Article

When A Christmas Pot Luck Gathering Turned Into ‘Bad Luck’

Last Christmas, I gave my kitchen a workout. This year, to save me from tears, I gave zero effort. It’s the time of the year again and I am sorely reminded of a friends gathering last year. The one where it was supposed to be a Christmas pot luck but the only chicken that was cooked was me. My group of friends decided to have a potluck gathering, and I thought we agreed that everyone would share the expenses for the food and drinks. Since most of them do not cook, I volunteered to prepare most of the dishes, as I had the time to spare. I was so excited to contribute because I don’t often attend potlucks. Months before the event, I planned out what I was going to cook, which included roasted chicken, lasagna, Caesar salad, and my mom’s signature fruitcake. My partner and I spent so much time, effort and money preparing the dishes, from sourcing the ingredients to carefully plating each one. At the time, it reassured me, knowing that the total cost would eventually be split. That night, we arrived at one of our friends’ houses for the party with all the dishes. To my disappointment, there was minimal effort. Some brought sides, some brought cups and ice, and some brought nothing at all. It didn’t bother me that much since I thought we will be sharing the expenses as everyone dug in the food without much discussion about splitting the costs. It was a joyful night—until the next day. I raised the issue of payment again in the group chat, but guess what response I got? Silence. My group of friends moved on to other topics, but none of them responded to my question. I didn’t want to ruin the festive mood by awkwardly bringing it up again, so I patiently waited for their reply until after the new year. Again, silence. My partner also helped by asking the group how we should proceed with the costs, but he was ignored as well. After days of ghosting, we sat down to see if we could handle the expenses ourselves. In the end, we decided to cover the entire cost of the dishes in the spirit of giving. We got over it since we could still afford to cover the dishes. But I was really salty about the fact that some of our friends got away without contributing at all. I had spent so much time preparing the feast while they didn’t even lift a finger. Lesson learnt. Always communicate on costs before taking on any shared activities. And next time, I’m only going to bring snacks. This article is part of TSS Confessions, a weekly column where we delve into personal finance topics that are unscripted and genuine real accounts from people.

Here’s How To Plan Your Career Break And Prevent HR From Questioning You

I Wanted To Heal My Inner Child. So, I Gave Her My Wallet.

I Was Exhausted By My 9-5 So I Left It To Pursue The Farm Life

Don’t Overpack, Pack Smart Instead For Your Next Holiday

Here’s How You Can Turn Everyday Spending Into Miles For Your Next Holiday

When An ‘Expensive Holiday’ Costs More Than Just Money

Buy Now, Regret Later: My Love-Hate Relationship With BNPL

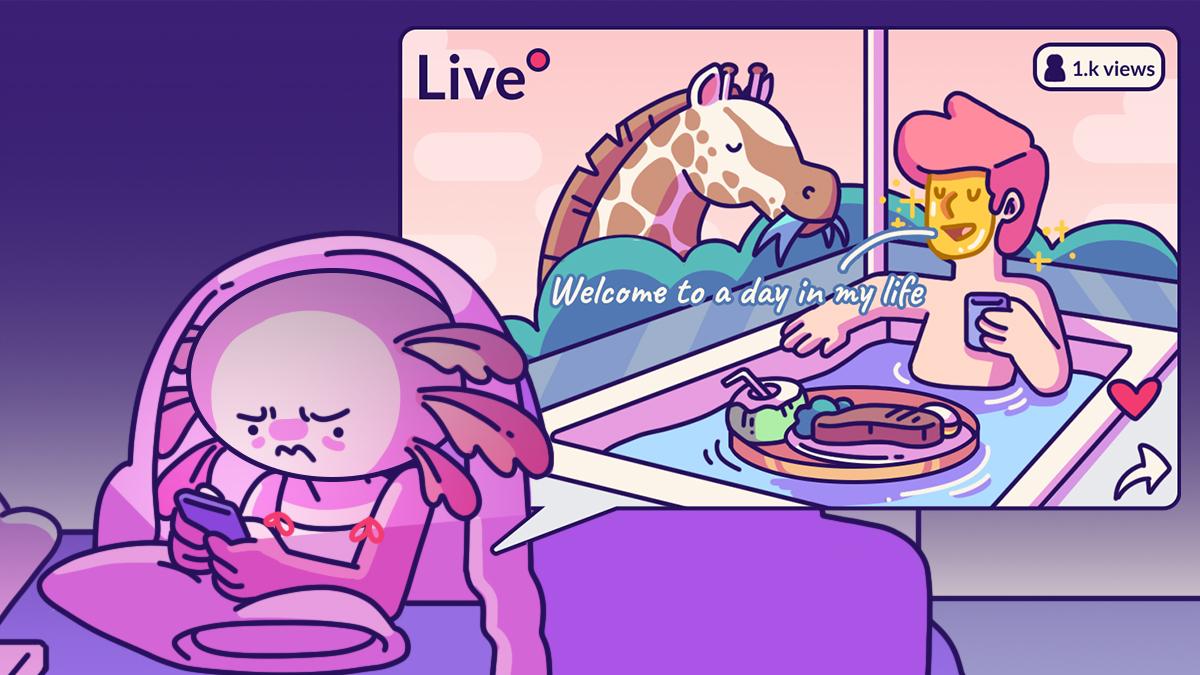

Seeing Everyone Have More Than Me Made Me Feel Like A Loser

Trapped In A Suffocating Cycle, Impulse Spending Gave Me Emotional Damage