Web3 | Article

Uncover the Power of Community With a Decentralised Autonomous Organisation (DAO)

by The Simple Sum Team | 11 Sep 2022 | 9 mins read

The power of the people – that is essentially what a Decentralised Autonomous Organisation (DAO) is, otherwise defined as an internet-native entity with no central leadership.

Decisions within a DAO are made from the bottom up and governed by a community organised around a specific set of rules enforced on a blockchain.

DAOs are collectively owned and managed by their members, and decisions are made via proposals that the group votes on during a specific period. Moreover, DAOs have built-in treasuries that are only accessible with the approval of their members.

A DAO works without hierarchical management and can have numerous purposes. Examples of these include freelancer networks where individuals pool their funds to pay for software subscriptions, charitable organisations where members approve donations, and venture capital firms owned by a group.

The workings of a DAO

As mentioned, a DAO is an organisation where decisions are made from the bottom up by a collective of members who own the organisation. And becoming a member of – or participating in – a DAO is usually done through the ownership of a token (i.e. a specific cryptocurrency).

DAOs operate using smart contracts – essentially chunks of code that automatically execute whenever a set criterion is met. Smart contracts are deployed on numerous blockchains nowadays although Ethereum was the first to use them.

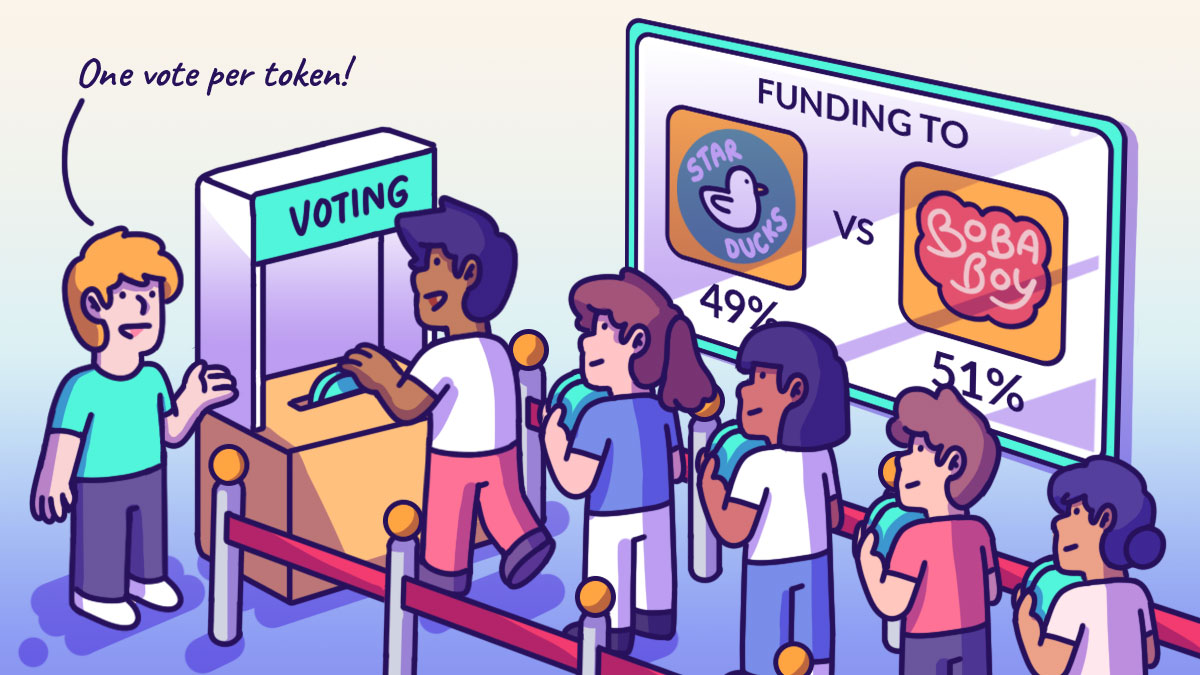

These smart contracts establish the DAO’s rules. Those with a stake in the DAO then get voting rights – proportional to the amount of tokens they hold – and may influence how the organisation operates by deciding on or creating new governance proposals.

This model prevents DAOs from being spammed with proposals. This means that proposals will only pass once the majority of stakeholders approve it. How that majority is determined varies from DAO to DAO and is specified in the smart contracts.

DAOs are fully autonomous and transparent. As they are built on open-source blockchains, anyone can view their code. Anyone can also audit their built-in treasuries as the blockchain records all financial transactions.

Here’s how DAOs and traditional organisations differ from one another:

| Traditional Organisation | Decentralised Autonomous Organisation |

| Usually hierarchical. | Usually flat and fully democratised. |

| Depending on structure, changes can be demanded from a sole party, or voting may be offered. | Voting required by members for any changes to be implemented. |

| If voting is allowed, votes are tallied internally and the outcome of voting must be handled manually. | Votes tallied, and outcome implemented automatically without a trusted intermediary. |

| Requires human handling or centrally controlled automation; prone to manipulation. | Services are handled automatically in a decentralised manner (e.g. distribution of philanthropic funds). |

| Activity is typically private. Public information is limited. | All activity is transparent and fully public. |

Related

Launching a DAO

A DAO launch typically follows three major steps.

1. Smart contract creation

First, a developer or group of developers must create the smart contract behind the DAO. After launch, they can only change the rules set by these contracts through the governance system. This means that they must extensively test the contracts to ensure they do not overlook important details.

2. Funding

After the smart contracts have been created, the DAO needs to determine a way to receive funding and how to enact governance. More often than not, tokens are sold to raise funds and these tokens give holders voting rights.

3. Deployment

Once everything has been set up, the DAO needs to be deployed on the blockchain. From this point on, stakeholders decide on the future of the organisation. The organisation’s creators – those who wrote the smart contracts – no longer influence the project any more than other stakeholders.

The potential of DAOs

Being internet-native organisations, DAOs have several advantages over traditional organisations. One specific advantage of DAOs is that trust between two parties is not needed. Whilst a traditional organisation requires a lot of trust in the people behind it – especially on behalf of investors – with DAOs, only the code needs to be trusted.

Trusting the code is easier to do as it is publicly available and can be extensively tested before launch. Every action a DAO takes after being launched must be approved by the community and is completely transparent and verifiable.

Despite having no hierarchical structure, a DAO can still accomplish tasks and grow whilst being controlled by stakeholders with its native token. This lack of hierarchy means that any stakeholder can put forward an innovative idea that the entire group will consider and improve upon. Internal disputes are often easily solved through the voting system – in line with pre-written rules in the smart contract.

By allowing investors to pool funds, DAOs also give them a chance to invest in early-stage startup sand decentralised projects while sharing the risk – or any profits – that may come out of them.

Related

The Risks of DAOs

Whilst DAOs have huge promise, they also present potential risks. DAOs decentralise governance so that no one party holds control. However, it is possible that some members can have more power over others. When voting power is determined by token ownership, wealthy groups such as venture capital firms owning a large supply of tokens can end up having a major influence over key decisions.

Moreover, as DAOs have economic growth baked in through their incentive mechanisms, they may end up placing too much focus on financial interests. For example, a group dedicated to supporting emerging musicians using NFTs may select those with a bigger community following in the hope that they reap rewards for the group in the future.

DAOs ultimately depend on the community to drive the direction in a way that matches the group’s ethos. As much as the rules can be embedded into the code, ideological values are harder to record on the blockchain. DAOs need communities to evolve in fitting with the organisation’s mission without being influenced by the potential financial rewards.

DAOs in action

Let’s delve into some DAOs that have been established and how they differ from one another.

1. The DAO

The DAO was one of the earliest attempts to build a decentralised finance network for crowdfunding and venture capital. Unfortunately, it was hacked, resulting in the theft of $60 million worth of Ether. This theft was controversially reversed, and the funds returned to their rightful owners.

2. Uniswap

Uniswap is one of the biggest and most popular DAOs, and operates as a cryptocurrency exchange built on the Ethereum blockchain. Anyone can become a member by holding the UNI token which gives voting rights for the way the organisation is run and administered.

3. Decentraland

As mentioned in our previous instalment, Decentraland is an online world governed by a DAO where administrative and governance decisions are made by its stakeholders in a democratic fashion. Anyone who owns the platform’s token – known as MANA – can take part in the process, and the platform is quickly becoming popular with global brands including Morgan Stanley, Coca Cola, and Adidas as a way of reaching out to digital-native audiences.

4. American CryptoFed DAO

This DAO made news headlines by becoming the first DAO to be recognised as a legal entity in the US thanks to a law passed in the Web3-friendly state of Wyoming. It positions itself as a kind of crypto-equivalent to the US Federal Reserve and aims to enable fee-free trading using its own token which is known as the Ducat.

5. BitDAO

BitDAO is a decentralised investment fund backed by PayPal founder Peter Thiel. It was created to allow anyone to buy a stake in Web3 and DeFi startups and initiatives. Token holders have a chance to vote on how managed capital is spread across the projects supported by the fund.

6. LexDAO

This DAO aims to create smart contracts capable of carrying out legal services. It is headquartered in the Cryptovoxels metaverse platform and is concerned with building blockchain tools that can automate aspects of legal services such as arbitration. With many DAOs existing in a grey area of legality, services like this may be essential in the future.

7. Friends With Benefits

A crypto club where owners of the Friends With Benefits (FWB) token can meet to network and collaborate on individual projects. There are individual hubs for different cities, so users can meet up with similar Web3-minded individuals in their own locality. The more FWB tokens a user holds, the more interaction and opportunities to connect become available.

8. Constitution DAO

This DAO was set up in 2021 as a decentralised, crowdfunded effort to win a rare edition of the US constitution which was put up for auction by Sotheby’s. Ultimately, despite raising over $40 million from 15,000 contributors, it failed. However, the organisers stated that even though they did not win the auction, the project was a success in that it had educated many people about the potential of DAOs as a vehicle for raising crowdsourced funds.

9. Pleasr

Pleasr is a collective of artists and art lovers that invest in NFT artwork and other digital collectibles. It focuses on pieces that its members believe represent important ideas and causes, and experiments with the idea of “fractional” ownership of art as all members have a share in the growing collection.

10. Ukraine DAO

A fundraising DAO set up to collect and distribute donations to assist those affected by the war in Ukraine. Its success was the auctioning of an NFT image of the Ukrainian flag which sold for ETH2,258 (about $4.7 million at the time). Initiated by UK-based Ukrainian activist AlonaShevchenko, the project has received support from activist group Pussy Riot.

The Future of DAOs

Like NFTs and the Ethereum ecosystem itself, DAOs are still in their infancy. In fact, they arguably occupy the least explored niche in Ethereum today. However, it is already clear that DAOs could form a key part of the future of Web3.

DAOs highlight the power of community – something that is integral to the blockchain movement. They create a way for online groups to gather and coordinate in a way that did not exist pre-Bitcoin. As the world moves towards an open, internet-based financial system, DAOs will create a way for communities to cooperate via rules that live immutably on a public blockchain.