Budgeting | Managing Debt | Personal Finance | Article

Stress-Spending Earned Him $28,000 in Credit Card Debt

by Sophia | 13 Mar 2020 | 9 mins read

At age 23, Daren, who works in IT sales, signed up for five credit cards. By the time he turned 25, his credit card spending had snowballed into a debt totaling $28,000.

This was in part due to friends telling him about those cards and also because banks were, according to Daren, constantly calling to introduce him to their latest offerings.

His average salary per month was $3,500, and with no financial obligations to speak of – Daren lived rent-free with his parents and had no student debts – he went ahead and opened up five credit lines that nearly added up to $100,000, from DBS, Standard Chartered, Citibank, American Express, and OCBC each.

Needless to say, it was the beginning of a tumultuous financial journey.

Indulgence and Stress-Induced Spending

In the beginning, Daren used his credit to save himself when money was tight for the month. Then he eventually transitioned to fully using credit cards to pay for anything and everything.

Additional out-of-pocket expenses (without using credit cards) included impulse purchases that included durian delivery services that were being sold over WhatsApp.

“I’d pay the guy via PayNow after placing an order with him, and the durian would arrive within two to three hours,” he told me enthusiastically, lauding the level of convenience. “You don’t have to run to the ATM.”

Ardent love for durian aside, Daren was spending freely with his credit cards too. This included a lot of Grab rides, “even at outrageous surge prices” during the week. On top of that, after getting his driver’s license in 2015, Daren’s love for driving led him to renting cars thrice a month and paying with credit.

“Back then, I’d rent cars just to drive around the country and familiarise myself with the roads. There’s something very peaceful about driving alone, aimlessly cruising,” he said.

“Was it stress relief from work?” I questioned.

“It was. Like a mental reset, a mini vacation,” he responded. “It’s really therapeutic. My job’s in a high intensity environment; I have monthly targets that reset every month, so… the stress never stops.”

The rental price of these cars, along with the price of petrol and his ride-hailing habits, added up to nearly $2,000 a month.

While this was going on, Daren told me that he had taken a rather avoidant approach to dealing with these staggering bills. He also avoided warnings from his friends and family, who said that credit cards were dangerous and hard to handle.

“Whenever the bill statements came, I’d just ignore them and shove them into my briefcase to pretend they didn’t exist,” he said. “And then I’d just pay the bare minimum.”

He hid it so well that even his parents at the time did not realise he was sinking himself deeper and deeper into credit card debt.

All of that came to a breaking point two years later.

The banks started calling every day to hound him for repayments, and Daren said he came to a moment of realisation.

“When I turned 25, I had a bit of a life crisis,” he told me. “I realised all I was doing every month was just paying off the interest, even though I was sinking over $1,000 every month to repay the banks. I started to think about marriage and my future home, and realised that this huge debt is going to affect my standing when it’s time to take huge home loans.”

Interestingly enough, Daren actually isn’t going to marry or get a house anytime soon.

When I asked him about his status, he said he didn’t have a partner at the moment. Yet he thought deeply about the future, and realised that if these things were inevitably coming, then he was nowhere near being ready for them.

“I’ve read enough horror stories to know that our credit rating won’t recover that fast. It’ll take a couple of years,” he said seriously. “So I decided to make a move now and do something about it, rather than wait until it’s too late, and end up getting rejected for a loan that I really need next time. My future partner won’t be happy about it either!”

Daren also managed to get his hands on his own credit bureau report. Much to his horror, his credit rating was nearly at rock bottom.

“That was the point where I woke up.”

Personal Loans to Save the Day

With the bank’s staggering interest rates, Daren resorted to taking two personal loans from HSBC and Standard Chartered.

These loans amounted to $17,000 and $13,000 respectively.

He pumped $28,000 into wiping out his credit card debt, and managed to reduce his monthly repayment amount from over $1,000 to only $900 a month. It’s not a huge drop, but Daren says it’s much easier to manage without the interest rates hitting him hard every month.

“The money I was paying before did nothing for the balance, so that got me quite frightened.”

Today at age 26, he’s still slowly paying off these loans.

When he first started out, Daren noted that his standard of living dropped drastically because of the huge repayment amount he had to fork out per month.

This also created a strain between him and his parents. He recounted that his family didn’t come from substantial means, so his father and mother had no means to bail him out of trouble.

“I needed to suck it up and pay for it myself. It was tough,” he reflected.

“I did consider asking friends and family for help, but I’m a proud person. I’d rather solve this myself before asking anyone for help, because it might change things between us, and anyway I dug this hole myself. I should dig myself out of it.”

Better Spending Habits

To help himself along on the road to recovery, Daren’s done a few things: blocking his durian guy on WhatsApp, taking more public transport, and only renting cars once every couple of months.

He’s still not in a good place, financially, but he’s still better off than when he first started with debt that kept snowballing.

“Just knowing that I owed the banks $28,000 made me breathless,” he said. “Now I’ve become more mature, I think. I second-guess myself a lot and avoid impulse purchases.”

But going cold turkey is not for Daren. “Denying myself of everything isn’t sustainable,” he told me. “So I’m just whittling it down to something I can control.”

He brings up the durian again and mentions that he only orders it whenever it’s in season, and not every other time.

As for his love of driving and renting cars, Daren compromises by scheduling all his family and household errands in a single weekend so it makes more sense to fork out money for a car to drive.

“I do monthly grocery shopping with my parents using the car, so we can buy things we wouldn’t normally get if we were going by public transport. Things like rice and detergent,” he said. “We used to order from RedMart, but I realised that we only get the best deals when you’re buying it offline.”

On his changed spending habits, Daren reflected, “I’m way more frugal now. After I started going back to public transport, my monthly expenses dropped like crazy. But I still believe in moderation. We still have to treat ourselves well. But I’m more on top of things now.”

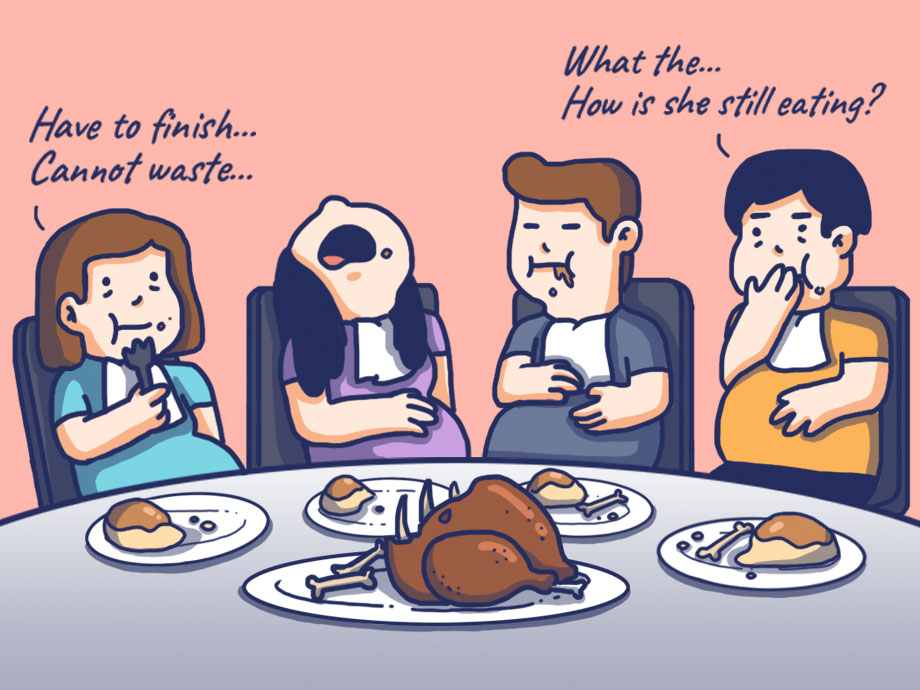

And as for his method of stress relief, Daren now spends a lot more time eating out with his friends. While it’s still money being spent frequently, it’s decidedly much better than blowing $450 a week just to drive a car around.

Before You Get a Credit Card…

Daren has some sound advice from his experience with credit card debt: “Don’t get it for the sake of getting it! Just get a maximum of two cards for rainy days, when your savings can’t cover an emergency.

“And for goodness’ sake, check your iBanking app after every transaction. Don’t just blindly sign for all your purchases then forget about it. I learned this the hard way,” he added.

He also wants people to figure out what they want to use the credit card for, before actually jumping into it.

When I asked him if he regretted getting himself into such huge debts, his answer was a surprising no.

“Everybody needs to go on their own journeys before they truly learn,” he said. “I’m thankful that I got into trouble at this age, instead of much later like 35 or 40. Nobody forced me to get those cards, and I didn’t listen when they warned me against it. I’d say this was a very expensive lesson that cost nearly $30,000.”

“Would you have changed anything about how you handled credit cards if you could go back in time?” I asked.

“Knowing myself, I’d still have done it the same way,” he said, completely candid. “Credit cards really are useful for rainy days, but it’s best to pay them off as soon as we can.”