Financial Planning | Personal Finance | Article

How To Manage Medical Costs in Singapore Amidst Inflation

by Asher Mak | 25 Oct 2022 | 6 mins read

This article is brought to you by IHH Healthcare Singapore.

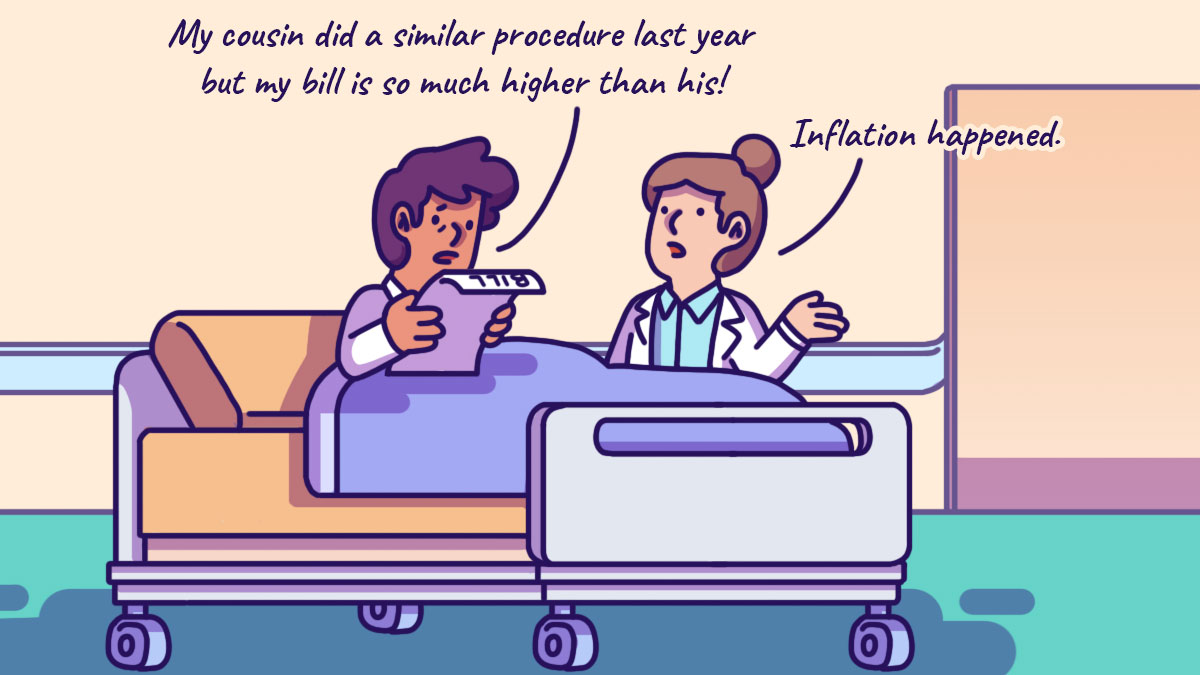

By now many of us are well aware that we’re facing a period of high inflation. The costs of everyday essentials, like groceries, transportation, and heck, even our haircuts have crept up. Because of the rising cost of living, we’ve had to relook our budgets and tighten our belts and while we do that, there’s probably one area we may overlook – the rising cost of medical expenses.

According to this Business Times article from 2019, “…Medical cost inflation — was 10 per cent in 2018, 10 times the Singapore economy’s estimated 2018 inflation rate of 1 per cent”. And while we await new statistics to reflect the climate in 2022, one can be certain that the news will not be music to our ears.

Thankfully, there are some measures you can take to prepare yourself (and your wallet) for the possibility of a medical emergency in the future. While hospital stays aren’t exactly in the top ten places to stay on anyone’s mind, they can suddenly become a necessity following an unexpected illness or accident, and they cost a pretty penny! So, it’s always wise to be prepared financially for such a life crisis, so let’s get cracking.

Attend regular medical screenings

With medical issues, prevention is always better than cure, especially when it comes to critical illnesses like cancer. The Singapore Cancer Society estimates that 1 out of 4 people might develop cancer during their lifespan.

The most common forms of cancers that afflict women and men in Singapore are breast cancer and colorectal cancer, respectively. Some forms of cancers in their early stages are asymptomatic, so early detection can literally save your life, or a limb.

Early detection allow for more effective treatment options and puts your mind to rest if there are no issues. This way, you can plan for your other life goals with the confidence that you’re in the pink of health.

Pro-tip: If your company’s medical coverage offers health screening packages, there’s no reason not to utilise them each year to ensure that you’re in the clear health-wise at zero cost to you. In addition, you can also take advantage of MOH’s Screen for Life subsidies to help cover the cost of your health screening.

Live a healthy lifestyle

Needless to say, your lifestyle and diet play a major role in ensuring that your body remains healthy for a longer period of time. Many chronic lifestyle-related illnesses such as diabetes and high blood pressure can be costly to treat over time.

In other words, the time, cost and effort you don’t invest in exercising or eating well can result in you racking up thousands in the form of medical bills — not the best way to spend your hard-earned money.

You don’t have to overhaul your entire life overnight to be healthier. Start small with just being more conscious of what you eat, going for walks, managing your stress better or even just getting enough hours of sleep every night.

Hitting the gym can prove to be good for you too. According to a research in the UK, “Weekend warrior exercisers had a 30 per cent lower risk of premature death from all causes compared to inactive people.” So even if you are too tired after your work commitments to head to the gym, dedicating slots on your off days to put on those yoga tights or running shoes can help prevent major illnesses in the long-term.

Utilise your employer’s health insurance plan

If you’re on the lookout for a new job and are fielding job offers from different companies, it’s tempting to say yes to a particular offer based on salary alone. But you shouldn’t neglect accounting for is the other components of your compensation package.

One such component is the health insurance plan that a potential employer is offering you. Some employers may only cover for visits to the general practitioners, while others may offer coverage for specialist treatments and hospitalisation too.

As medical expenses can add up over time, it may be worth considering a compensation package that provides for a more comprehensive package.

Whether you’re on a job search or currently employed, knowing what medical expenses are covered for by your employer can also help you plan your personal health insurance coverage to ensure that you are filling in the gaps in your coverage.

Have sufficient personal insurance coverage

Even if one is to take the above points seriously by diligently exercising and going for health screenings regularly, there is still a chance that one may fall sick or get injured.

This is exactly why personal accident and medical insurance plans exist, and it would be wise to have insurance protection while you are still young and healthy. That’s because insurance premiums increase as you age and become prone to developing more medical conditions.

When choosing an insurance plan, consider what you need coverage for above and beyond your MediShield Life coverage. For instance, Integrated Shield Plans covers you for treatment in both public and private hospitals, which means that if you happen to require treatment, which may require a longer wait time, you can opt to go private without having to fork out a ton of money.

All in all, health is wealth and investing in your health is as important as buying into bonds and stocks. Detect issues early, lead a healthy lifestyle and finally, set aside some of your monthly income to get yourself covered with medical insurance so you can live your best life without the dark storm of a potential major illness brewing at the back of your mind.

Related

A message from our sponsors

IHH Healthcare Singapore is the largest private healthcare group in Singapore with well-known hospitals like Mount Elizabeth and Gleneagles under its umbrella of brands. With a Private Integrated Shield Plan with Rider, getting treatment from any of IHH SG’s private healthcare brands will no longer feel out of reach. In addition, private health insurance can also give you the flexibility to get treatment from the doctor of your choice and recover from your treatments in the hospital rooms of your choice.

Being struck by a critical illness is extremely disorienting and the extra service private hospitals provide can put you at ease, while also giving you access to doctors of your pick within a short time frame. IHH SG’s hospitals have bill estimators so you’re able to get a ballpark figure of how much you will be expecting to spend, easing your financial worries by allowing you to plan your treatment costs better.

Here are bill estimators for Gleneagles, Mount Elizabeth and Parkway East hospitals.

To understand more about Private Integrated Shield Plans that will work with IHH SG’s hospitals, you can contact the Parkway Insurance Concierge via call or WhatsApp at +65 9834 0999.