Budgeting | Personal Finance | Comic

Is a Credit Card Right for You?

11 Jun 2019

Free plane tickets! Instant discounts on spending! Credit cards are great. Heck even (slightly contrived) online wars have erupted between miles and cashback camps, each side insisting their card is better.

Seeing the online passion for the plastic can make it seem that owning a credit card is just good financial sense, the freebies are just too good to miss out.

But if you are a card newbie, this noise can obscure a fundamental question: is a credit card right for you?

First, one has to understand what is a credit card.

What is a credit card?

Most of us have debit cards, which are simple, whenever we swipe them, we spend from our bank accounts.

Credit cards are different, every time a credit card is used, a loan is taken from the bank.

But wait, you might ask, don’t loans charge interest?

Yes, and credit cards are no different. The difference is that the interest is waived if cardholders are timely with their bills.

So what happens when I cannot pay my credit card bill?

Many bad things happen at once, let’s detail them one by one.

Interest

Once a bill is late, interest starts being charged. In Singapore, credit card interest rates are typically 26% per year but increase to 30% once payments are late (we will come back to why there are two interest rates later).

To understand how interest rates are applied, divide 30% by 365 (the number of days in a year). So, 0.0821% in daily interest will start being charged.

But what is this interest rate applied to? The easy – but wrong – assumption is that it’s charged on an unpaid balance. For example, the $400 left owed, when only $600 is paid off a $1,000 bill.

But in reality, the interest is applied to the average daily balance of a credit card. Or how much is charged cumulatively to the card each day (then averaged) during the billing month. So, even if an outstanding bill is $400, interest is actually applied to a potentially higher average daily balance.

Additional late payment penalties

Late fees are also applied when one cannot pay at least the minimum repayment sum (at least $50, or 3% of the credit card bill, whichever is higher). These can range from $60-$100 dollars and also attracts interest.

And remember the original 26% interest rate? Well, once any bill isn’t paid in full, any new charges to the credit card instantly attracts the standard interest rate (26% / 365), also applied daily.

So yea, lock away your credit card once you can’t pay up.

Lastly, personal credit scores will get affected too, so getting a loan in the future will get harder.

How to pay your credit card bills

A common tip is to use GIRO payments to ensure that credit cards are automatically paid in full, and on time.

But it’s still not a set-and-forget system, because of 2 reasons:

- Credit card fraud happens, it’s important to monitor credit card bills each month.

(our colleague recently discovered unauthorised charges to his credit card) - Card annual fees (typically $192.8) are also charged via GIRO. You’ll want to waive these fees to maximize a credit card.

Okay, whew. So as you can see, owning a credit card isn’t fuss-free. There is a small level of effort required. If you felt tired (or bored) reading this article about credit card mechanics, maybe they aren’t for you.

But wait there’s more! All we’ve covered so far are just the basics – all this simply ensures one does not get burnt by credit cards.

The next level

But to become a true master of cards – and benefit off them – there’s more work involved. What that entails depends on the type of card.

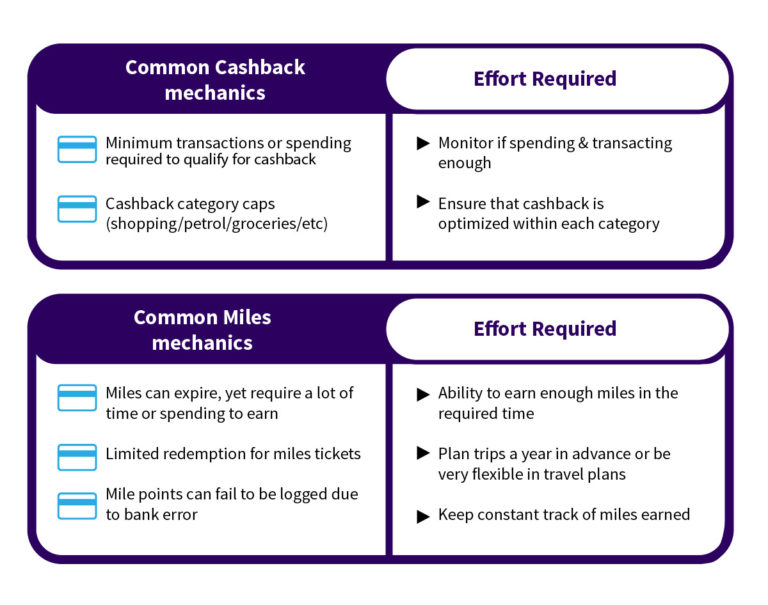

The two most popular credit cards are cashback and miles cards, and they each have their own set of hoops to jump through to be maximized.

What are they?

- Cashback cards: Earn cashback on purchases

- Miles cards: Earn points which can be redeemed for plane tickets

Here is a quick summary of just some of the tricky mechanics of each, and the effort needed to overcome them.

For both cards, the most sensible way to overcome these issues is to thoroughly evaluate if your current lifestyle fits the spending requirements or rewards system.

After all, spending more to save, or suddenly becoming a spontaneous traveller…doesn’t make a whole lot of sense.

But even after ones does all this work and gets the perfect card, there’s still a final obstacle.

T&Cs for the rewards system change, sometimes yearly. It’s very common to see credit cards become the hottest thing in town – with the best cash back or miles bonuses – attracting frenzied sign-ups.

But after a year or two? The rewards get quietly scaled down to ho-hum levels. The savviest card users would cancel their cards and go through the whole process again, in the quest to find a new card that suits them best.

Shag.

In the end, credit cards can really provide nice benefits and can be a sound financial choice – if you’re up for the effort. As illustrated, winning with credit cards is not a given, it requires effort and a basic level of finance geekery. There are dedicated websites and blogs just to teach people how to optimise their cards – if the whole thing was truly easy – they would not need not exist.

Credit cards are unsuitable for those who prefer not to introduce financial clutter into their lives. What’s worse, if placed in the hands of someone who crawls towards payday every month – it can be the gateway to financial ruin.

For these camps, there’s really nothing wrong with the good ol’ debit card.