Budgeting | Personal Finance | Article

How To Make Your Credit Card Work With Your Budget

by The Simple Sum Team | 10 Aug 2021 | 6 mins read

This article is sponsored by Standard Chartered Bank

When used responsibly, credit cards can be a great financial tool that can work to your advantage. In addition to giving you cashback and rewards, a credit card allows you to build your credit score – a healthy credit score makes it easier for you to get financing for when you’re looking to buy a house or a car. Not to mention, credit cards come in handy when you want to keep track of your spending and stay on budget.

It might seem like the words “budget” and “credit card” don’t go together. But, believe it or not, using a credit card can actually help you plan your finances better – provided you use it the right way, of course.

Set a budget before signing up for a credit card

Being disciplined and knowing every inch of your budget is important in managing your spending habits and your credit card.

The most important thing is not spending more than you earn even if you own a credit card. A credit card gives you a lot of flexibility; you can pay for something first even if you don’t have enough money for it yet, and you can break down large transactions into monthly instalments. But, having a credit card isn’t a license to spend mindlessly beyond your means.

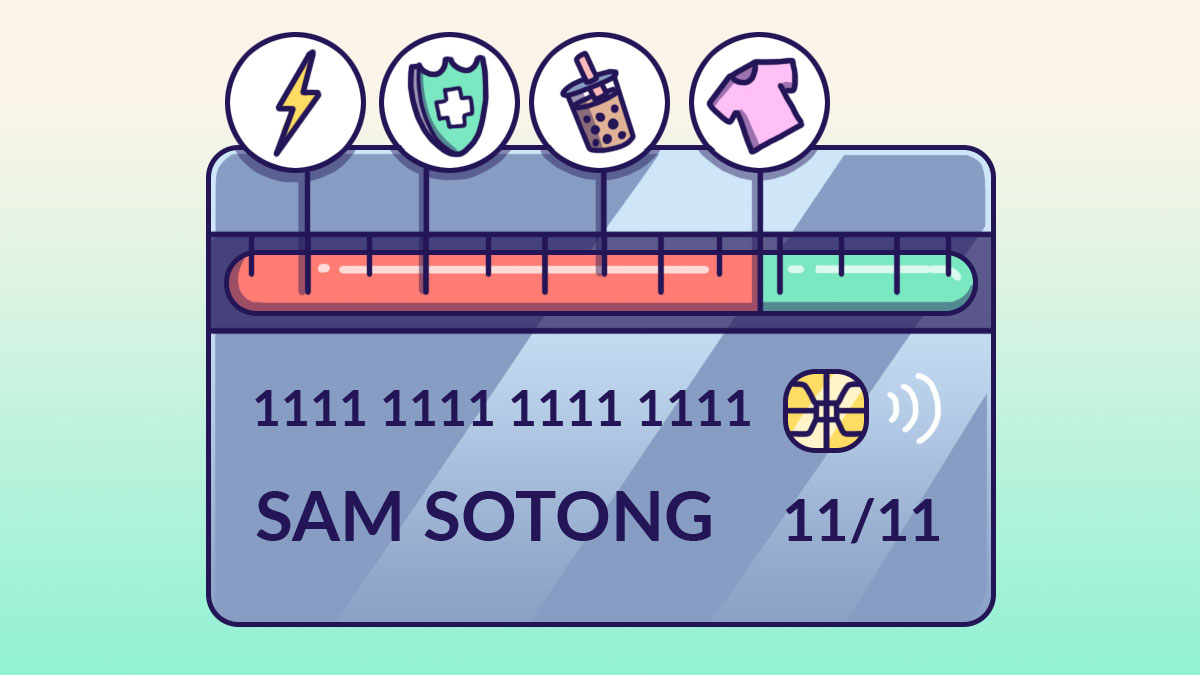

If you don’t know how much money you’re spending every month, it’s best to create a budget before you get a credit card. Get an overview of the expenses that you incur each month such as your bills, groceries, entertainment expenses, and travel expenses. Even if you don’t have an exact amount in mind for each category, start with a ballpark number.

Once you know what your expenses are, you’ll have an idea of how much you should be charging to your credit card each month for each category.

Use your credit card to keep track of your spending

Once you have a budget in place and start spending with your credit card, it becomes much easier to keep track and review your spending.

You can easily log into your mobile banking app and check your credit card transactions. Some banks even provide detailed spending reports and summaries that allow you to see what categories you’re spending on and how much.

Make it a habit to check your credit card transactions regularly. When you track and monitor your expenses, you’ll be able to tell if you’re overspending and subsequently, cut back on your expenses in the following weeks so you can stay on budget.

Over the course of a few months, you’ll even notice patterns in your spending! Maybe you notice that you’re spending more and more each month on dinners with friends or taxi rides. While it’s completely normal to veer off your budget once in a while, reviewing your spending regularly allows you to rein in unnecessary expenses.

What’s more, once you can see the categories that you’re spending heavily on, you can take advantage of your card’s rewards to save more money. Wouldn’t you want to get cashback or rewards points on taxi rides that you’ve already accounted for in your budget?

Your credit card helps you stay on top of your recurring bill payments

Every month, you’ll definitely have recurring expenses like your utility bills, telephone bills, and subscription in your budget, and a missed payment could lead to more trouble and late payment fees.

One advantage of using a credit card to pay for these expenses is that you can set up automatic payments so you don’t have to worry about having your phone line cut or your subscription cancelled because you missed a payment.

Plan large purchases and put them on your credit card

Whether it’s buying furniture for your new flat, upgrading your laptop, or building your ideal work-from-home set up, seeing your bank balance drop drastically because of these large purchases can make you feel a bit disheartened, despite the excitement of having your dream purchase fulfilled.

One way you can regulate your budget and keep your expenses consistent each month is by planning these purchases in advance and using your credit card to pay for them. You can then take advantage of the card’s instalment facility to manage your monthly cash flow better (and earn cashback or rewards points on your card, while you’re at it).

Instead of a single S$1,000 deduction for a sofa, splitting it into instalments over 10 months means that you’ll need to only set aside S$100 each month in your budget to pay off this expense.

Of course, remember not to overspend on large purchases simply because you can break the expense down into monthly instalments. Stay on top of your planned expenses and you’ll reap the benefits of owning a credit card!

And remember, pay off your credit card balance regularly

If you’re checking your credit card transactions weekly, pay off your credit card every time you check. This prevents you from getting charged any credit card interest on your balance.

For example, if your credit card has an annual interest rate of 24%, that means 2% will be charged per month on top of your outstanding balance. Thus, if you have $1000 outstanding and you don’t pay it off in time, you owe S$1,020. An extra S$20 may not seem like a lot, but that amount will compound quickly over time. If you didn’t pay off that S$1,000 in a year, you’ll have S$240 in interest!

Think of your credit card as a tool that you should use to help you manage your money better. It is very possible to stay on budget with your credit card – all you need is discipline and some simple planning!