are extreme stress tests that run a portfolio and a SWR through a gamut of 5,000 random economic scenarios to gauge its rate of failure — or the chances of a portfolio depleting prematurely.

So a more modest-returning portfolio, with a lower SWR can be tested to attempt to match the 95% success rate. To find out which numbers to use, we looked as far back as we could for the average returns on a global stock fund and a local bond fund. We then ran them through the same test, and see what SWR can be achieved.

Investments returns

- Backtested since 1999, IWDA, an Exchange Traded Fund (ETF) that tracks the performance of stocks around the world. It had an average annual return rate of 5.91%

- Since 2005, The local ABF bond ETF, had an average annual return rate of 2.73%

We used the same 50/50 blend of stocks and bonds used in Bengen’s study. We also used a lower rate of 2.2% average inflation to be conservative as Singapore’s inflation rate has actually been lower at a compounded 1.74% over the last 30 years.

When running Monte Carlo simulations we find that using a 2.65% withdrawal rate matches Bengen’s four percent model’s 95% success rate.

If this is true, a 2.65% SWR means for one sustain a $1,500 a month retirement — for at least 30 years — a $680,000 nest egg is required, versus the original $450,000.

If you are feeling disheartened over the 40% increase, it’s not all doom and gloom. There is one thing that we have not considered, our CPF retirement funds! A fixed payout during our retirement years reduces the reliance on spending down on our investments, which will definitely boost our SWR — but by how much?

We will investigate in another article.