Financial Planning | Life | Personal Finance | Personal Stories | Article

He Postponed Early Retirement to Take Care of His Father

by Sophia | 21 Sep 2019 | 6 mins read

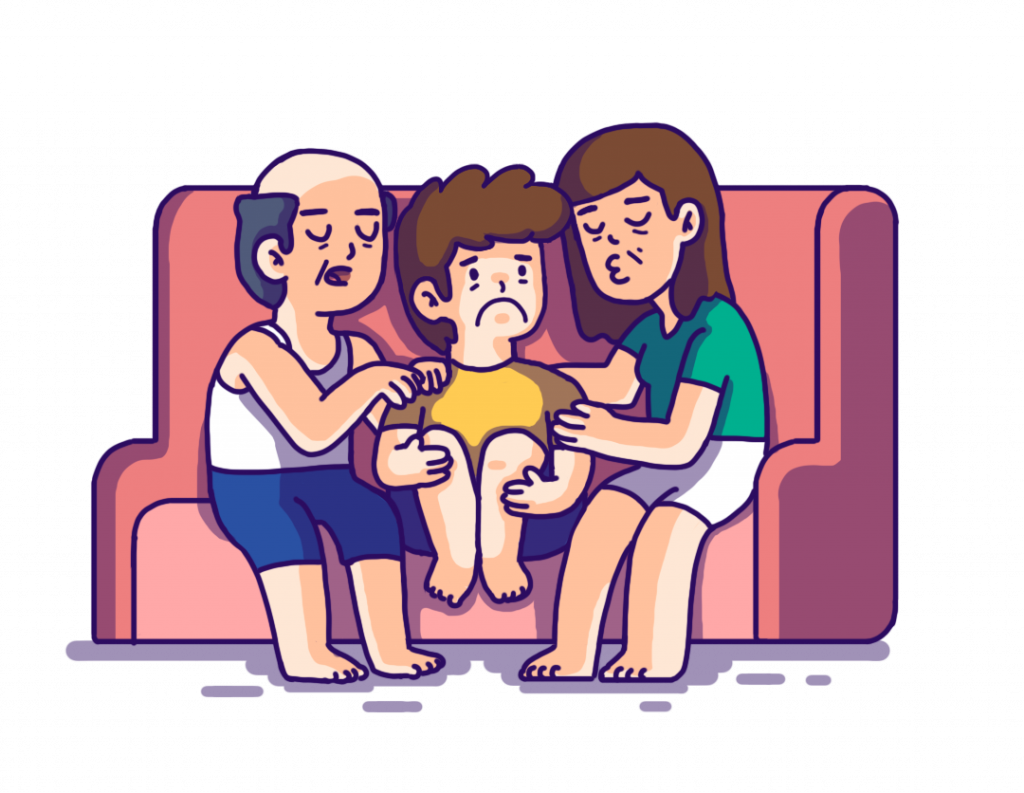

Just when he’d saved and invested enough for early retirement, financial blogger Brian had to deal with a sudden family emergency while on a trip to Hong Kong and Macau. His father had unexpectedly collapsed and was later put on a private plane back to Singapore for immediate medical attention, after the family discovered that his condition had become quite dire and serious.

His father had been warded in the Intensive Care Unit at Gleneagles Hospital for 21 days but wasn’t adequately insured; his insurance portfolio was a mixed bag of investment plans and poor coverage.

Brian and his family worried for the health of his father and also, at the same time, worried about the hospital bills that were to come. “ICU bills and daily doctor visits add up to about $4,000 daily,” he recounted.

It was the start of a financially demanding period for Brian, who recounted that it was like “watching [our] money draining every minute, every second” and called it a “surreal feeling”.

Naturally, his early retirement plans needed to be shelved for the time being, to make way for taking care of his father’s health in a time of need.

This might just be a worry all children will one day face: having to deal with a serious family emergency related to the failing health of a parent — or even both. How prepared are we for a task like this, especially financially?

All Sandwiches Are Made the Same Way

Most of us in Singapore are resigned to one of many fates: Having to take care of our parents, financially, in their old age on top of caring for ourselves and our children.

We’re what we call the sandwich generation, forever caught between two groups of dependents. If one is not paying for their child’s education, then they’re busy footing the bill for their elderly parent(s), much like what Brian had to do.

Brian describes himself as a financially prudent person. “I took care of insurance for my wife, myself, and our two children at a very early stage,” he told me. “All of us had full hospitalisation coverage.”

But the one thing that he’d missed out on was taking that same care for his parents. So when his father collapsed and ended up in ICU, Brian recounted feeling very panicked. “We were not sufficiently prepared to deal with it.”

He stresses that the best way to approach this, for the sandwich generation, is to always consider the worst case scenario.

“Ask yourself, in the event of such a thing happening, will you be ready to handle that?” he said. “I’m talking about basic technical skills like CPR, knowing which number to dial in an emergency, but also being mentally and financially prepared to handle the risky events that can happen unexpectedly, before your very eyes.”

So how can one approach this aspect of financial planning for both family and parents?

Planning for Your Parents

We have to look at things holistically. Most parents will provide for their kids through savings, for their future education and insurance coverage,” Brian said. “Our parents did the same for us. Given the higher medical costs today, we have to consider all possibilities and plan for it.”

Today, Singaporeans have MediShield Life. This form of protection is also extended to Permanent Residents too, regardless of age and health condition.

Brian advises, “Depending on your household budget, discuss the possibility of getting an additional tier of private hospitalisation on top of MediShield Life. If your parents are already retired and minimally contribute to their CPF, you may also take over the responsibility of paying for their medical bills with your MediSave.”

There’s also an added option of enrolling one’s parents for ElderShield, and paying for their premiums via one’s MediSave account.

For Brian, his parents are not Singaporean citizens and thus do not have CPF accounts. However, he now actively manages and pays for their insurance premiums — about $1,100 a month per parent — and ensures they’re covered by an in-depth hospitalisation plan.

Part of planning for your parents involves planning for yourself, too. “The sandwich generation has to provide for the family and retired parents. It would be wise to meet with a financial advisor, to look at your financial situation and consider options that you can afford,” he suggested. “This means drawing up a chart, projecting your income and expenses for the next 10 years for a broader view.”

“Start as early as possible,” he said, “to work out the differences, to figure out what you need to work on now to prevent problems later.”

Brian put forward the suggestion of letting aging parents move in with their children, which would reduce one’s day-to-day expenses. He also reminded us of CPF Life payouts, which kick in after retirement age, that would help to alleviate these expenses.

He knows that the sandwich generation is not a new concept in Singapore, regardless of whether one wants early retirement or not. “The goal is to break the cycle through proper financial planning,” he said, “so your children will not have to face these problems, and their children as well. From having sufficient savings and insurance protection, we do all we can not to burden the next generation.

“There’s no overnight solution, but one that requires proper planning and dedication over time.”

Looking forward to starting your own family and a new lease of life is exciting — and also financially demanding. However, we must not forget taking care of our old folks at home, too — that, too, is a financially demanding responsibility that may cause great hiccups in the future if not adequately prepared for.

“In some ways, life will punish you when you’re not well-prepared,” Brian said, reflecting on his feelings about being pulled out of early retirement, “and that’s what happened to me back then.

“But we came out stronger as a family in many ways — especially mentally. All in all, it was a good lesson to learn.”

Not sure where to start with planning your insurance coverage? Listen to our podcast episode here on the top four types a beginner should look at.