Financial Planning | Life | Personal Finance | Personal Stories | Article

Interview with Shiny Things: HWZ’s Very Own Ang Moh Finance Guru

by Marianne | 17 Dec 2018 | 8 mins read

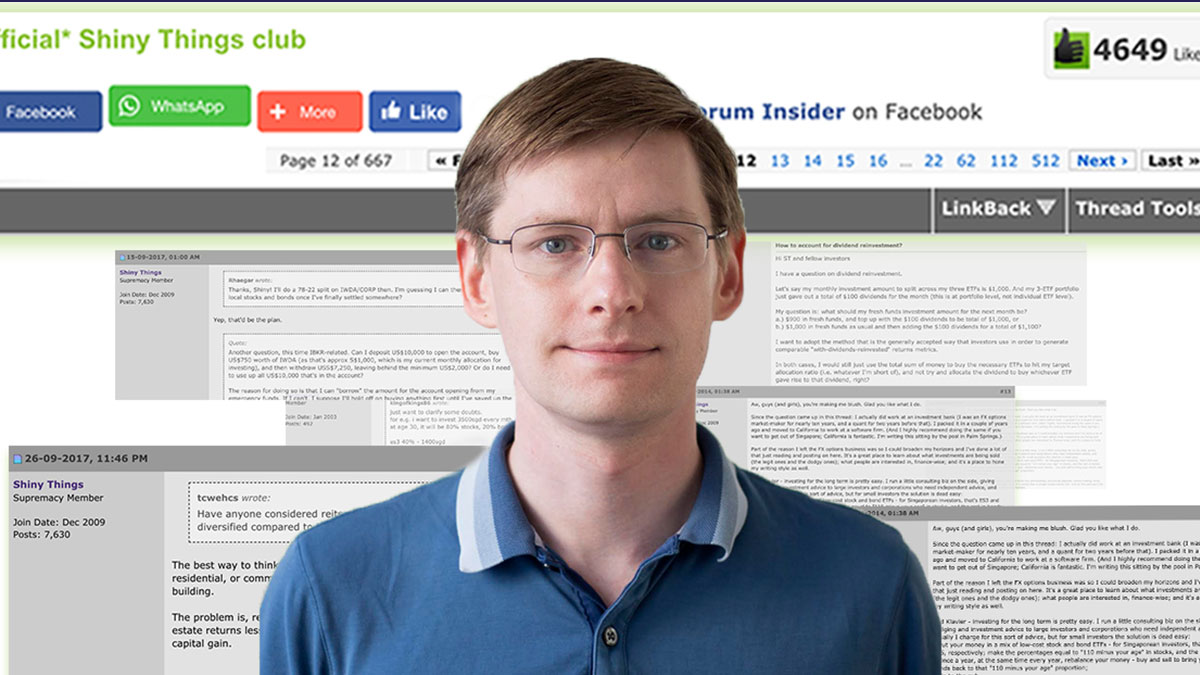

Joshua Giersch, better known to his troves of fans by his online moniker Shiny Things, has successfully amassed a huge following on HardwareZone – so huge that his fans decided to create a dedicated thread on the online forum on his behalf in 2014.

Today, the thread has garnered more than 13,000 posts.

His claim to fame? Dispensing effective financial advice in a simple, straightforward way to the uninitiated in Singapore.

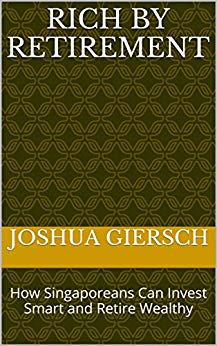

Besides being forum-famous, he also blogs about politics, economics and finance at Josh Reviews Everything, and has even written an e-book, Rich By Retirement, where he outlines a simple, fuss-free way for Singaporeans to invest for a comfortable retirement.

His work online has certainly resonated with his audience – he is now working on a third edition of the book.

So who exactly is he? And how did he become an online guru in Singapore?

Currently also a senior product manager at cryptocurrency startup Ripple, the San Francisco-based Australian guru was introduced to the local crowd when he spent five years in Singapore working for ANZ and Commerzbank.

We caught up with Joshua to find out a bit more about the man behind the moniker:

First off, could you tell us a bit more about yourself and your connection with Singapore?

I’m a 35 year-old born and bred Australian, having spent five years in Singapore, from 2007 to 2012.

My finance background has involved trading currency options for big Australian and German banks, and structuring investments that were sold to corporates, investment funds, and HNWIs.

Some of those investors were savvy, and knew what they were doing, but a lot weren’t. They just bought the products that were offered to them, without understanding the risks and the hidden fees.

I’ve been writing for a long time as well. When I was a junior trader, working for an Australian bank based in Melbourne, I was notorious for writing funny, quirky daily market wraps for the trading desk. I had a couple of hundred daily readers by the time I left the bank in 2008

I then joined a German bank, stuck with them through the Global Financial Crisis and the downturn, and kept on writing on the side.

In 2008, the Financial Times’ Alphaville blog reposted a terrifically nerdy blog post I wrote about a structured investment that blew up during the crisis and took small Singaporean investors’ money with it. The piece was shared all around the world, and I discovered I had a knack for writing about the things I’d done and seen in finance.

So a few years later when someone suggested writing a book, it seemed like a great way to spread the knowledge that I’d learned, keep my writing skills sharp, and have some fun as well!

How and when did you start using HardwareZone?

To be totally honest, I don’t remember why I started using HWZ. It’s been so long ago (late 2009 according to my profile page) that I’m not even sure which forum I started reading off. I did spend a few months lurking before making my first posts, and the community was welcoming and engaging so I stuck around.

Most of the time I’ve been engaged on Money Mind (a sub-forum dedicated to money matters on Hardwarezone), but I pop up in the travel forum occasionally as well, mostly raving about places to visit in the western USA. Utah’s national parks are amazing, especially in summer and autumn.

Is there a story behind your handle, Shiny Things?

There’s no particular story behind “Shiny Things”. I’ve been using it as a handle even before HWZ, maybe even as far back as the ‘90s.

Financial advice in Singapore used to typically come from an insurance company or a funds management company. You’d sit down in their plush office and they’d say, look at this fund, hasn’t it performed well?

How did your dedicated thread for financial advice on HardwareZone come about?

Funnily enough, I didn’t start the “Official Shiny Things Thread”. I’d been giving advice across a bunch of different threads, and someone decided to start a fan thread. Everyone converged on that thread, and the rest is history.

We hit the 10,000 post mark in early 2018 (HWZ’s threads are capped at 10,000 posts), spilled over into a second thread, and now we’re somewhere north of 13,000 posts in those two threads, over a span of nearly five years.

Why do you feel the need to dispense advice?

When I started writing, there was a lack of good financial advice in Singapore. There was no Singaporean equivalent of Suze Orman or Dave Ramsey to give advice that was tailored to the needs of Singaporeans and to the unique features of the Singaporean markets.

When I started posting, I was mostly looking to share my perspective as someone who’d “been there, done that”, but I learned that what people really wanted was help taking complex financial concepts and turning them into simple investing strategies.

And it’s rewarding to see people come back to the thread two or three years later, and say, hey, I’ve set myself up with a simple strategy and stuck with it. I didn’t think I could invest, but it’s not as hard as people make it sound! It’s a great feeling to be able to teach people, help them, and see them grow.

Why do you think you’ve resonated with so many readers?

There are so many people who’ve asked questions on the thread, or worked with me directly, and they all have their own reasons, but I think the most important reason people reach out to me is that Singaporeans want financial advice that they can trust.

Financial advice in Singapore used to typically come from an insurance company or a funds management company. You’d sit down in their plush office and they’d say, look at this fund, hasn’t it performed well?

The fund might be a European equity fund, an emerging-market bond fund, whatever. It didn’t matter. The only thing that mattered was persuading you to buy it, so the salesperson could pocket their three – or five – percent sales commission.

Next year, they’d try to flip you into a structured note or an endowment policy, and pocket more commission. Those salespeople aren’t working to get the best outcome for their customers. They only want the best outcome for themselves.

I don’t work that way. I want the best outcome for my readers. That means low cost investments that are easy to understand. That means strategies that are simple to explain and simple to execute. That means giving people the tools to invest for themselves, so they can see how the

process works, and trust that I’m giving them fair advice.

How many copies of your book have you sold?

Without wanting to get too deep into specifics, I’ve definitely sold enough copies to make it worth the effort writing.

What do you do in your free time when you’re not dispensing advice?

Everyone’s gotta have some hobbies, right? I played badminton for a year or so in high school way back when, and picked it up again a couple of years ago. I wouldn’t say I’m good—I’ve only played in one tournament so far, and I was bundled out in the first round—but I train every week with a group of friends, so I’m slowly getting better at it.

There are some great cycling roads and trails around where I live, so you’ll find me out and about there as well when it’s warm. It can get a little chilly in winter over here, so it’s not an all-year-round activity like it is back in Singapore.

And for something more cerebral, I’m a casual Magic: the Gathering player and collector. It’s a fun excuse to invite some friends over and spend an afternoon playing games

What are your thoughts on the Singapore personal finance landscape?

The personal finance landscape in Singapore has improved by leaps and bounds over the last few years, but it could still be so much better.

The best thing that someone could create for Singaporean investors would be a low-cost, Singapore-focused robo-advisor like Wealthfront or Betterment, with low annual fees, and with a Singaporean tilt to the stocks and bonds that it invests in.

Right now, if Singaporeans want to invest in the best exchange-traded funds at the lowest costs, they have to open two or three brokerage accounts, and they have to do all of the rebalancing themselves.

I’d love to be able to say, here’s a robo-advisor whose fees are low and whose funds are sensible. They do everything my book recommends and it doesn’t need any work on your part. That doesn’t exist yet in Singapore, but I wish it did!

Aren’t there already some robo-advisors in Singapore?

There are robo-advisor platforms in Singapore, yep. They’re not quite good enough to whole-heartedly recommend, for one reason or another: some are too expensive; some don’t have any allocation to Singaporean assets, which is baffling when that’s the market they’re going after.

I think there’s still an opportunity for some entrepreneur to launch a low-cost Singaporean robo-advisor—maybe an independent operation, maybe attached to one of the brokers—and I’d love to help them design it.