Budgeting | Personal Finance | Article

Quality over Quantity: Why It’s Not Always a Bad Idea to Spend More

by The Simple Sum Team | 30 Mar 2021 | 8 mins read

This article is sponsored by HSBC for the HSBC Advance Credit Card and HSBC Everyday Global Account

In personal finance, you’re often told to save as much money as possible. Naturally, you’d think that to save money you should always buy the cheapest option available. While this is good advice in theory, cheap doesn’t necessarily equal cost-effective over the long haul.

In my case, if I add up the costs of all the cheap items I’ve bought and had to replace over time, I’m actually spending more money!

Overspending? It’s more likely than you think

All I need to do is take stock of all the handbags I’ve bought over the years. During my school years when I was on a shoestring budget, I perused flea markets and bazaars for deals on totes and handbags. If a bag was cheap, looked halfway decent, and could do the trick of carrying all my notes and books, I’d buy it without a second thought.

Unfortunately, these bags would only last me several months at best. Before I knew it, a bag’s fabric would start peeling. A strap would come loose. Or, worst of all, the entire bag would rip open, scattering its contents all over the floor. And I’d be back to square one, buying yet another replacement bag. The same experience goes for my shoes and clothes.

I’ve also been guilty of impulsively buying clothes just because they’re cheap or on sale, not because I truly loved or felt excited about them. Though I felt certain in the moment that I’d wear that $5 t-shirt all the time, that t-shirt ended up finding a forever home in the back of my closet, never to see the light of day again.

For years, I lived my life with this buying philosophy, unaware of how much I was spending on cheap, low-quality clothes, bags and shoes. Even when I started working and had more spending power, I still gravitated towards the sales rack at fast fashion stores hoping to get a good deal.

That is, until I received my first ever salary bonus.

Spend more now, save in the long run?

When I got my bonus, the first thing I did was put most of it into my savings. The second thing I did was treat myself – I bought a pair of designer leather flats that I had my eyes on for years.

It was my first splurge, but little did I know that those shoes were one of the best investments I’ve made for my wardrobe. The flats lasted me 5 years! And I wore them practically every day – to work and to outings on the weekends. They finally did give way, though, after I went on a month-long trip through rocky terrain.

At the time, the shoes cost me $300. Though they cost more upfront, I saved money on footwear because I didn’t need to keep buying new shoes to replace these leather ones – unlike the $20 pair of shoes that I used to buy that wore out within months.

And I didn’t just like wearing my leather shoes because they were versatile, comfortable, and matched every outfit I had – I also loved how those shoes looked on me. When I wanted a boost of confidence, they were my go-to shoes.

So, really, it’s not just about how it looks. It’s also about how it makes me feel.

Research shows that investing in well-made clothes, bags and shoes has a psychological effect on you too – people profile one another by their shoes, and clothes have a strong influence over how others perceive us and can influence the way we think.

Hence, if you’re a go-getter with big dreams, dressing up in the right clothing can be half the (psychological) battle won. Consider the job interview: When you’re gunning for the role of your dreams, you want to appear professional, which means dressing the part. Wearing a tailored blazer you love won’t just give you a confidence boost, you’ll also make a good first impression when walking into the interview.

Eventually, I adopted a new philosophy when it comes to shopping for clothes and then in life – buying less, but investing in high-quality, durable items that I intentionally saved up for and actually loved.

Clothes as investments

Conventional personal finance advice tells us cutting down on spending, or buying cheaper alternatives helps you keep your financial health in check.

But what if we looked at our clothes the way we looked at our investments?

Just like we would invest in companies with a good business model, we could invest in clothes that bring more value to our lives, both financially and emotionally.

Yes, high-quality clothes tend to cost more. But I get more wear out of them. My overall cost per wear for these well-made clothes is significantly lower than the ill-fitting, neglected fast-fashion items in the back of my closet. Though I’m forking out more money now to own better quality clothes, it literally pays off in the long run.

Don’t get me wrong, it’s not about buying branded things. Rather, it’s about buying less and buying items that are sustainable and last long. When I’m deliberate about the pieces that I add to my wardrobe, I won’t have a huge sack of clothes to throw away come spring cleaning time. Thus, buying quality helps me reduce my negative impact on mother nature.

Spend strategically, not recklessly

That’s not to say you should go out now and revamp your entire wardrobe and exhaust all your funds. Here’s where conscious spending comes in.

As defined in Forbes, conscious spending means looking at your spending habits and understanding where you derive the most value and using your every dollar optimally to align better with those values.

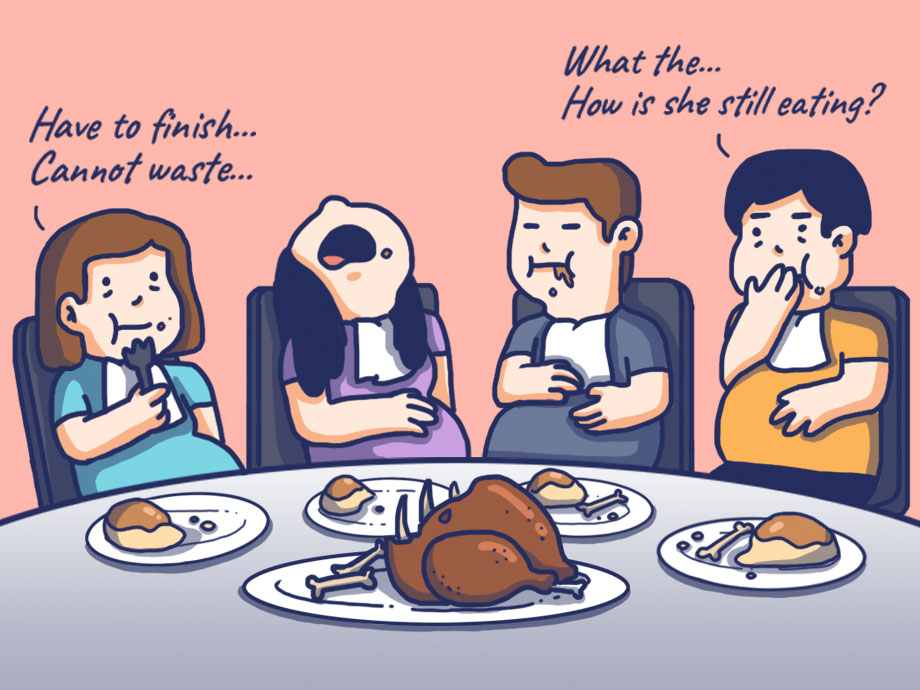

You could be someone who derives the most enjoyment and value from looking put together in the clothes that you wear. Or you could be someone who values having a good meal with good company. Or someone who values using the latest tech gadget to make your life easier. Whether it’s clothes, furniture, gadgets, or even dining experiences, spend smart, mindfully, and within a range that you can afford.

Consider how the items you’re eyeing can add value to your life and prioritize the expenses that matter most to you in your life.

If it’s choosing between buying the latest fast fashion trend and spending on a nice meal with your partner for your anniversary, ask yourself, which expense will make you happier?

Then set a budget and save up towards the expense. And if you’re planning to buy several big-ticket items, prioritize and purchase them one at a time. You’ll also have more time to shop around and to see if you can score a good discount on items you want with the sales that take place all year round these days.

Spending smart also means being strategic with how you purchase your items. While you’ve already saved up for a high-ticket purchase, keep a lookout for how else you can save more money on your purchase. This extends to the financial products, such as credit cards, that you use to make your purchase. You can save more on your purchase by spending on a credit card that gives you additional discounts, cashback or perks.

Just because you’ve made up your mind to buy quality over quantity doesn’t mean that you should buy the item you want straight away the moment you have enough money. Always plan out your purchase to maximise your savings, and make sure that your finances are in order so that you can buy quality items that last a lifetime with peace of mind.

Content sponsored by HSBC

If you’re looking to get a card and a savings account that can help you maximise your every dollar spent and earn more cashback the more you save and spend, you can consider using the HSBC Advance Credit Card and HSBC Everyday Global Account.

Save up and purchase the items that you’ve had your eye on, while earning more than S$4,000 in cashback annually by:

- Earning up to 2.5% Base Cashback on all your purchases when you spend with HSBC Advance Credit Card

- Earning 1% Bonus Cashback on your credit card spend when you bank with HSBC Everyday Global Account

- Get extra perks including complimentary access to ENTERTAINER with HSBC, which offers over one thousand 1-for-1 deals at dining, leisure, attractions and wellness merchants

If you apply now, you can get up to S$200 cashback for an HSBC Advance Credit Card plus an additional S$68 for an HSBC Everyday Global Account. Terms and conditions apply.