Financial Planning | Personal Finance | Article

How Not to Be Stressed Over Your Finances

by Andrea | 5 Jun 2023 | 8 mins read

This article is brought to you by Income’s Gro Cash Sure Insurance savings plan.

How do you feel about money matters? If you often fret over your finances, you’re not alone. According to a well-being report by Cigna, 86% of Singaporeans stress over money-related issues. Another survey by HSBC shows that one in three people in Singapore are losing sleep over money.

It’s pretty concerning that such a large chunk of the population is being weighed down by stress related to financial uncertainty. People often worry about whether they’ll have enough money for the future, or even just for tomorrow, and this can lead to fears about potential losses of income, either through job loss or through investments.

Factors like the rising cost of living and job market instability can really contribute to our stress levels when it comes to money matters. So, it’s no surprise that more and more people are becoming anxious about their finances like never before.

Why does that matter to me?

Stress can have some pretty serious long-term effects on your health. Left unaddressed, it can lead to chronic fatigue, constant irritability, and the inability to sleep and concentrate.

But the effects of stress don’t just stop there – left unchecked, stress can also begin to affect our personal lives and relationships, and even become a real threat to our careers and livelihoods.

So, what can we do to help reduce financial stress? There are a few things you can do, but they all involve taking control of your finances in a tangible and disciplined way.

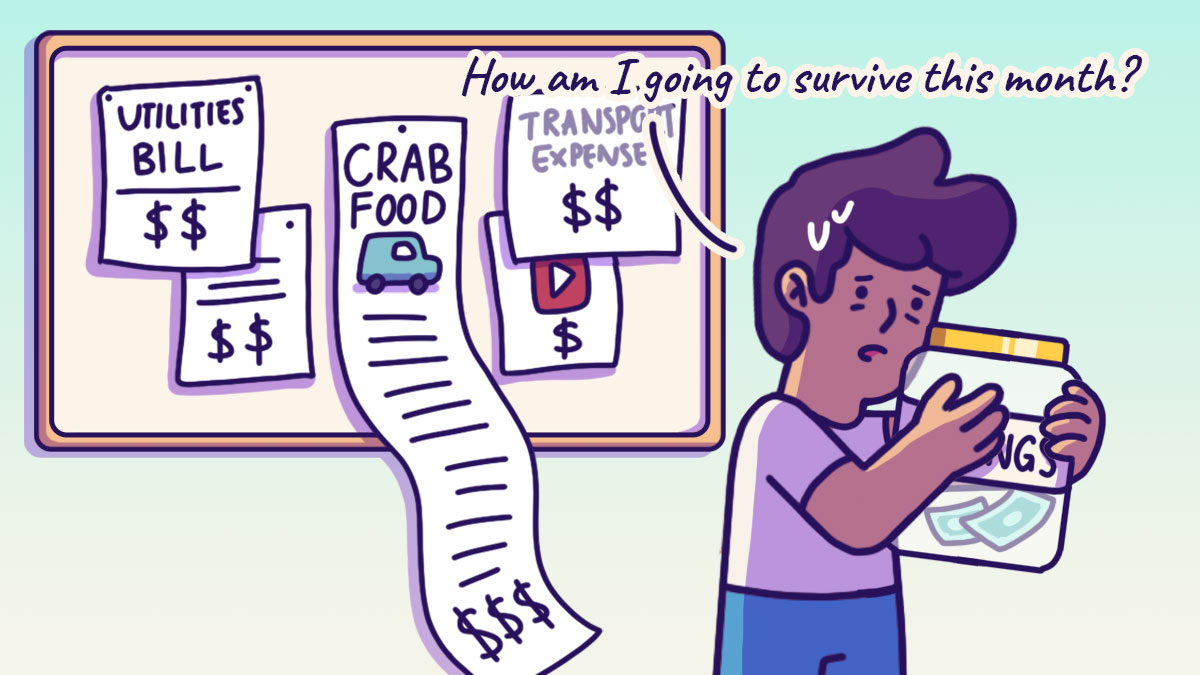

Figure out where your financial stress is coming from

The first step to alleviating your anxiety and stress is to figure out what’s causing that stress in the first place. Are you constantly worried about running out of money before the end of the month? If the answer is yes, then it might be time to take a closer look at your budget and spending habits.

That means getting real with yourself and tracking your expenses more closely – no more ignoring those bank statements! It helps to set a budget for yourself that’s realistic and that allows you to save a bit each month. And if you’re really struggling to make ends meet, you can consider finding ways to earn more money. This can mean asking for a raise or even finding a new job with better pay.

For some, the anxiety comes from worrying about not having enough money for the future, instead of right now. In that case, setting concrete goals and financial milestones helps you feel more in control and ensures you’re on track to meeting your savings target.

Also consider your existing financial obligations and decide what you can cut out. Do you really need all those subscriptions to platforms that provide the same service or could you do with less?

Cutting out unnecessary expenses can lighten the pressure on your budget, giving you some much-needed breathing room and less stress.

Related

Emergency funds are key to reducing some of your stress

Speaking of uncertainty, one way to make sure you’re not stressing out too much over what might happen to you is to build up a healthy emergency fund. This is money you’re setting aside specifically for those unexpected emergencies and large expenses to meet an urgent need that can really throw a wrench in your finances.

Having an emergency fund in place takes a huge weight off your shoulders and gives you peace of mind. The rule of thumb is to have an emergency fund of six times your monthly living expenses—just enough to keep you secure, in the event you suddenly lose your job or find yourself facing a costly emergency.

Knowing you have a safety net to fall back on makes all the difference in reducing your financial stress levels.

Related

Emergency Fund Calculator

Find out how much you need to have stashed away in your emergency fund for accidents, unanticipated expenses and possible loss of income.

Pay off your debt—always

Debt can be a massive financial stress for anyone. Whether it’s your credit card bill or that loan you took to buy your flat, it’s always best to pay it down as soon as possible. It doesn’t pay to wait —the longer you drag it out, the more you’ll end up paying thanks to interest fees, and the longer it’ll drag out.

Having debt looming over your head will cause plenty of financial stress. If you’re feeling overwhelmed, take a moment to sit down and work out a repayment plan —either by yourself or get some guidance from a professional. Having a clear path forward will give you a sense of control and help alleviate your stress.

Once you have a plan, all you need is the commitment and discipline to see it through. It won’t always be easy, but it’ll be worth it in the long run. Imagine the relief you’ll feel when you finally pay off that debt and can move on to bigger and better things.

Work on building your wealth

Investing is a great way to grow your wealth, but investing recklessly can open you up to a great amount of risk. Making hasty or uninformed investment decisions might steal your sleep more than it assures you of a financially secure future.

If you’re the kind of person who prefers to play it safe, opting for low-risk investments or insurance savings plans may be the way to go for you.

Consider options such as Income’s Gro Cash Sure insurance savings plan, which comes with capital guarantee1 upon the end of the premium term. This means that the initial amount of money you pump into this plan won’t be lost and this certainty can alleviate your stress.

After all, there’s no point in making a big investment that keeps you up at night worrying about whether you made the right choice or not.

Related

Content sponsored by Income Insurance

One contributor to financial stress is not knowing with certainty what happens to the money you invest. Gro Cash Sure is an insurance savings plan that gives you the assurance that your capital is guaranteed1 and provides you yearly cash payouts2 upon the end of the premium term (5 or 10 years) till age 120.

Find out more here at income.com.sg/savings-and-investments/gro-cash-sure.

Important notes for Income’s Gro Cash Sure

1At the end of the premium term, if the policyholder did not cash in this policy and all premiums for this policy have been paid for, the guaranteed cash value for this policy is equal to total premiums paid, excluding premiums paid on riders. If the policyholder chooses to cash in this policy partially, the sum assured after the partial cash payout cannot be less than the minimum sum assured limit or any other amount Income may tell the policyholder about. Income will use the new sum assured and reduced regular premium amount excluding premiums paid on riders to work out the guaranteed cash value (if any) from the policy entry date.

2If the insured survives at the end of the premium term, and if all premiums for this policy have been paid for, Income will start paying the cash benefit at the end of the premium term. Income may pay a cash bonus on top of each cash benefit, by applying a bonus rate to the sum assured, and may include any loyalty bonus payable from the end of 20th policy year after the end of premium term. Income may or may not pay this cash bonus for each policy year.

*Disclosure: All opinions expressed in this article are solely those of thesimplesum.com and do not reflect the opinions of Income Insurance Limited (“Income”). Income is not responsible nor liable to any party in any manner whatsoever for such opinions, and thesimplesum.com is solely responsible for any opinion and the accuracy and completeness of any information and intellectual property used in this article. The information contained in this article pertaining to any insurance product or plan is provided and meant for general information only and do not constitute an offer, recommendation, solicitation or advice by Income or thesimplesum.com to buy or sell any product(s), plan(s) or investment product(s). It is not and should not be relied on as financial advice and has no regards for any person’s investment and financial needs. If you are unsure whether this product or plan is suitable for you, you may seek personalised financial advice from a qualified insurance advisor. Otherwise, you may end up buying a product or plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. Precise terms, conditions and exclusions of the product are found in the policy contract. This plan is underwritten and issued by Income.

For customised advice to suit your specific needs, consult an Income insurance advisor.

Protected up to specified limits by SDIC (applicable for Income products that fall under the Policy Owners’ Protection Scheme).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as of June 2023