6 Questions to Ask Yourself Before Taking a Personal Loan

The Simple Sum

25 Aug 2023Share

This article is brought to you by GXS FlexiLoan

In times when you find yourself in need of cash, the solution is to take a loan, whether it’s from a friend, your credit card or the local bank.

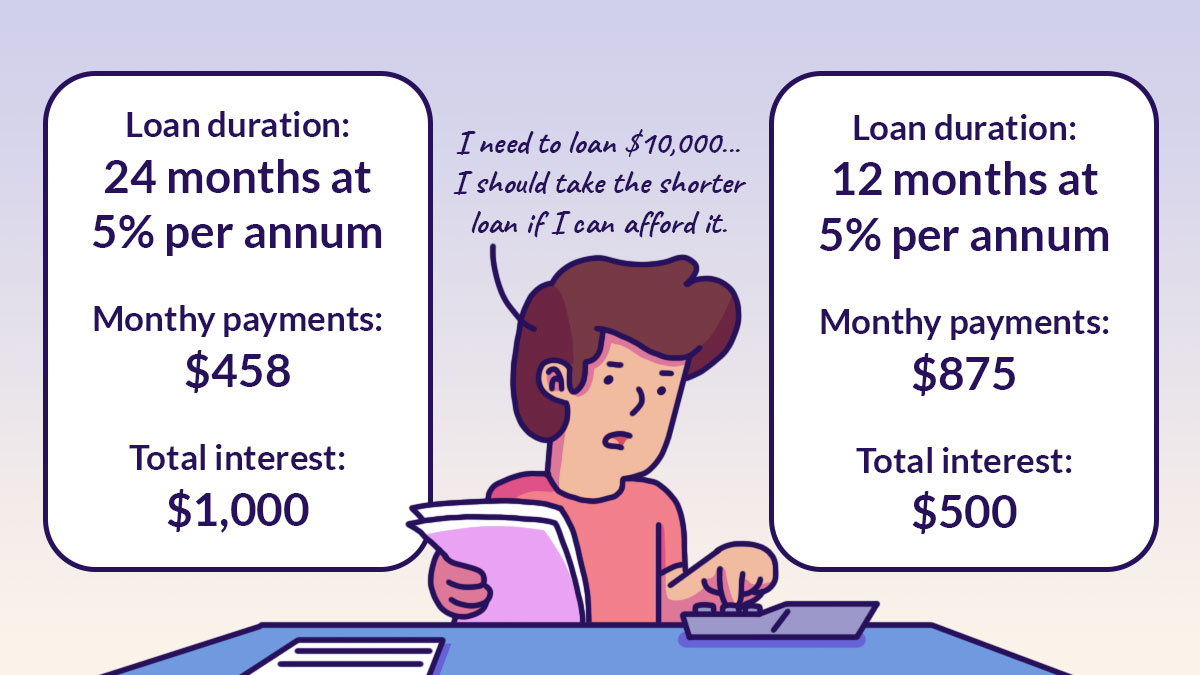

The problem is that friends may not have enough money themselves and credit cards come with high interest rates. As for loans from banks, most, like housing loans, car loans and education loans, come with a set of criteria that must be met, and extensive paperwork that must be completed before the money is released to you. Personal loans are the exception to the rule. Whilst you must pass the basic requirements of having a decent credit score and a minimum annual income, you don’t need to show evidence to support why you are taking out the loan. In fact, the bank won’t even ask why you are taking the loan. And this is why personal loans could be a good option if you need an inflow of cash such as during unexpected emergencies, or for planned big ticket expenses like home renovations.

As with any financial decision, it’s always best to be prudent and exercise good financial decision making. Ensure you know what you are getting yourself into by reading the terms and conditions, and understanding them before agreeing to the personal loan. You also want to be equipped with a plan to pay back the loan because it’s never a good idea to get into bad debt.

Here are some important questions to ask yourself before you put pen to paper, or in this digital age, tap the “Agree” button.

Related Stories

How To Travel With Friends And Keep The Friendship Intact

21 Mar 2025

0

5 Renovation Mistakes That Can Cost You Big Time

20 Mar 2025

0

How To Decode Your Payslip And Ensure You Are Paid Correctly

19 Mar 2025

0

You May Also Like

See All

I Was Too Nice And Always Bought Shopping Favours For My Friends, But It Ended Up Costing Me

18 Mar 2025

812

0

Living Paycheck To Paycheck? Here’s A Guide To Effectively Track Your Expenses

14 Mar 2025

1063

0

SG60: How A Group Of Friends Teamed Up To Sell ‘Awfully Chocolate’ Cakes

13 Mar 2025

493

0

Microlending: Why Are People Signing Up For Microloans And Are They Dangerous?

12 Mar 2025

404

0

7 Frugal Grocery Shopping Tips to Help You Stop Overspending

13 Mar 2025

681

0

After A Year Of Rejections And Unpaid Gigs, I Gave Up On Trying To Find A Job

10 Mar 2025

464

0

© Copyright 2025 The Simple Sum. All Rights Reserved.