Investing | Article

Why Exchange-traded Funds (ETFs) Are Best for Beginner Investors

by The Simple Sum Team | 29 Dec 2021 | 7 mins read

This article is brought to you by FUTU Singapore (moomoo trading app)

We’ve heard the well-meaning advice “start investing now” a hundred times over by now. But knowing we need to invest is vastly different from knowing how to start. That knowledge gap is one reason we put off investing in the first place.

On top of that, many baulk at the mere thought of having to monitor the markets. Who has the time, after all?

So, maybe investing is only for people who have the time, knowledge, and money – and the rest of us should just take the backseat, right?

Wrong!

Investing doesn’t have to be difficult and time-consuming. In fact, anyone can start investing! The trick is to tailor your investments to your needs and level of knowledge – there are low-effort options that beginners can start with, and more sophisticated ones that seasoned investors can get their hands dirty with.

For the beginner investor and those with very little time to spare (and not a lot of technical knowledge), consider the ETF – or Exchange-Traded Funds.

WTF is an ETF?

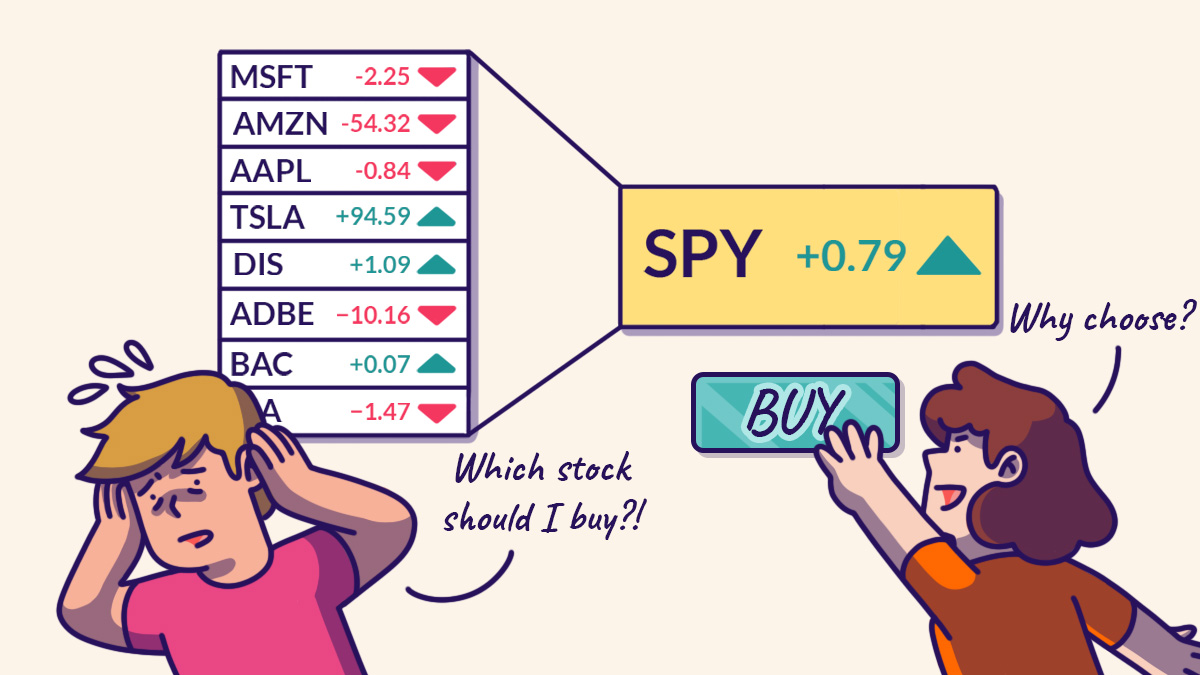

ETFs are a type of index fund that you can buy and sell on an exchange, hence the name “exchange-traded funds”. These funds invest in stocks that make up a particular benchmark or index. By investing in ETFs, you’re investing in the stocks that are in the index.

In other words, the simplest way to invest in the stock market is through an ETF because you don’t have to spend time figuring out which stocks to buy. The ETF already has a number of them in it!

A notable ETF is the SPDR S&P 500 (SPY), which was launched by the asset manager, State Street Global Advisors, in 1993 and tracks the S&P 500 index (the index that comprises of the top 500 companies in the United States). Buying 1 unit of the SPY would mean that you’re indirectly buying into 500 companies.

Why invest in an ETF?

Get exposure to many companies and industries

Think of ETFs as a starter pack to help you achieve stocks spread across various companies or industries. The variety of stocks you’ll get exposure to will depend on the ETF and which industries or benchmarks it tracks.There are ETFs that track indexes in specific countries such as the earlier mentioned SPY for the US and STI ETF (ES3), which tracks the top 30 companies in Singapore. There are also ETFs that track specific sectors such as the Technology Select Sector SPDR Fund (XLK) and the Energy Select Sector SPDR Fund (XLE) which tracks the US tech sector and US energy sector respectively.

In addition, you aren’t limited to stock ETFs! You can also invest in ETFs that track commodities, bonds and other asset classes.

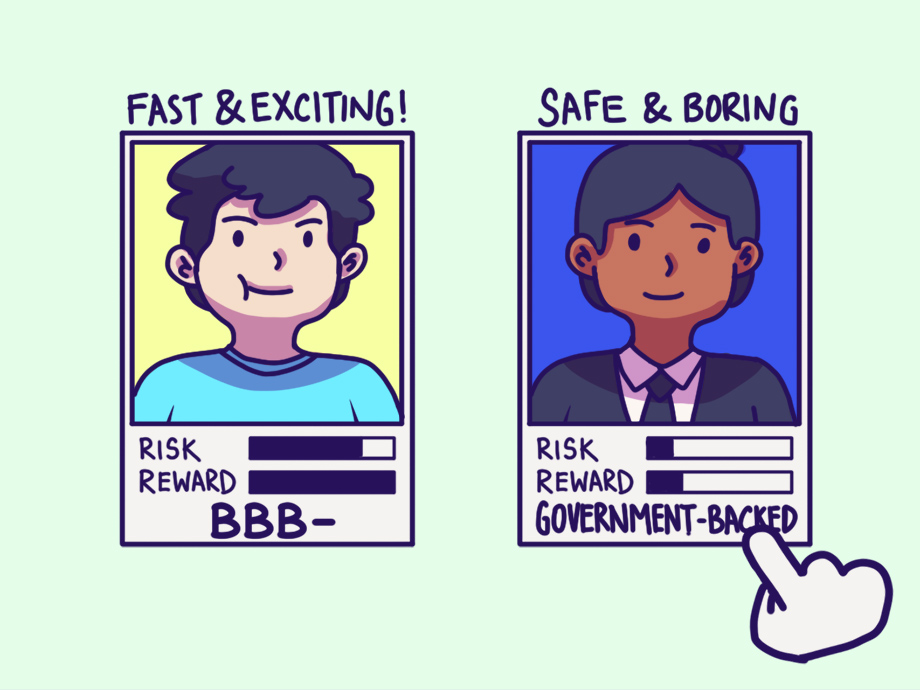

Reduce your risk by diversifying across different companies

By investing in an ETF, you’ll be able to park your money with multiple companies and count on your diversified portfolio to mitigate the risk that inevitably comes with putting your money in the market. What do we mean by that?

Say you invest in the SPY ETF, which contains companies from industries like tech, banking, healthcare, energy, and so on. One such company that’s included in the SPY is Apple. If the price of Apple’s stock drops drastically, for instance, your overall investments will likely take less of a hit because there are other stocks in the ETF that help to minimise your losses.

Or if the airline industry is facing a downturn, another industry in the ETF, such as tech, could be having a boom, which could offset the loss in value the airline industry with the gain in the tech sector.

It’s no wonder investors always like to warn each other against putting all their eggs in one basket – it could be more risk than we can handle if we place all our bets on one company or sector, especially as a beginner investor.

Spend less time thinking about what to invest in

Investing in ETFs puts you on the path of passive investing. Investing in a basket of companies at once through a single ETF alleviate the burden of having to actively suss out the best stocks to put your money in, or doing the math to identify the next Apple or Google. It’s simply too much work for those of us who have day jobs and families to think about – and stock-picking also comes with its fair share of risks, especially if you’re going in without prior experience or knowledge.

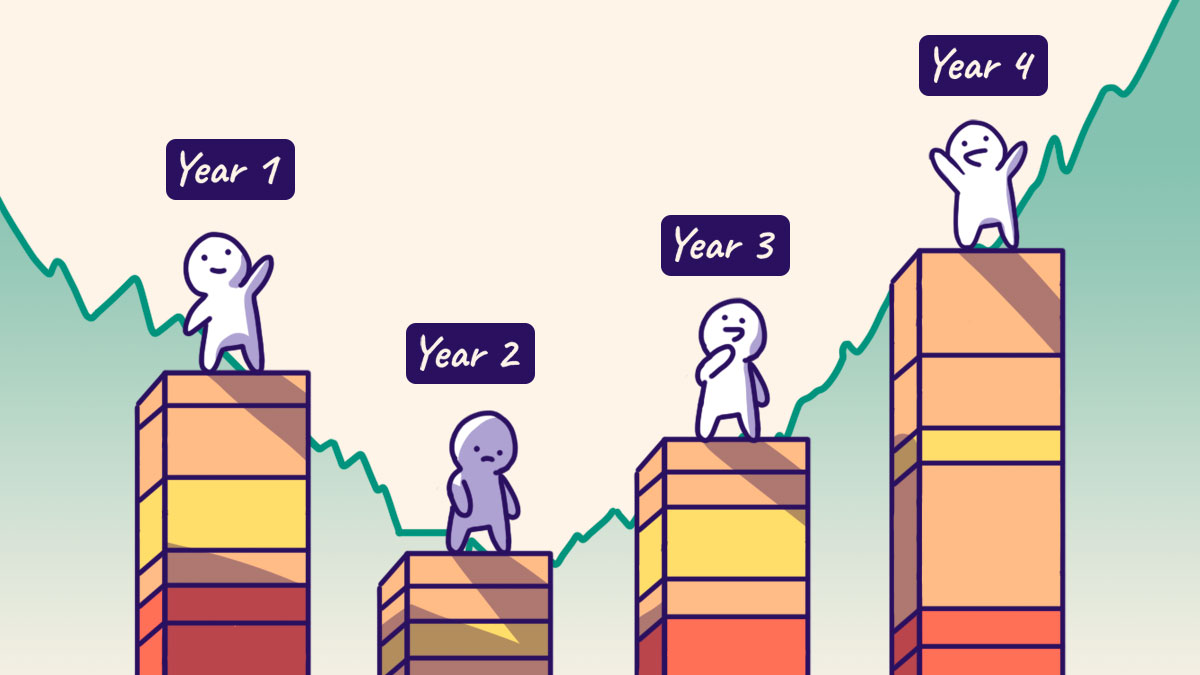

It’s better to earn the market return than try to beat it

Stock markets have historically gone up over the long term. The S&P 500, for instance, has returned about 10% annually over the last 15 years. In financial circles, the return on a benchmark index like the S&P 500 is called a “market return”.

Because ETFs track indices like the S&P 500, you’ll likely earn the average market return if you bought and held an ETF over a long timeframe.

Sure, you could earn a return greater than what an ETF will give you if you choose the right stock, but stock picking also entails more risk. And if you can’t stomach the higher risk, investing in ETFs allows you to invest in the market wisely by way of diversification.

That, and it ensures you won’t have to pay close attention to individual companies, their performance, or transfix yourself on daily news and developments to determine your next investing move.

It might sound like you won’t make as much money as an active investor who’s searching tirelessly for the next Facebook and Microsoft but consider this: research has shown that only about 23% of actively managed funds outperform the S&P 500. Translation: Even a large majority of professionals fail to earn a higher return than the market!

Better ETF than nothing at all

While ETFs are not without their own risks – the overall market can still go up and down in the short term – investing in an ETF is better than not investing at all because you’ll putting your money to work, earning a return, and growing your wealth passively.

Even though passive investing sounds boring, you won’t feel like you’re gambling on a single company. With your investments spread across many companies through an ETF, your investments are better prepared in the event of an economic crisis or if an industry takes a huge hit for whatever reason.

This makes passive investing and ETFs a gateway for beginner investors, especially the everyday worker who won’t have enough hours in a day to tend to their full-time job, their family, and watching the market.

Content sponsored by FUTU SG (moomoo trading app)

A message from our sponsor:

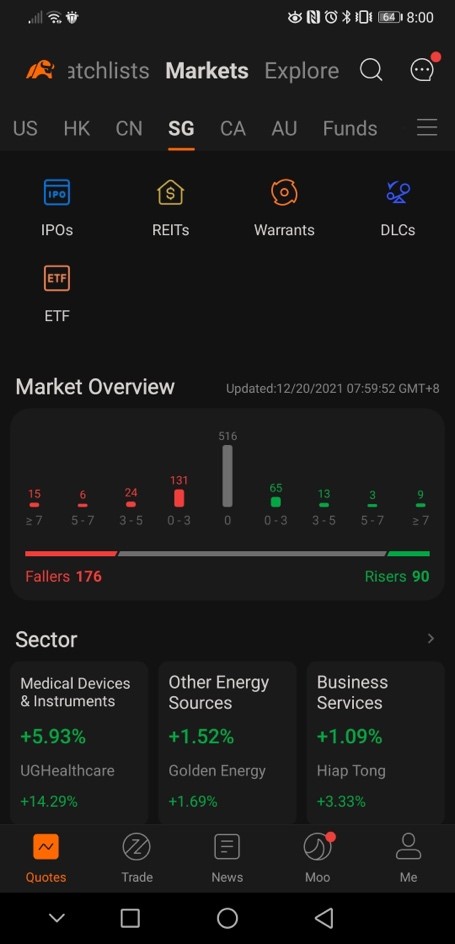

moomoo trading app allows you to invest in over 3,000 ETFs across US, Hong Kong and Singapore markets, as well as other assets like stocks, futures, and REITs.

How to find ETFs on moomoo

moomoo supports ETFs trading in Singapore. Users can find diversified ETFs and invest according to their preference and appetite for risk.

Sign up and deposit* now via moomoo app to enjoy Welcome Bundle worth up to S$1,700 which includes an Apple share (worth ~S$230 ), S$40 stock cashback coupon and snatch ‘n’ win additional rewards like iPhone 13, Airpods, vouchers and more this Christmas! Terms and conditions apply.

Start your investment journey via the moomoo trading app!