Investing | Article

What is Investing?

by Sophia | 14 May 2019 | 4 mins read

Seems like everybody’s nagging at us to start investing early. That geeky finance friend, the government, and (especially) financial planners we meet on the street. For some of us, all we know about investing is “something something stock market.” So, what exactly is this ‘investing’ that these people speak of? What does it all really mean?

Here’s a quick overview.

What the heck is investing?

Simply, investing is seeding money to grow more money.

Why would I be interested in investing?

Parents and grandparents always mention how things were cheaper “back in the day.” In 1950, the price of a bowl of prawn noodles was 20 cents. Today, in 2019, a bowl is at least $3.50.

At that rate, 40 years into the future, a bowl might cost $18.40.

The phenomenon is called inflation, and it doesn’t happen by accident. Governments target a 2% inflation rate each year. In Singapore, prices have increased, on average, by 2.51% a year since 1961. So here’s the problem: while the 1.8% interest (in general) offered by high-interest rate savings accounts are better than the pathetic saving accounts of old, they still lose to the average inflation rate by 0.71%.

So this means one has to save more of today’s money to make up for the difference.

This is where investing comes in. Investors target investment return percentages – and it’s all about the percentages– that beat the rate of inflation (and savings accounts). In fact, higher investment return percentages above inflation opens doors to better possibilities, such as an earlier retirement.

What can I invest my money in?

Here are some popular forms of investments in a nutshell, and how they can grow money.

- Shares/stocks. A stock investor purchases a unit of ownership in a company. There are two ways this investment reaps rewards.Some companies reward owners by distributing their profits each year (dividend payouts)

- Increase in the share’s unit value (capital gains)

Bonds. Essentially a bond investor loans money to government bodies, businesses or other entities.

- Fixed interest payments based on the amount loaned

- Capital gains on bond unit

There are many, many other investment vehicles to look into: commodities, mutual funds, unit trusts, cryptocurrencies, and Real Estate Investment Trusts (REITs).

Investment Risks

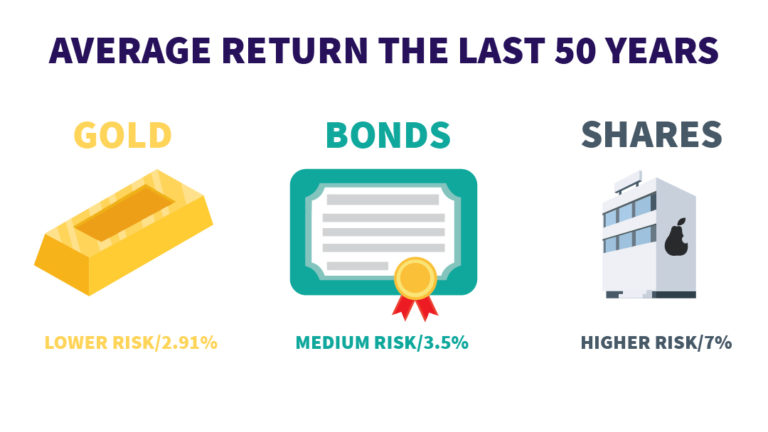

Here is the downside: all investments carry risk – the risk of losing money. The higher the reward, the higher the risk

But there are ways to lower this risk. For example, if investing in shares, there are many things to consider. How’s the company’s financial situation? Is the company’s management team talented or even competent? How is the economy in general? Risk can also be managed with investment methodology. For example, not putting all your money into a single investment. If an investor buys shares in two companies, it is less likely for both companies will go bankrupt at the same time.

So diversifying investments reduces the chance of losing all invested cash at one go. In a better scenario, if one company does poorly, there is a chance the other will do well, negating – sometimes even outperforming – a bad investment’s losses.

Setting a goal

This is the first and the most important step before considering making an investment. And this can’t be stressed enough: give the act of investing a purpose and invest with a measurable goal in mind.

How does one set a measurable goal? Very simply:

- Define a specific amount required;

- To be achieved in a specific time frame (after considering yearly inflation)

Considering the capital one is able to commit, this would guide an investor in the selection of appropriate investment vehicles, based on their rate of return percentage on the invested amount each year. For example, you have $1,000 in capital and wish to have a total of $2,000 in 10 years time. This requires an investment that provides a 7.18% return rate. Here’s a rate of return calculator. Identifying the return rate required allows an investor to search for investments that might provide such a return. The investor can then perform the necessary research to understand the risks of the investment, or adjust their goals if they find the investment unsuitable for their risk appetites.

Before hopping on board the investing train

Before even thinking about getting started as an investor, it’s important to make sure you check off these important milestones first:

- Clearing off outstanding debt (like school loans)

- Owning a 6-month emergency fund for rainy days

As you can tell, investing is not a “get rich quick” scheme. It requires knowledge and study time. But, investing is a worthwhile and perhaps even necessary path to take – if only for a better future.