Investing | Article

How Can I Invest Better in 2024?

by The Simple Sum Team | 27 Dec 2023 | 8 mins read

This article is brought to you by FSMOne’s FSM Invest Expo 2024

2023 has been a year where the increased cost of living and continuous interest rate hikes has been the talk of the town.

And with 2024 just around the corner, everyone is wondering what the new year will bring.

We speak to the iFast research team to understand more of what we can expect in the markets in the new year, how investors can combat 2024’s expected inflation and some countries to consider if you want to invest outside of Singapore in 2024.

Q: How were the markets like in 2023 and was there anything that took you by surprise?

A: To date, global equities performed better than fixed income, which comes as a surprise. In a slowing economic environment, bonds usually tend to be relatively defensive. In particular, the digital economy and semiconductors sectors have achieved more than 50% returns to date.

The other surprise was in tech sector. Many had expected to go down this year because it is growth oriented. However, it emerged as one of the strongest performers.

We had also expected the US to go into recession. However, it did not materialise and the US GDP continued to grow. This resilience of the US economy should continue as it has proven that it has become less sensitive to rate hikes. One of the reasons is because unlike most of Europe and Australia, nearly 90% of US mortgages have interest rates fixed over long periods. Hence when the Fed tightens, most homeowners are unaffected and the economy keeps going.

Other things that will contribute to the US economy being resilient are an acceleration in US government spending, a still-tight labour market, and increased business investment. Risks will still remain, but because the US economy is highly diversified, the impact of a shock on the overall economy will be lessened.

Related

Q: What does 2024 look like for the everyday investor?

A: The same issues of inflation, higher capital costs and geopolitical issues around the world will continue in 2024. To navigate this, focusing on quality within equities is crucial. Thus, we expect this to be a major investing trend next year.

Currently, we are also seeing the rapid growth of major corporations where they are expanding their market share dominance and leveraging their competitive advantages to safeguard their profit margins. It’s now harder for startups to disrupt established players as there’s less funding available, and instead, they are being acquired by larger counterparts. Hence, being invested in high-quality companies would be prudent in the longer term.

We also expect US inflation to stay above 2% in 2024, even though Fed officials say that there will be at least three rate cuts in 2024. This is because there will continue to be inflationary pressures from the tight labour market, the surge in oil pressure. Long-term factors, such as increased government spending on healthcare, defence, and climate change, as well as the trend of deglobalisation leading to duplicated supply chains, are expected to keep pushing prices higher for an extended period.

Our belief is that long-term inflation will stabilise at 4% and long-term yields are expected to rise to around 6%. Both inflation and interest rates are anticipated to remain elevated for an extended duration.

In such an environment, investors can opt for short-duration bonds in fixed-income portfolios and consider investments in quality companies and commodity-related stocks for equities. Another implication would be on the Singapore REITs (S-REITs) sector as elevated interest rates continue to weigh on their ability to comply with MAS’ regulatory leverage limit. We caution investors to be selective in this sector as we believe that potential downside risks involving cap rate expansion and near-term refinancing risks have not been fully priced in.

Related

Investment Calculator

Find out how much your money can grow with the power of compound interest if you start investing early.

Q: Are there any industries that are poised to do well in 2024?

A: With the prospect of a recovery on the horizon, our optimism has shifted towards the digital economy and semiconductor industries.

Notably, prominent tech giants are expected to perform well, driven by their resilient financial positions and diversified revenue streams. They do not need to borrow at the current elevated interest rate levels due to their healthy cash position.

In terms of semiconductor industries, we believe there are plenty of tailwinds. Similar to past revolutions driven by the PC, smartphone, and internet, the artificial intelligence (AI) revolution is anticipated to generate substantial demand for semiconductors. As it is, monthly semiconductor sales have experienced six consecutive months of growth.

The upswing is propelled by substantial government subsidies and sustained structural drivers of semiconductor demand. The anticipated increase in capital expenditure (CAPEX) is expected to further amplify semiconductor sales, reflecting a robust and promising outlook for the industry.

TLDR:

Digital economy: The sector has successfully navigated challenges through significant layoffs and cost-cutting initiatives, positioning themselves on a trajectory toward recovery. Big tech entities, boasting robust business models and substantial cash reserves, are expected to excel. They also stand to benefit from enduring mega-trends such as the increasing adoption of AI, automation, and cybersecurity.

Semiconductor: Anticipate a resurgence in the semiconductor sector in 2024. Inventory correction is nearing an end, with monthly semiconductor sales marking a consistent rise for six consecutive months. The demand is poised for an upswing, driven by both low-base effects and substantial government subsidies.

Related

Q: As inflation is expected to continue in 2024, what are some investment strategies that investors can consider to combat this?

A: You can consider fixed income, dividend-paying stocks, inflation-resistant equity investments and commodity-linked investments.

For fixed income, at FSMOne, we have numerous fixed-income funds offering yields of 6%-7%, providing investors with a monthly income stream that outpaces inflation.

When it comes to dividend-paying stocks, explore those with a solid track record of consistent dividend payouts and a trend of increasing dividends year-over-year. This offers a steady stream of income and helps manage growing inflation.

If you’re looking at inflation-resistant equity investments, these would be in the utilities, healthcare and infrastructure sectors. Companies in these sectors often possess pricing power, potentially enabling them to pass on increased costs to consumers, making them resilient during inflationary periods.

As for commodity-linked investments, these would include gold and energy ETFs and funds. In the current climate of increasing oil prices, energy funds are poised to deliver stronger returns, particularly within an inflationary environment driven by elevated oil prices.

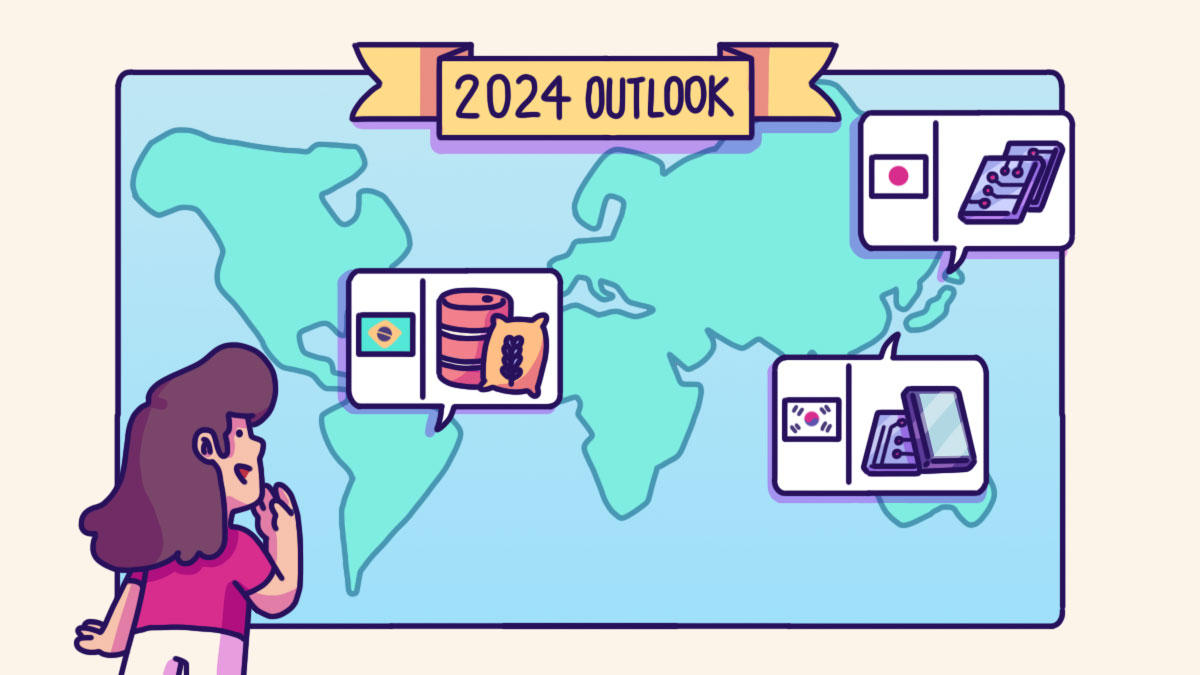

Q: If I would like to invest outside of Singapore in 2024, what markets would you suggest to look at?

A: Japan is currently undergoing a policy shift with a loosening yield curve control. Thus, it is poised for a strengthened yen. The nation is also strategically positioning itself for growth in the semiconductor industry, working towards developing a supply chain that is less dependent on China. This shift makes Japan an attractive destination for foreign semiconductor companies seeking overseas expansion.

As a prominent leader in dynamic random access memory (DRAM) manufacturing, South Korea stands to gain from the recovery in the semiconductor sector. The Biden Administration’s decision to lift export control restrictions on key industry players, such as Samsung and Hynix, serves as a pivotal catalyst for the country’s growth in this crucial sector.

The surge in oil prices is expected to fuel economic growth in Brazil, where commodity exports play a substantial role in trade revenue. Additionally, the country has experienced positive growth driven by expanded agriculture and consumption, a resilient service sector, and a stabilized political outlook.

Related

Content sponsored by FSMOne’s FSM Invest Expo 2024

Want to dive deeper into investing in 2024 or curious to know what other experts views are on how they would invest in the new year? All this and more to do with investing will be covered at the upcoming FSM Invest Expo 2024.

On 6 January 2024, you can fuel up for the next lap by hearing from industry experts, fund managers and prominent figures in the finance community about where and how to invest in the financial markets in 2024 at Suntec City. Topics covered include deep dives into equity markets, fixed income investing, as well as investing opportunities in the region.

You can find booths and activities where you can interact with major asset managers and fund houses such as Capital Group, Nikko AM, JP Morgan and BlackRock to learn more about investing. There will also be exclusive event-only deals, as well as lucky draws and sure-win prizes of over $20,000. And the best part is that entry is free for everyone.

Find out more about FSM Invest Expo 2024 here.

This advertisement has not been reviewed by the Monetary Authority of Singapore.