Financial Planning | Personal Finance | Article

CPF Hacks You’ll Regret Not Doing Now

by Sophia | 10 Jun 2021 | 8 mins read

This article is sponsored by CPF

We’re not going to mince words: We probably don’t think about our CPF money often enough.

That’s probably because we aren’t accessing our CPF savings right now (at least, not in the way that we’re able to with our disposable income). Money that’s out of sight tends to be out of our minds. So, it’s easy to forget accounting for our CPF savings when we’re planning our finances in our 20s and 30s.

But ultimately, your CPF savings is still your hard-earned money. It’s money that you’ll use to pay for your home or fund your retirement 30 years down the road.

That’s why you should consider maximising your CPF savings now while you’re still young and have more time to save up for retirement. If you don’t, you risk losing the chance to grow these savings even more. And let’s be honest, who doesn’t want more money?

Yes, your money’s compounding already, but you can level it up

Though your CPF accounts are already earning interest, there’s still room for your money to work even harder. And it’s through compounding interest — in fact, the earlier you start optimising your CPF savings, the more powerful the effect of compounding will be.

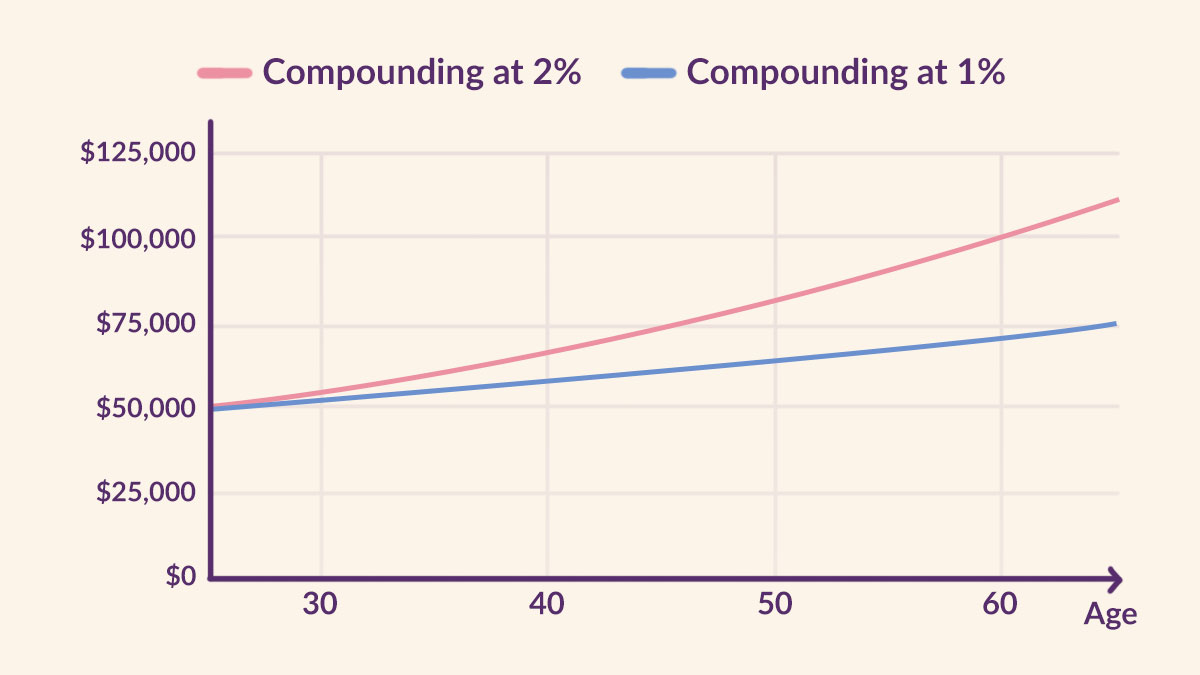

To illustrate the power of compounding over time, let’s assume that you kept $50,000 in an account that earned 1% per annum and another $50,000 in an account that earns you 2% per annum.

How much of a difference does the additional 1% make over the course of 40 years?

Well, if your money is growing at 1% a year, you’ll have around $74,000 in 40 years. But when your money grows at 2%, you’ll have around $110,000. That’s an additional $36,000 that you could earn with almost no effort at all! That’s the beauty of compounding interest.

So, here are five ways to take advantage of your CPF account to help grow your money even more.

1. Top up your Special Account (SA)

Money you’re setting aside for retirement should grow at a rate that beats inflation. But most savings accounts can’t even match the inflation rate to begin with. Topping up your SA is one no-frills, failproof way to grow your retirement pot because you can earn up to 5% interest per annum (or up to 6% interest per annum after age 55)*, and potentially double your CPF savings in more than 20 years with minimal effort.

If you top up your SA early in the year (instead of at the end of the year) you’ll give your cash an entire year to work hard for you. Just by topping up your SA in January, you’ll effectively earn up to 20% more in interest§ on your CPF savings in just 10 years. You might feel reluctant to part with your hard-earned money or year-end bonus so quickly but it’s better to put that money to work early than let it erode to inflation in your savings account.

Not to mention, you can get dollar-for-dollar tax relief of up to $8,000 per calendar yearΔ when you top up your SA. If you want to go the distance and get even more tax relief, making cash top-ups for your loved ones (your parents, parents-in-law, grandparents, siblings, and spouse) will get you another $8,000 in tax relief.

To help you stick to your savings plan, you can also automate small and regular top-ups to your SA. Unsure about how you can make these cash top-ups? Here’s how (look under “ways to top up”).

2. Top up your MediSave Account

You’ll likely rack medical bills or hospitalisation fees at some point in your life and your MediSave can be used to offset your medical bills. Not to mention, you can also tap on MediSave for your MediShield Life and CareShield Life premiums.

Read more about the uses of MediSave.

When planning your finances, it’s important that you set aside enough savings for your healthcare expenses, especially since they’re likely to increase as you grow older. Topping up your MediSave will allow you to grow your savings for healthcare needs at up to 5% per annum*. You’ll also enjoy tax relief# from the cash top-ups to your MediSave! Here’s how you can make voluntary contributions to your MediSave (look under “payment”).

Just note that that the maximum amount of voluntary contributions you can make is the difference between the CPF Annual Limit of $37,740 and the mandatory CPF contributions made for the calendar year. In addition, you can only top up to your MediSave, up to the Basic Healthcare Sum& (BHS).

Once you have the BHS in your MediSave, any future contributions to your MA from your salary or employer will be funnelled to your SA or Ordinary Account (OA). Hence, by topping up your MediSave, you can be adding to your retirement savings earlier and faster as well!

3. Retain up to $20,000 in your Ordinary Account (OA)

Most of us think about using CPF to pay for our home purchase, but before you go dumping all your OA savings for a roof over your head, here’s a tip to consider.

If you’re planning to take a loan from HDB, you have the option of retaining up to $20,000 in your OA instead of depleting it completely.

This way, your OA savings can still grow at a rate of up to 3.5% per annum*. Your OA savings will come in handy when you’re in a pinch. Whenever there’s a need, such as if you’re in between jobs, you won’t have to worry about paying off your mortgage because you can draw from your OA savings to help you cover that expense. If unused for your housing needs, these savings will continue to grow for your retirement needs.

4. Pay your monthly housing loan instalment in cash

Though you can use your OA savings to pay for your housing loan instalment every month, it might be wiser to pay your loan fully or partially with cash instead.

This is especially so if you’re someone with a high disposable income, and you’ve worked out your budget perfectly. If you have extra cash that you aren’t using for monthly expenses and investments, then why not pay your housing loan with it?

After all, that spare cash isn’t going to be growing at a rate of up to 3.5% per annum* the way your OA savings will.

Remember that your OA savings can be used for your monthly housing loan instalments in times of need, and this also means that your OA savings can compound quicker over time if cash is used for monthly instalments instead.

Better savings rate for your future needs, and you still get your house. A win-win, in our eyes!

Related

5. Transfer your OA savings into your SA for higher interest

Not intending to use all your OA for your housing needs in the future, and want to start saving for retirement early? Great! This means you can transfer your OA savings into your SA^ to earn a higher interest rate of up to 5% per annum*.

How much of a difference will this make? Here’s an example:

Say you have $60,000 in your OA and $15,000 in your SA at 30 years old. Right now, your OA savings are currently growing at up to 3.5%* every year.

On the other hand, transferring some of that money into your SA allows it to compound at up to 5%* per annum instead.

By transferring $25,000 from your OA to SA, you would have earned an additional amount of close to $7,500 in interest over 10 years, as compared to leaving your savings in your OA. Try using the OA to SA savings transfer calculator (look under “retirement calculators”) to find out the amount of interest you might earn.

The only downside to this option is that the transfer is irreversible. There’s no turning back once your money goes into your SA, so make sure that you don’t intend to use that money to buy a home. Here is how you can make an OA to SA transfer.

Save now and max your gains in the future

Though these hacks are simple, optimising your CPF savings now with just one of these hacks can help you retire with more money. And it doesn’t take that much effort on your part either. So, instead of procrastinating, start putting your plans – no matter how small they may seem – into action. Future you will be grateful, if nothing else!

Content sponsored by CPF.

*Includes extra interest paid on the first $60,000 of a member’s combined balances. Refer to

the CPF interest rates page for more information on extra interest.

Δ Cash top-ups beyond the prevailing Full Retirement Sum will not be eligible for tax relief. Personal income tax relief cap of $80,000 applies. Other terms and conditions apply.

^ Transfers from OA to SA are applicable for members below age 55, and up to the current Full Retirement Sum. Other terms and conditions apply.

# Personal income tax relief cap of $80,000 applies. Other terms and conditions apply.

& Refer to information on the prevailing BHS. Once you reach age 65, your BHS will be fixed for the rest of your life.