Career & Education | Life | Managing Debt | Personal Finance | Article

Is It Okay To Be In Debt?

by The Simple Sum Team | 3 Nov 2021 | 5 mins read

This article is brought to you by Maybank for Maybank Education Loan.

Contrary to popular belief, it isn’t always bad to have debt. There is such a thing as good debt, which works to your advantage and can benefit you in the long run.

What is good debt?

Low-interest debt taken to purchase something that will increase in value over time or contribute to your overall financial health is known as good debt. Good debt such as education loans or housing loans functions almost like an investment that can help you build wealth in the long term.

Education loan

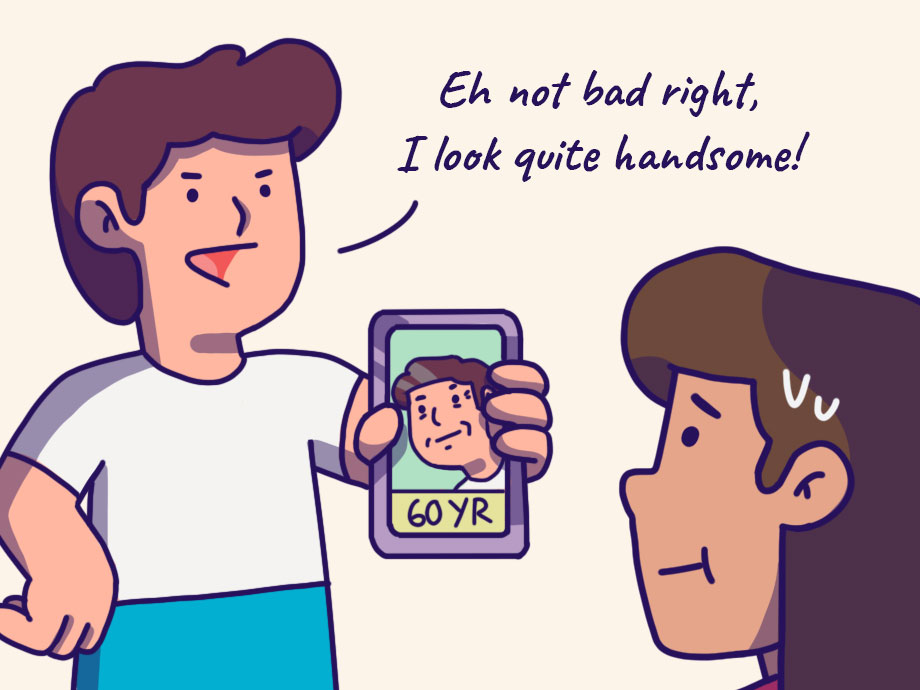

Education loans are one of the best good debts you can have as they allow you to further your studies, which can then increase your income potential.

According to the United States census, earnings nearly tripled for those who hold bachelor’s degrees, compared to those who do not. It is estimated that people who have a degree are half as likely to be unemployed as those with only a secondary school education.

Obtaining tertiary education is not just a goal for school-leavers. Middle-aged adults wanting to upskill or looking to change their career direction are turning to education, to improve their knowledge in a certain field. For example, computer science skills are in high demand now. With constant technological advancements, people need to be up to date to stay relevant.

Aside from career advancement, hobby courses with specialised skills integrated with academic curriculum are gaining popularity. For instance, if you have always wanted to be a master chef but only know how to cook instant noodles, then take a course and learn how to whip up delectable dishes in the kitchen.

These forms of education feed personal development and may even lead to something bigger down the road. Imagine learning a new language for fun and finding, some years later, that it allows you to take on a new job and penetrate a different market. You never know, right?

But to make all that happen, you need money. The good thing is, there are various education loans available.

If you are thinking of applying, look for one that has a low interest rate and flexible payment plans. Find a loan that suits your course (studying locally or abroad) and fits your repayment timeline. Speak to professional advisors who can help you map out your repayment scheme.

Remember, an education loan is an investment for the future.

Housing loan

Everyone has to live somewhere and buying a house is believed to be the way to go, rather than renting one. Home ownership gives you equity, security and stability as you will have a roof over your head and an asset to your name.

But owning a home is a big commitment. Before signing on the dotted line, be prepared for the costs and responsibilities that come along with buying a home. Make sure that you’ve set aside enough money for your home down payment, legal fees, and any home renovations you’d like to make. Also, check to see if you can afford the monthly loan repayments before putting in an offer for a home.

Related

What is bad debt?

Now that we know what good debt is, let’s talk about its evil cousin – bad debt.

Bad debt is when you borrow money to purchase material things, and are unable to repay the outstanding balance. As interest accumulates each month, this might snowball out of control, leading you further into debt.

For instance, while having a credit card in itself isn’t inherently bad, if you aren’t disciplined with your spending and keep charging your purchases to your card, you might end up owing a large amount to the bank that you’ll have a difficult time paying off.

So, before you take on any debt, whether it’s a car loan, education loan, or a housing loan, it’s important to have a plan in place to pay it back.

How to manage your debt

As a rule of thumb, never borrow more than what you can afford.

You should also formulate a repayment plan that fits your budget. It is advised to keep your monthly debt-to-income ratio below 36% of your salary. For example, if you earn S$5,000 a month, it is recommended that your monthly loan repayment shouldn’t be more than S$1,800.

If you have multiple debts, it is wise to pay off the high-interest debt first because your debt could compound to larger amounts much quicker. For low-interest loans, or fixed interest loans, try to pay them off as quickly as possible because being debt-free will allow you to build your wealth and pursue your dreams as you are not ‘forced’ to work to bring home a pay cheque each month.

Remember, proper planning enables you to see the bigger picture and set your money aside accordingly. Then you can look forward to being debt-free…with perhaps a house and a degree in tow.

Content sponsored by Maybank

A message from our sponsor:

Looking to further your studies and achieve your full potential? Don’t let money get in the way.

Maybank Education Loan offers a range of flexible plans that allow students to repay interest only of their loans during their course up to a maximum of 3 years, so they can focus on their studies without financial worries. You can borrow up to S$200,000 and take up to 8 years for local studies and 10 years for overseas courses, to repay your loan.

Maybank also offers additional funding for education-related expenses such as accommodation, computers and books.

Unsure which plan is best for you? Get personalised advice from professional advisors who can assist you with loan repayment options, application, and disbursement processes.

The best part is that you don’t even have to leave the comfort of your home as you can apply online using Singpass. Receive S$150 eCapitaVouchers when you sign up for a Maybank Education Loan by 14 January 2022.