Career & Education | Life | Personal Stories | Article

Thinking of Futureproofing Your Career? Here’s How 2 Individuals Transitioned Their Careers With a Professional Qualification

by The Simple Sum Team | 27 Feb 2024 | 8 mins read

This article is brought to you by CPA Australia.

Been seeing artificial intelligence in the news more often lately?

It’s a sure sign that times are changing – and changing fast.

And if the Covid-19 pandemic has taught us anything, it’s that nothing is sacred or guaranteed, especially when it comes to our careers.

This is probably why futureproofing one’s career has become something of a trending topic. On social media platforms like TikTok, plenty of advertisements about picking up cybersecurity certifications flood our For You pages, showing how much technology has become a part of our professional lives. It’s also an indicator of what’s in demand in the professional sphere.

People are starting to realise that it’s important to always stay ahead of the curve in order to remain relevant. It’s no different in finance and business. For two professionals, Si Chun Siang and Coco Hu, this was certainly the case – which was why they pursued the CPA Australia professional qualification.

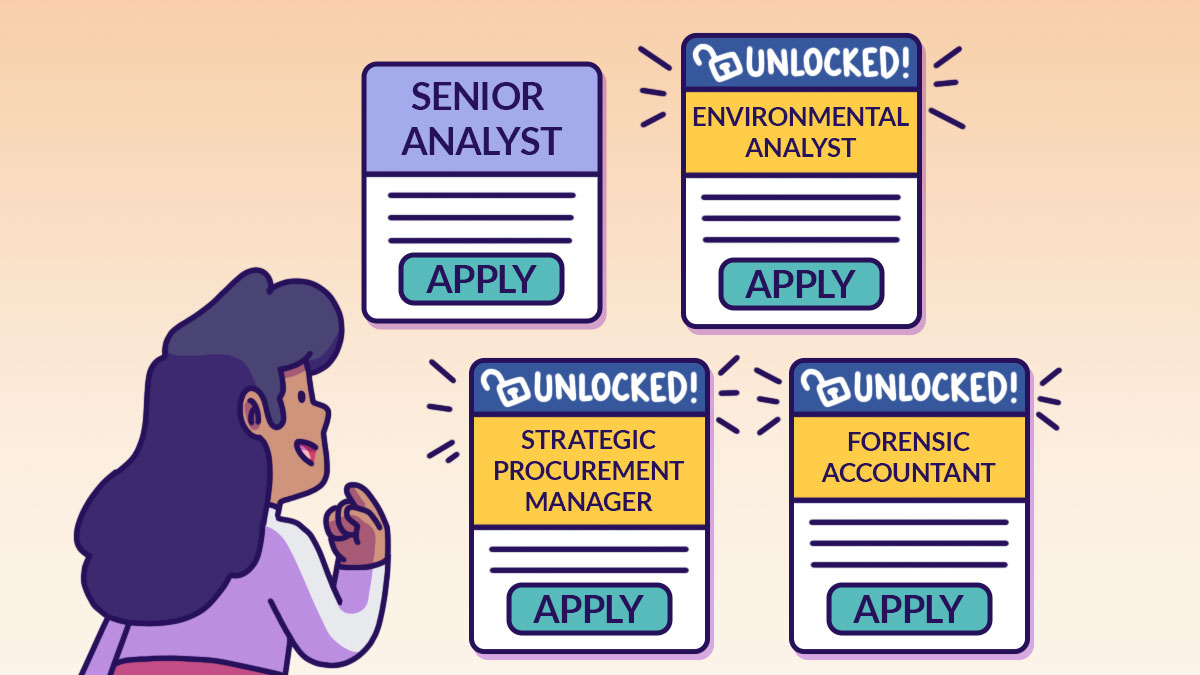

Opening new doors and career pathways

For Chun Siang, a seasoned forensic accountant, what drew him to the CPA Program from CPA Australia was a module called Digital Finance. He first encountered CPA Australia, a professional global accounting body, while visiting career fairs as a university student, all the way back in 2013.

“It was about the future of the corporate world, as I understood it,” he says, “where emerging technologies such as artificial intelligence and machine learning are deployed for a multitude of functions.”

Related

Sensing that it was an opportunity to enhance his skillsets as an accountant, and to also build more credibility and trust among his clients, Chun Siang took the leap and enrolled in the CPA Program in late 2020.

His efforts would eventually pay off, as the CPA qualification would open him up to new opportunities for a promotion at work as well as new client business opportunities.

“CA and CPA are common qualifications, and most countries have their own local programmes, but there are only a few globally recognised ones, including the one from CPA Australia,” he explained. “This was an important qualification to get because I wanted to climb the career ladder and to also stand out from the crowd in a professional sense.”

Easier said than done, of course. It wasn’t easy for Chun Siang to juggle full-time work and studying for the CPA Program. Gunning for the qualification meant that he had to make a few sacrifices and more diligently set aside his time accordingly.

“I had to sacrifice most of my weekends in order to set time aside to concentrate and prepare for my exams,” he said. “My wife was very supportive of my study plan and we would have to reduced the frequency of our travel plan to cater for my exam.“

He spent most of his time diving into materials, which included video lectures, study guides, and digital textbooks provided by CPA Australia. Thanks to the extensive amount of resources readily available to him at all times, Chun Siang eventually graduated with high distinctions, and attributes his career growth with attaining this qualification.

“The CPA Program helps you to demonstrate a high level of competency in terms of technical expertise, which is very useful for advancing your career in finance,” he said.

It was the same story for Coco, an investment analyst, who had been seeking opportunities to expand her professional knowledge in the industry. Having started out with a genuine interest in personal finance and investing, she soon developed a natural affinity for analysing company performance after embarking on an employee share purchase scheme. Following this, she started to veer towards wealth management, and enrolled in the CPA Program in hopes of working towards a career switch.

Coco’s determination knew no bounds. She would set aside two hours every morning to study and found what she learnt to be very practical and relevant to her line of work and interests. She spent three years hard at work, and eventually attained her new professional CPA qualification in 2018.

“I really enjoyed the study structure of the CPA Program,” she said. “I had the flexibility to choose electives I was genuinely interested in, and ultimately went for financial risk management and advanced taxation.”

On why she was so eager to complete the Program, Coco said, “It was important for me to get the CPA qualification on my resume because it’s an evidence that I have solid accounting skills. Accounting is the backbone of the financial market. Having the CPA qualification also greatly helped my job search in Singapore, since I had very little connections here, and I was new to the wealth management industry.”

Becoming a member of CPA Australia, thankfully, resolved some of Coco’s problems with establishing a professional network of contacts and industry peers.

Related

“There were webinars and in-person events for members of CPA Australia that I really benefited from,” Coco said. “I met lots of people and got the opportunity to build up my network through CPA Australia, and it ultimately helped in my move to Singapore after I attained the qualification. I do think I was rather lucky, since the career switch was so smooth even though I switched both industries and the place that I live in.”

Emerging trends, and the future as we know it

These days, it’s not uncommon to hear about rapid leaps in advancements in the fields of blockchain, web3, and other fields. What is possible today was perhaps only a pipe dream several decades ago, and such promising advancements mean that there are newer skills that employers will find highly attractive and useful.

In the face of such a future, what’s a professional to do? Chun Siang and Coco both saw the biggest upside to enrolling in the CPA Program from CPA Australia – the fact that it could equip them with knowledge and technical know-how to futureproof their careers. Coco now works in a role that adopts the ESG framework into risk management work and due diligence processes. And it just so happens that ESG is an area of personal interest for her.

“It’s my belief that things just aren’t sustainable on earth right now, especially with the rapidly growing population,” she said. “If we continue operating the way we are, then things are going to become more dire. By integrating ESG analysis into our line of work, we can better identify and manage risk and also do our part for this world.”

Related

Chun Siang’s interest lies in forensic accounting, a specialised arm of accounting that enables better fraud detection in the market. As opposed to traditional accounting, forensic accounting involves data analytics, legal knowledge, and the use of forensic technology to, as Chun Siang put it, “better figure out the modus operandi of the perpetrator and learn how frauds are concealed.”

“There will always be a need for people like me, to step in when fraudulent activities are being conducted, for a thorough and proper investigation...Where traditional accounting is more concerned with bookkeeping and maintaining records, forensic accounting looks into these records when they’re being manipulated and falsified,” Chun Siang said. “It gives me great satisfaction to uncover and bust a fraud scheme.”

As the world progresses, we might find that a lot more can be done with new technology at the forefront of our industries – spelling more up-and-coming job roles. This also means that other job roles might soon become irrelevant, or just no longer as lucrative anymore. Chun Siang and Coco may have been pursuing their interests, but they were also finding a way to secure their careers at the same time. CPA Australia has empowered them to take control of their career growth and point it in the right direction.

As Coco eloquently put it, “Following your passion is the best hedge to a rapidly-changing world.”

In other words, we must embrace change and learn how to move with the world. By learning to identify topics and industries that are increasing in relevance and taking the leap to enroll in certification courses like CPA Australia, we’re equipping ourselves with the needed skills to protect our future and build a life that not only fulfills our dreams, but is robust enough to withstand – and roll with – the tides of change.

Content sponsored by CPA Australia

Thinking of breaking into emerging accounting trends such as forensic accounting, ESG and crypto accounting? CPA Australia can equip you with the skills you need to succeed, just like Chun Siang and Coco, in these new areas that require relevant accounting knowledge.

CPA Australia is one of the world’s largest accounting bodies with more than 170,000 members working in over 100 countries and regions. There are more than 28,000 CPA Australia members working in senior leadership positions.

The CPA Program goes beyond the numbers. It teaches you the skills that will help you reach the next level in leadership, strategy and business, allowing you to make great impact on your tomorrow.

Step forward to create an impact. Start by finding out what the CPA Program has to offer at an information session now here.