My Findings

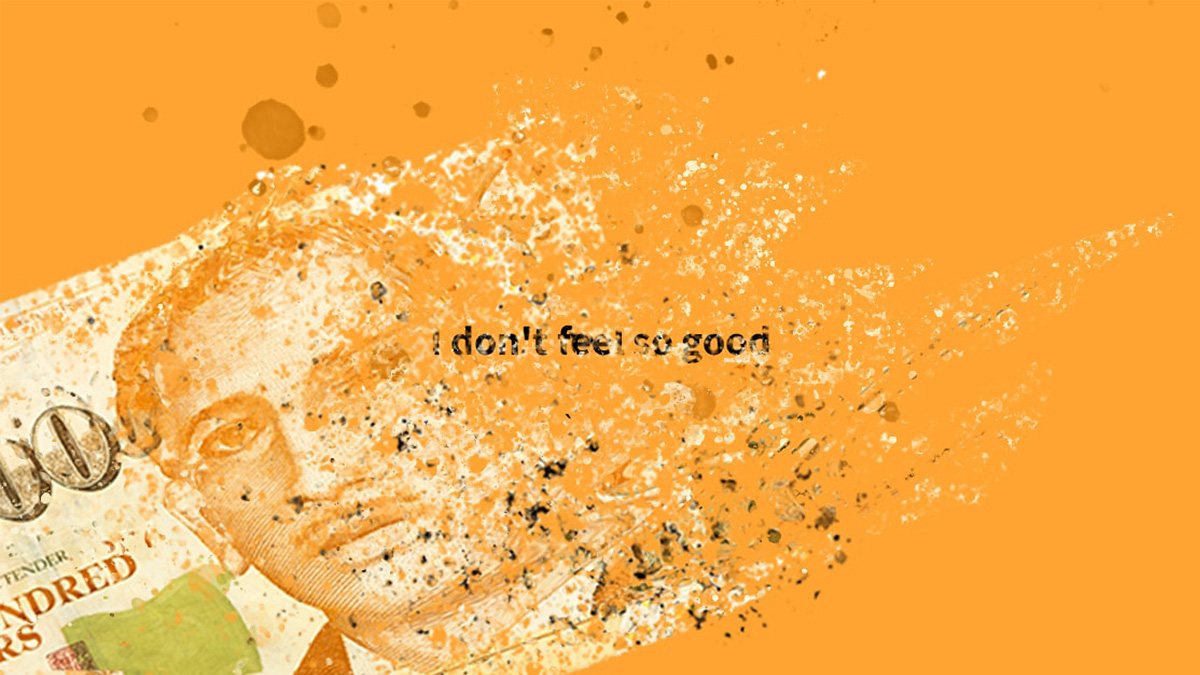

While my experiment was hardly scientific, and the difference in spending does not seem staggering. I definitely felt going cashless put fewer obstacles between me and parting with my money, it was just a bit too easy to spend.

The key, at the end of the day, is awareness. Without the tactility of cash, one needs to set time aside for spending awareness.

Checking your bank statements regularly or writing down your expenses can go a long way to reminding yourself of your budget.

That doesn’t mean that cashless payments are all bad. With perks such as cashback on credit cards, if used wisely, can actually help you save some money.

So is it possible to go fully cashless? Yes, definitely.

In fact, it’s much more convenient than paying with cash only in this day and age. Cashless has crept up on us, it is now (almost) everywhere, and there is no going back. The onus is on us to find new ways of staying fully aware of our spending.