Financial Planning | Personal Finance | Article

Insurance for First Jobbers: What Protection Do I Need Now That I Have Started Working?

by The Simple Sum Team | 23 Jun 2022 | 8 mins read

Congratulations, you’ve taken your first steps into adulthood by securing your first job.

Armed with regular monthly pay cheques, you’re ready to start living the life and become Mr (or Miss) Independent. Time to buy all the things that you couldn’t afford back then or your parents didn’t allow you to.

But, there’s also the nagging voice at the back of your head — a seed no doubt planted by your parents and the numerous strangers with lanyards who asked for “a moment of your time” at the bus interchanges or train stations during pre-Covid days.

And that voice wonders if you should get some insurance for yourself. The short answer is, you probably should.

The importance of being insured

While you’re probably more excited to start building your savings — because the prospect of getting a lump sum of money in a decade or two is thrilling — any financial planner worth their salt will recommend some basic protection plans first.

Why? Because it gives you the financial backup you need in case of emergencies, especially those of the medical kind.

You may be thinking: Aren’t I just throwing money down the drain though, since I won’t get any returns on the premiums for protection plans unless some disaster were to befall me. And who wants that?

However, that is precisely why you need protection plans. It’s for the off chance that something bad were to happen and you would require large sums of money. Surely you wouldn’t want one incident to wipe out your savings, or even worse, lend you in debt. With the right insurance, you don’t need to worry about your cashflow should you lose the ability to continue working due to critical illness or severe injuries.

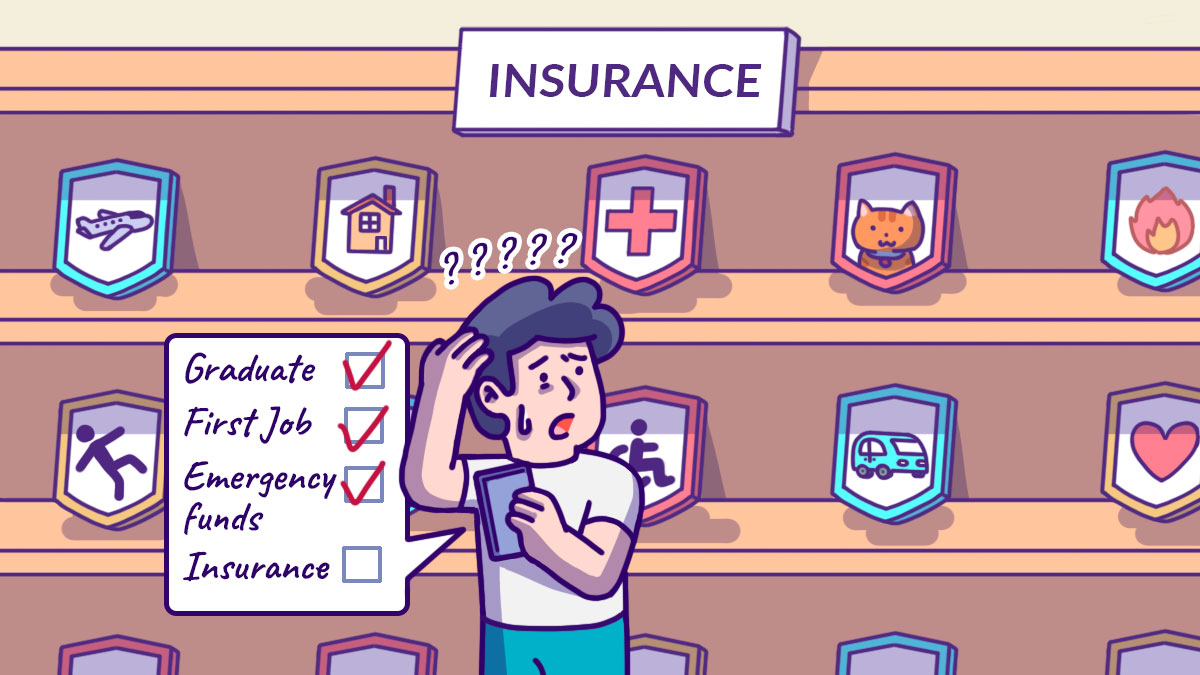

So what kind of protection do first jobbers need? Here are some protection plans that you should ensure you have.

1. Hospitalisation

Yes, all Singaporeans and PRs are covered under a compulsory government health insurance plan called MediShield Life. And this helps to pay for large hospital bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer.

So, you might be wondering why you should still get a private hospital plan.

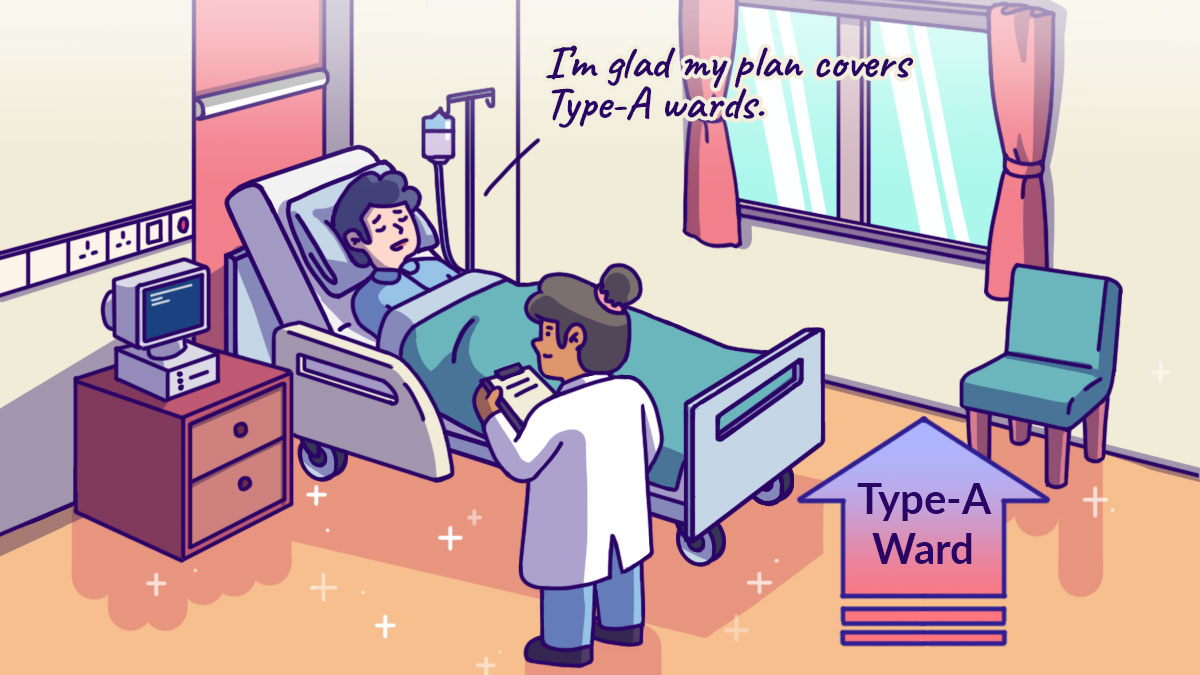

Well, the government plan is pegged at B2/C-type wards. If you choose to stay in a higher tier ward or a private hospital, you’ll still get a payout but it will only cover a small proportion of the bill.

If you get a standard Integrated Shield Plan (IP) provided by private insurers, you can cover a stay in B1/A-type wards, as well as private hospitals — after deductibles and co-payments.

For first-jobbers, an IP has to be one of the staples in your portfolio because it subsidises your hospitalisation bills (up to private hospitals) and eases the burden on your finances and MediSave. This is especially important since you don’t want to drain your savings or your MediSave too early in life.

Being hospitalised may seem like an unlikely event for young adults, but it’s always better to be prepared because when you might find yourself staring down a bill that’s a couple hundred thousand dollars.

2. Personal Accident

As the name suggests, the personal accident policy covers your treatments for (almost) every injury sustained as a result of an accident.

Accidentally fell off your bicycle and scraped your arm? Check. Accidentally suffered a nasty bruise from a fall in the shower? Check.

Well, you get the picture.

Some insurers even offer coverage for TCM treatment — good for those who prefer seeing the sinseh instead of a general practitioner.

You may think that isn’t a hospitalisation plan enough? Well a personal accident plan allows you to claim for inpatient and outpatient treatments, like MRI scans and CT scans, without you being hospitalised, unlike hospitalisation plans. And treatments like that can cost a pretty penny.

Hence, regardless of whether you’re a sporty adrenaline junkie or a couch potato, this should be another staple, since you really can’t tell when you’ll get into an accident — that’s why it’s called an accident It’s a very handy policy to have since it covers treatments that you would generally have to pay for, especially if you’re freelancing or if your company doesn’t provide insurance as part of its benefits.

3. Critical Illness

After getting your hospitalisation and personal accident plans, next up would be critical illness (CI) coverage.

Fundamentally, what CI coverage do for you is to pay out a lump sum once you get diagnosed with a “critical illness”. Most of the time, the payout is made when you get a late-stage diagnosis.

Don’t confuse it with life insurance. Most life insurance policies only cover death, terminal illness and total permanent disability, unless you get a critical illness rider.

There are a myriad of CI plans in the market covering early or intermediate-stage diseases and even policies that offer more than one payout. For the latter, the plan usually pays a sum upon diagnosis of early or intermediate-stage disease, and you can get a second payout if you are diagnosed later with late-stage disease.

What falls under the definition of critical illness, though, varies depending on the policy.

Related

For a general reference, you can take a look at the industry list of 37 critical illnesses listed under the Life Insurance Association Singapore (LIA) Critical Illness Framework 2019.

You’ll want to have Ci coverage because getting a late-stage diagnosis means you won’t be able to work and support yourself. Not only do you have to seek treatment and continue monitoring your health, but you’re also dealing with the emotional and mental fallout of your diagnosis.

Imagine dealing with that while you’re being saddled with a mountain of bills.

To put things into perspective, let’s look at cancer, the leading cause of death in Singapore between 2017 and 2019.

According to a tabulation of fees — based on data from the Ministry of Health — by DBS Bank, treatment costs can go up to (depending on your treatment plan, the type of hospital you’re treated at, and the available subsidies) hundreds of thousands of dollars.

Losing the ability to work while incurring a huge financial debt isn’t really a wise way to start your career; not when you have the ability to provide yourself with a payout and peace of mind if you start your protection early.

4. Life Insurance

A life insurance plan pays out a lump sum upon death or terminal illness. If you like, you can also add riders to your plan to cover total permanent disability and critical illness.

As someone new to the workforce, life insurance can be seen as a way to provide something for yourself in the event of a total permanent disability which leaves you unlikely to ever work again.

And, pardon us for being morbid, but in the event of death or terminal illness, you can look at the payout as a way to leave something behind for your loved ones, like your parents or your siblings.

How much you should insure yourself varies based on a few factors — budget being one of them — but it’s usually calculated based on the estimated loss of earnings.

When looking at life insurance, there are two ways to go about it.

One is a term plan, which is pure protection and covers you for a set period of time.

The other is a whole life participating plan that offers protection till the age of 99, and also has a cash value that grows yearly based on the insurer’s projected rate of returns. This may sound enticing, but it also means that the premiums are higher compared to the term plan.

Be sure to decide carefully on what best suits your needs because each has its benefits.

Related

Changing your coverage as you grow older

Now that you’ve gotten a general overview of the various aspects of protection planning suitable for a first jobber, the next things to consider are your budget and needs.

Based on your life stage, the needs of your protection may vary.

Perhaps, as a first jobber and a young adult, you may want to make sure that your earning potential and ability to work are insured. Hence, you may focus on getting an IP, a personal accident plan, critical illness with a splash of life insurance.

As you get older, you may find yourself being the sole breadwinner with more dependents (like your spouse and kids) and you’ll need to increase the coverage on your life insurance.

Or if you’re single with no dependents, health issues could be a larger concern and you might decide to focus on your critical illness coverage while decreasing your life insurance coverage.

Similarly, your budget may also fluctuate due to circumstances in life.

With the economic downturn brought about by the pandemic, people have been hit hard as they face retrenchment and/or pay cuts.

According to the figures by the Ministry of Manpower, the overall unemployment rate in July 2021 rose to 2.8 per cent, ending an eight-month improvement.

So get the coverage you need, within a budget that makes sense for your situation. You wouldn’t want to go overboard and find yourself in a situation where you can’t pay for your policy and it lapses, leaving you in the lurch and without any coverage.

Getting protected is important but having peace of mind while doing so is equally important.