What are short-term goals?

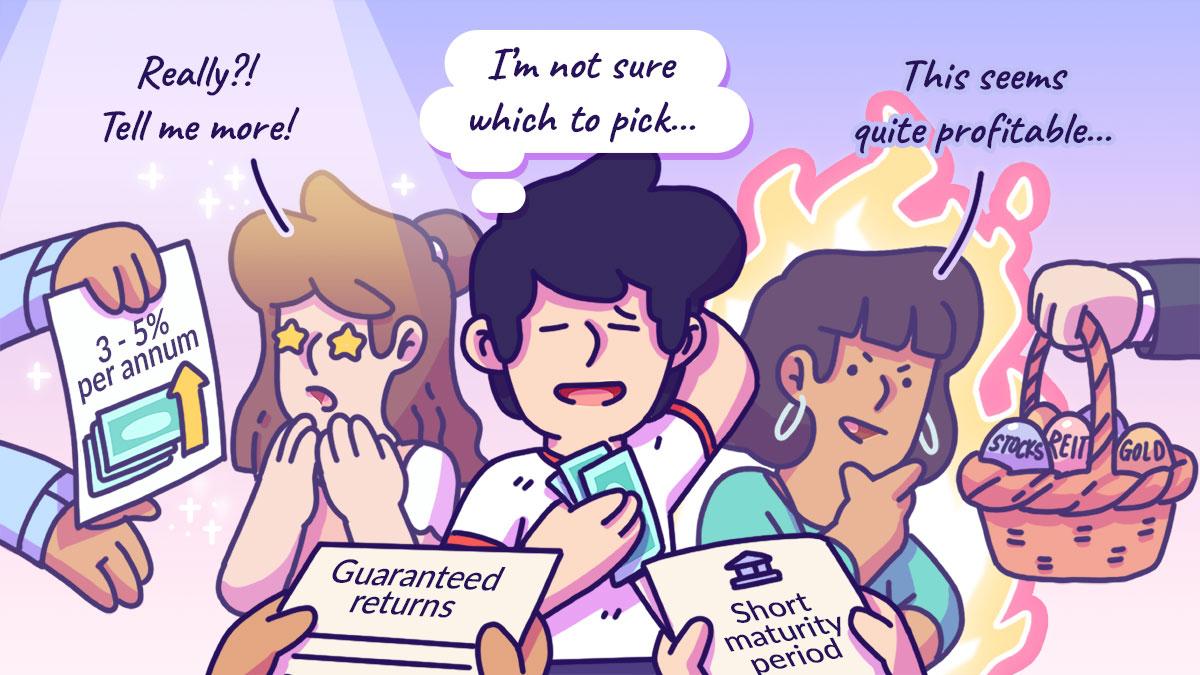

Short-term goals are defined as those that can be achieved within 3 to 6 months or up to 12 months. They tend to have specific deadlines and may include paying off a university study loan, planning an overseas vacation, setting aside money for a wedding, having a pet or even getting a tattoo. Your short-term goals may also support any major expenses or purchases in the coming years, such as saving up for the down-payment of your home or building an education fund for your child.The approach you take investing for short-term goals is different from long-term goals

You want to save up fast and ensure your money is available when you need it to fulfill your short-term goals. Unlike long-term goals, which are typically 10 years or more into the future and can change as you progress through life, the short timeline of your short-term goals requires you to think about how to make the most out of your idle money right now. Although the stock market in developed markets like the US have a history of going up over the long term, you don't want to lock 90% of your savings in public equities that are subject to market fluctuations and can significantly drop in value at the time of withdrawal. Instead, you'll be looking for financial instruments with higher liquidity, and a history of steady returns and lower risks to achieve your short-term goals.