Budgeting | Managing Debt | Personal Finance | Article

6 Questions to Ask Yourself Before Taking a Personal Loan

by The Simple Sum Team | 25 Aug 2023 | 6 mins read

This article is brought to you by GXS FlexiLoan

In times when you find yourself in need of cash, the solution is to take a loan, whether it’s from a friend, your credit card or the local bank.

The problem is that friends may not have enough money themselves and credit cards come with high interest rates. As for loans from banks, most, like housing loans, car loans and education loans, come with a set of criteria that must be met, and extensive paperwork that must be completed before the money is released to you.

Personal loans are the exception to the rule. Whilst you must pass the basic requirements of having a decent credit score and a minimum annual income, you don’t need to show evidence to support why you are taking out the loan. In fact, the bank won’t even ask why you are taking the loan.

And this is why personal loans could be a good option if you need an inflow of cash such as during unexpected emergencies, or for planned big ticket expenses like home renovations.

As with any financial decision, it’s always best to be prudent and exercise good financial decision making. Ensure you know what you are getting yourself into by reading the terms and conditions, and understanding them before agreeing to the personal loan. You also want to be equipped with a plan to pay back the loan because it’s never a good idea to get into bad debt.

Here are some important questions to ask yourself before you put pen to paper, or in this digital age, tap the “Agree” button.

1. What is the purpose of the loan you are taking?

Understanding the purpose of the loan can help you assess if it is aligned with your financial goals. Personal loans are versatile, but it’s important to use them wisely. Whether it’s to address medical emergencies, home repairs, or consolidate credit card debt, make sure the loan serves a specific purpose and not for unnecessary expenses.

2. How much do you need?

Knowing the precise amount you require prevents you from borrowing more than necessary, which could lead to higher interest payments and potentially put you in a difficult financial situation.

Before taking out a loan, make a list of the expenses you need to cover with the loan and calculate the precise amount needed to meet those needs. For example, if you are taking this loan to pay for your bills or home fixes, list down the items you are paying for. This also lets you consider if you can cut back on the amount or find other ways to reduce the loan amount and save money on interest.

3. How much can you realistically pay back each month and how much time will it take?

The last thing you want to do is to miss any of your loan repayments as you’ll end up paying more because of late fees and interest. Look at your monthly budget and make an honest assessment of how much you can comfortably allocate towards the loan repayment.

From the amount you can afford, work out which loan tenure works best for you.

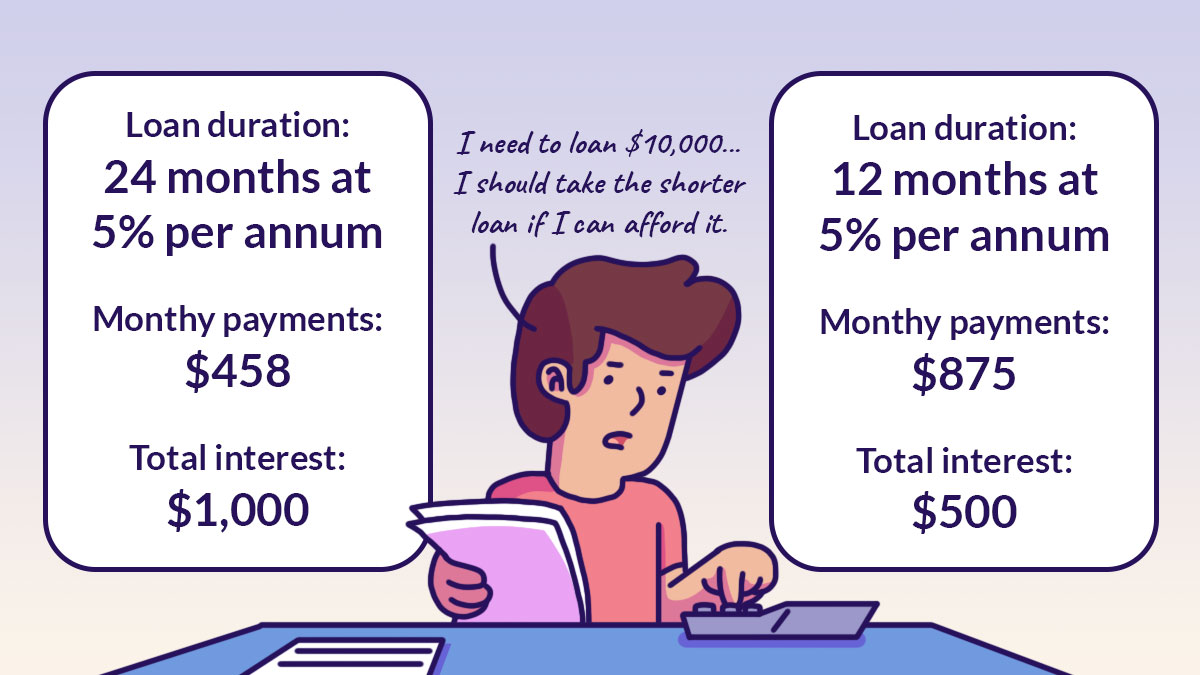

Longer tenures may lower your monthly payments but could also result in higher overall interest costs. On the other hand, shorter tenures may increase your monthly payments but help you save on interest. For example, a $10,000 simple interest loan for 24 months at 5% per annum will cost you $1,000 of interest over 2 years, whereas if the tenure is shortened to 12 months, your interest cost is halved to $500.

You have to find a balance between affordable monthly payments and a reasonable loan tenure to make sure that you don’t strain your finances and that you can meet all your obligations.

4. How much will you pay in interest and other fees?

Don’t simply look at the interest rates when deciding which bank to with for your personal loan. The actual cost of your loan includes the interest that you have to pay as well as any other fees the bank may charge such as administrative or processing fees.

Instead, you should look out for the effective interest rate (EIR), which is the true cost of the loan you take as it includes service fees and admin charges you have to pay when taking the loan.

The good news is that all financial institutions in Singapore are required to publish EIR, so use this to

accurately compare and find the most affordable option within your budget when shopping around for a personal loan.

5. How do you plan to pay it off?

Having a clear repayment plan is important to avoid any payment delays or defaults and this would include knowing how much you can put aside to service the loan every month and making adjustments to your spending to meet it.

A plan will help you stay organised and avoid late payments, which helps you maintain a positive credit history. Don’t forget to also have a backup plan in the event of unforeseen circumstances, so that you can avoid defaulting on loan payments and not incur late charges.

6. Do you have other options?

If you have more time before you need the funds, consider saving up for it. For smaller sums, you can try to get a loan from family or friends. But for larger sums – whether planned (be it a home renovation or furthering your studies) or unplanned (a medical emergency) a personal loan could be the solution.

And if you have credit card debt that you have accumulated, getting a personal loan with a lower interest rate is a much better option than subjecting yourself to high credit card interest rates.

Remember that any loan that you take on, no matter what the amount, is a financial commitment. And if you take up a personal loan and default on the payments, no matter how small the amount, it will hurt your credit score and your financial future. Plan wisely and only take one if you can commit to its repayment schedule.

Content sponsored by GXS FlexiLoan

A personal loan can help when you need a cash boost to see you through an emergency or get you closer to your dreams.

GXS FlexiLoan offers low interest rates – from 2.99% p.a. (EIR 5.65% p.a), and the flexibility to customise a loan plan to fit your needs. Choose your loan amount (from as low as S$200), and pick a loan tenure (from between 2 and 60 months) that fits your needs. You can also customise your repayment date.

Best of all, pay off your loan partially or in full and enjoy interest savings, without any hidden processing or early repayment fees. GXS just might be the only bank that has incorporated incentives to encourage you to repay your loans early so you don’t have to stay committed to a loan longer than you need to. Sign up on the GXS app, and get the cash you need in minutes.

Terms and conditions apply.