Investing | Article

Sipping Tea with an Investment Banker

by Sophia | 24 Apr 2019 | 8 mins read

When someone says “investment banking,” what comes to mind? You might conjure images of Occupy Wall Street in the US that took place back in 2011, large-scale demonstrations protesting against the bankers of America. Or a guy in a well-cut suit rolling in heaps of cash.

Resentment against investment bankers had been building since the 2008 world financial crisis, as unethical practices by investment banks had set off a world-wide financial meltdown. Locally, many retirees had their fortunes wiped out.

Mini-protests were staged here too (though the local version merely occupied Hong Lim park). Investors were angry at the role local banks played in distributing compromised investment products.

Since then, the mental image of the 1 percenter – a fat cat investment banker – seems to have stuck. Popular culture has contributed to the unsavoury perception towards folks who work in finance. If you watched The Wolf of Wall Street, Margin Call or The Big Short, you would know they did not exactly portray finance-types in the best light, and it doesn’t help that these films were based off real people and events.

I wanted to know if these assumptions still hold any truth in 2019, so I asked an investment banker out for a quick chat in the morning. Since it was too early for alcohol, we defaulted on some tea. Better to have a clear mind than be fogged up with booze when discussing investment banking. After all, I consistently failed maths in school – and I’m now talking to a sleek investment banker? I’d better be sober for this.

Q: Why did you want to be an investment banker?

A: I wanted to try the more challenging stuff, as opposed to retail banking (consumer banking). It seemed more exotic, more brainy, and not so mass-market.

Q: But why a banker in the first place?

A: It seemed more challenging at that point after graduation. Another key reason was that it seemed to be a good place to kick off a career since I had the impression that I could always move onto any other domain after investment banking, but not so much vice versa.

Q: What was your path to becoming an investment banker?

A: I studied economics and later joined an RBS programme where I did structuring and trading for equity derivatives.

Q: Um. What’s structuring?

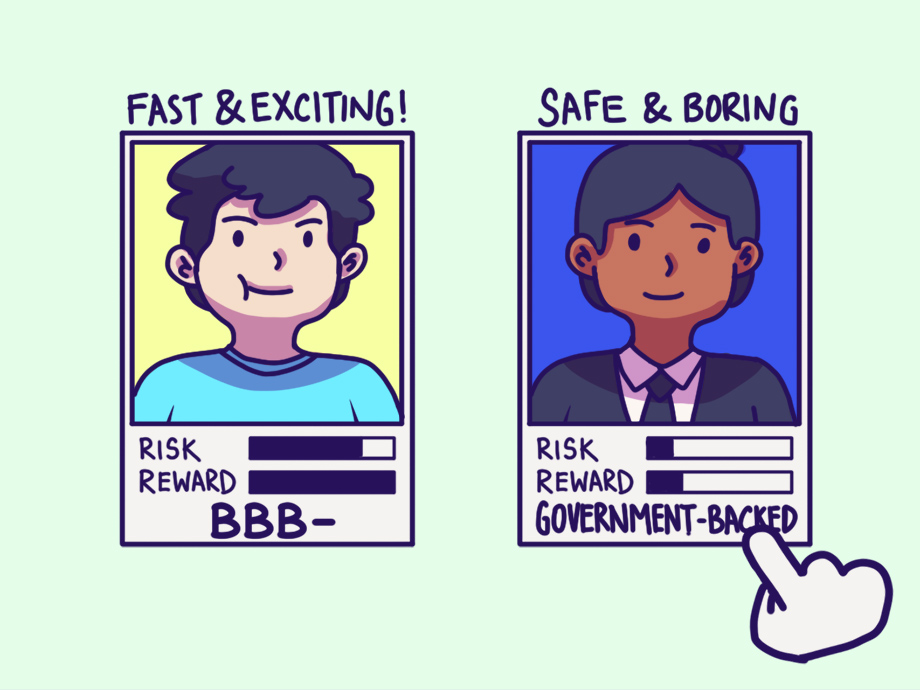

A: Structuring is where you create the structures or do the pricing for investment products. These are the products that people sell or trade. If selling is on one end of the spectrum and trading is on the other, then structuring is somewhere in the middle.

Q: Right… so that’s what investment bankers mainly do?

A: There’s either investment banking or the Investment Banking Division (IBD). This division is separate from investment banking; it deals with mergers and acquisitions and corporate finance for large companies. It’s not so much personal banking. For Investment Banking, we do asset management and equity research. I’ve never touched IBD myself.

Q: What, simply put, is asset management? What is equity research?

A: Asset management is where you help clients (investors) to build their investment portfolio across various asset classes like commodities, foreign exchange, and bonds.

In equity research, you study stocks. For example, if you’re a tech specialist, you research Apple, Samsung, Google, and Tencent stocks. You write a lot of reviews and provide forecasts. Every bank has these analysts. It’s up to the client whether they want to follow these leads.

Q: Is being an investment banker very stressful?

A: It can be. It usually is, especially for the first 3 to 5 years. You need to be ready to buckle down and work hard at the start. Get a good mentor and a good team – it’ll be a lot easier.

Q: What are the hours like for an investment banker?

A: For investment banking, it’s not so bad because it’s market-based. This is where you do sales, trading, or asset management. Once the markets close, you’re done (though you still have some work). IBD can actually go round the clock. People who work in IBD in the first few years will see an average of 15 to 17 hours a day. It’s very competitive, and very time-sensitive.

Q: What’s a day in the life of someone in your role?

A: You can expect to work north of 80 hours per week. A typical day could run from 9AM to 2AM, and it comes with its share of stress and intensity. The average routine is division-dependent (sales, trading, equity research, IBD).

It’s fast-paced and high stakes. You’ll be bombarded with emails and messages, pulling you in different directions. You’ll learn how to prioritise and put out fires quickly. Pulling research and data to compile into a professional, comprehensive format to present on a whim is very common. Building and running models on Excel and banking systems will have to be second nature to you. Stamina is key.

Having the right attitude along with a likeable personality will go a long way. I know it all sounds very daunting, but some crave and relish in the intensity and find it gratifying. Once you get into the flow and play your cards right, you’ll enjoy a more balanced work life, with the routine gym or yoga session thrown into the mix to maintain sanity.

Q: So… can you buy a yacht with your money?

A: [Incredulous look.]

Q: [Nervous laughter.] OK, let’s talk about starting pay instead.

A: IB will – assuming things haven’t changed since my time – start you off from 5k to 8k a month. For IBD, if you join a strong firm, you’ll get around 6k to 10k a month. But there’s a very lengthy interview process, and many tests you need to pass.

Q: So let’s talk about the rep surrounding investment bankers. Along with brokers, they now have a bad name after various financial crises. Do you think that’s deserved?

A: Yes, I do believe it’s deserved. The bad impressions came especially after 2008’s Lehman Brothers. Even people who aren’t in banking have a rough idea of it. But obviously not all bankers are bad, though there’s a huge chunk of the industry that’s… even if they weren’t responsible for the implosion, they turned a blind eye and took things for granted. Governments came down hard on banks for their negligence.

Q: Were you around in the industry during the 2008 crisis?

A: Yes.

…obviously not all bankers are bad, though there’s a huge chunk of the industry that’s… even if they weren’t responsible for the implosion, they turned a blind eye and took things for granted.

Q: What was that experience like? Have an anecdote?

A: It gave me a lot of perspective and wisdom – and helped me to take things in my stride when things got tough.

Q: On that topic, personally seen any shady/unethical stuff during your time?

A: Personally, no. But have seen a fair share of ideas/products structured that were unhedgeable* and built based on unrealistic and untenable assumptions. As such, they would likely implode once these assumptions don’t hold out, which they did.

*refers to practices that reduce investment risks.

Q: Do investment bankers really just see their clients as commission to earn, and not people? If it’s not true for you, do you think it’s true for others?

A: I don’t think it’s fair to generalise it.

Q: What is it about your job that makes it all worth it?

A: For me, it’s when we finally finish big projects and roll our products out into the market. That makes things worth it. But in terms of changing the world… this is not a job where you can do that.

Q: That’s fair. So what does it take to become a successful investment banker?

A: You need to know exactly what you’re getting into, align your passions. Make sure you know what you want before really getting into investment banking or just banking in general.

Q: What do you think are some good motivators?

A: You need to embrace the high intensity, the multitasking and roughing it out, whether pertaining to long hours, difficult high-stake situations or scrambling to put out fires constantly along the way to successfully pulling off trades and deals. If you can reap enjoyment and satisfaction from conquering these hurdles, you achieve longevity in the field.

Q: One more question: is capitalism bad, bad, bad, like what people like to say now?

A: The alternatives being… socialism, facism? I don’t think the full extent of each theory works on its own. Full on capitalism, it wouldn’t work. Full on socialism, it’s not going to work. Facism, let’s not talk about that. It’s really a blend or balance between capitalism and socialism. Capitalism with the right amount of giving back and sharing, I suppose. Full on capitalism would leave a lot of people behind. It won’t work beyond a certain point for society.