Budgeting | Personal Finance | Article

The Credit Card Cashback Game: Is it for Everyone?

by En Ci | 26 Dec 2018

“Get a credit card to save money!” is a common mantra we hear from our peers and family members alike.

The perks of the cashback card have been so lauded that applying for such a card has become a piece of almost-universal advice.

On the surface, cashback cards promise a slew of great deals. Offering a percentage of cash back on your spending, on a variety of products and services — groceries, dining, travel and transport.

But take a closer look, and you’ll find that the sheer number of terms and conditions will boggle even the most discerning spender.

In fact, these T&Cs seem like the rules of a game, and what other game deals with cards?

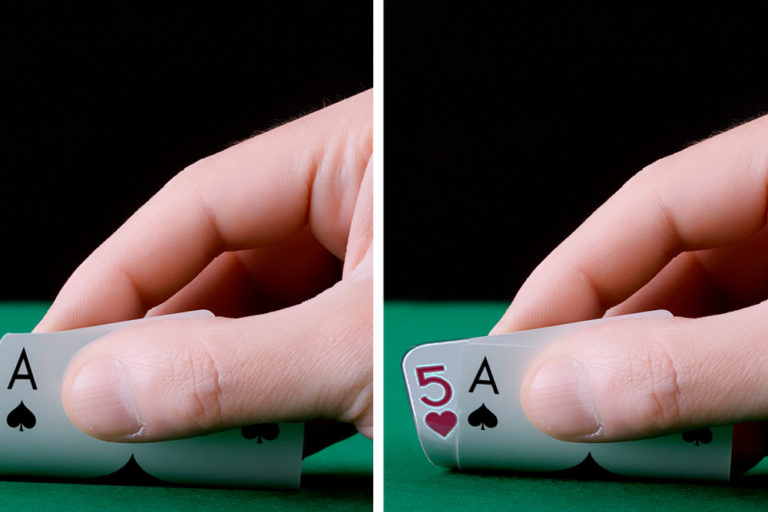

Well, Blackjack.

The banks are the dealer, or in local terms, quite literally called the banker (hah) — apt, as they are the ones dealing the (credit) cards.

Who are the players? Well you, the potential card-owner.

The stakes? Money of course. You can either win the banker’s money or lose yours.

So what are your odds? Let’s lay down the cards.

Case Study: Standard Chartered Unlimited Card

At first glance, the card offers a galore of goodies: no minimum spend, no cashback cap, and an alluring 1.5% cashback return on all expenditures.

Many potential cardholders may adore this fuss-free option because of its seemingly direct and simple-to-understand features.

This seems like a sure win, the Ace of Spades. However, take a closer look at your hand again.

First off, cardholders need to pay an annual fee of $192.60. This means that each month, your buy-in would be:

$192.6/12 months = $16.05

Using the cashback rate of 1.5% as our basis, we can calculate the minimum amount we have to spend to “earn” back the annual fee:

$16.05/1.5% = $1070

This means that $1070 is your “breakeven” point. As such, if you spend anything lower than that, you aren’t earning any money from the cashback feature.

$1070, seems okay until you realise that some bigger ticket monthly spends, such as monthly bills or insurance, can’t be easily charged to your credit card.

“But can just waive the annual fees!” you say.

Well, that may be true before, but most credit cards these days will clearly state their fee waivers are temporary.

For the Standard Chartered Unlimited, the annual fees are only waived for two years.

Many experienced card sharks will tell you to simply cancel the card before the third year. But many of us suffer from subscription inertia, simply put, just being too lazy to make a switch.

That’s exactly what banks are counting on. Or heck, you could have even grown emotionally attached to that piece of plastic that sat in your wallet for the last 2 years.

But it bought me so many things. The House wins.

Spending to Save

“But…If i spend more than $1,070, I still benefit from the card — right?”

If you consistently spend that amount a month? Then It’s a no brainer, this really could be the card for you.

But the key question to ask yourself is this: Do I need to up my expenses significantly to receive these savings?

If you are “spending to save”, or spending more to make sure you are hitting the required amount to gain the cashback, then you are not actually saving at all. Afterall, you are only getting a small percentage cashback on 100% that goes out, and those are not good odds.

Put it this way, If you were enticed to make an impulse purchase at half price, you didn’t save 50%, you spent 100% of your money on something you didn’t actually need. You lose.

Penalty Fees

And what happens if you forget to pay your credit card bill on-time for just one month? The bank smacks you with a $80 penalty fee. That is $5,332 worth of spending on your 1.5% cashback. House wins.

The Rules Change

Needless to say, it is extremely important that you do your homework and understand which cards suit your lifestyle. This ensures you won’t succumb to the abovementioned perils of “spending to save”.

But even then, cashback perks evolve with the seasons. In other words, you shouldn’t expect your card’s benefits to remain the same.

Instead, it’s commonplace for banks to change the cashback benefits every year.

As such, even if you do your homework in the beginning and apply for the card of your dreams, you may easily forget to check the changes and fail to follow the new rules, subsequently earning less cashback. The house wins again.

Takeaways?

The house always wins. Banks aren’t charities, they profit off these cards.

The skilled player might make some gains on them. But the question is, can you play the cashback game well?