Financial Planning | Personal Finance | Article

How to Decide on Your Private Health Insurance Plan

by Sophia | 5 Sep 2020 | 8 mins read

You likely have hospitalisation insurance foisted upon you by your insurance agent friend. But do you know what you really own?

It’s time to look harder into your private health insurance policy.

The savvier among you will know that these policies complement MediShield Life, which is the universal health insurance covers all Singaporeans for public hospitalisation and treatments.

Why does one need more health insurance? Because of MediShield Life’s low premiums (paid by MediSave), the coverage is basic. But as we know, healthcare costs can be really expensive in Singapore, so how will anyone be able to offset exorbitant hospital fees?

To offer some perspective, daily rates for Class A wards in public hospitals start from $466 a day. Should someone undergo, say, a knee replacement surgery for both knees, the total bill could go up to about $10,000 – and that’s in a Class B2 ward. Not many people can simply fork out these staggering amounts without breaking a sweat.

This is where private insurance comes in as an enhancement to Medishield Life.

The types of private health insurance

There are a few types of private health insurance to choose from among all the Integrated Shield Plans (IPs) and riders out there, so Singaporeans have a rather sizable pool of options that suit different needs. These types include:

- MediShield Life

- Compulsory government health insurance plan

- Standard Integrated Shield Plans (Standard IPs)

- Hospitalisation in public hospitals at Class B1

- Class B1 IPs*

- ‘As charged’ coverage of hospitalisation in public hospitals up to Class B1 wards

- Class A IPs

- ‘As charged’ coverage Hospitalisation at Class A

- Private IPs

- Private hospital stays

*As charged coverage covers the full medical bill that has been charged in the event of hospitalisation and other treatments – after deductibles and co-payments (we’ll come to that later)

When can one make their private health insurance claims?

The important mechanic to understand is when you’ll be able to claim your private health insurance for different events, including:

- Hospitalisation

- Outpatient cancer and diabetes treatments

- Day surgery

After making payment prior to discharge from the hospital, submit the final bill or receipt along with other supporting documents to the insurer that manages your coverage. These documents include hospital discharge papers, relevant medical reports, and physician prescriptions.

Some insurers take up to 14 days to process claims.

Important features to note when deciding

Benefits are regulated by the government and are the same for all insurers out there. However, insurance benefits still differ in terms of the extent of coverage periods, claim limits, and more. When shopping for a suitable private health insurance plan, keep in mind what types of benefits matter more than the others. Here are some of the more significant features to consider when doing comparisons.

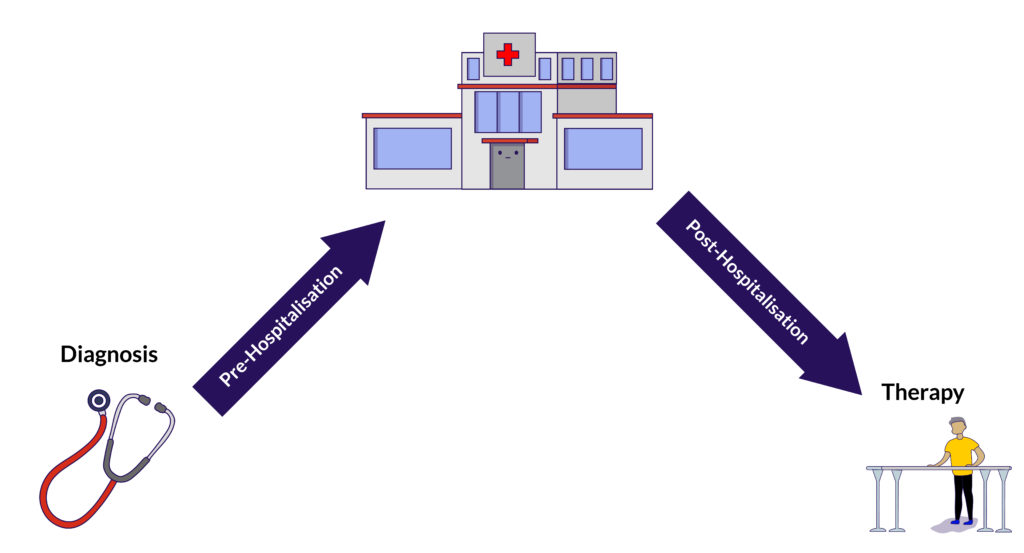

(1) Pre- and post-hospitalisation coverage

Aside from incurring costs during hospitalisation itself, one would generally have to get medical checkups or maybe even undergo treatment prior to being warded. These are pre-hospitalisation expenses.

Post-hospitalisation, on the other hand, may involve follow-ups and further treatment, depending on one’s medical situation. All of these events both before and after being warded and treated in the hospital will also cost money, hence the need for pre- and post-hospitalisation coverage.

Different insurers offer different coverage periods, even if there’s no cap to the claims one can make. Prudential and AXA, for example, provide up to one year of coverage for post-hospitalisation benefits, and half a year for pre-hospitalisation benefits.

(2) Policy year limit

This refers to the limit of the amount one can claim for hospitalisation and treatment expenses. Once the insured claims up to the policy year limit, their insurance coverage will cease since the capped amount has been fully claimed.

(3) Inpatient and day surgery coverage

Inpatient and day surgery are not the same thing. Inpatient refers to undergoing treatment at a hospital with overnight stays included, while day surgeries do not involve being warded overnight.

Across the various health insurance plans, daily ward charges, treatment charges, and surgical costs are covered to varying amounts. Some insurers offer a better deal with ‘as charged’ coverage without putting a limit on the duration of one’s hospital stay. Do note that coverage differs between public and community hospitals as well.

OK, how much is this all going to cost?

Singaporeans will be able to use Additional Withdrawal Limits (AWLs) – coming out of their MediSave – to afford private insurance coverage. These are the AWL tiers, based on age:

- $300: 40 years or younger on one’s next birthday;

- $600: 41 to 70 years old on one’s next birthday;

- $900: 71 years or older on one’s next birthday.

Anything more than that will have to be topped up with cash.

Based on the numbers provided by MOH, private health insurance premiums begin at a reasonable amount at a younger age, requiring no cash top ups.

But the older someone gets, the premiums skyrocket. Let’s take a look at the average premium costs for the different types of private health insurances, across three age groups.

Standard IPs

| Starting Age | Average Annual Premium (across all insurers) |

| 21 | $243.80 |

| 41 | $538.70 |

| 66 | $1,205.00 |

Class B

| Starting Age | Average Annual Premium (across all insurers) |

| 21 | $252.80 |

| 41 | $685.90 |

| 66 | $1,340.80 |

Class A

| Starting Age | Average Annual Premium (across all insurers) |

| 21 | $274.60 |

| 41 | $659.70 |

| 66 | $1,342.10 |

Private

| Starting Age | Average Annual Premium (across all insurers) |

| 21 | $389.30 |

| 41 | $984.30 |

| 66 | $2,206.30 |

Shocked by the exponential increases? These premiums only get more expensive as one is older.

This can reach up to $3,452 a month by age 75. This means that annually one has to fork out $2,552 a year in cash to maintain the insurance policy. (After MediSafe’s $900 annual withdrawal limit past 71).

This might be unsustainable if one is retired and not generating income. So choose wisely.

Co-payment and deductibles

For every type of IP or private health insurance, there will be deductibles. Deductibles refer to a fixed amount a person needs to pay, out-of-pocket, before MediShield/IP benefits kick in.

So it’s not possible for private health insurance to pay 100% of the bill. In other words, full rider plans are no longer available. This was put into effect in April 2019 by the Ministry of Health, because they were previously abused (thanks, fellas).

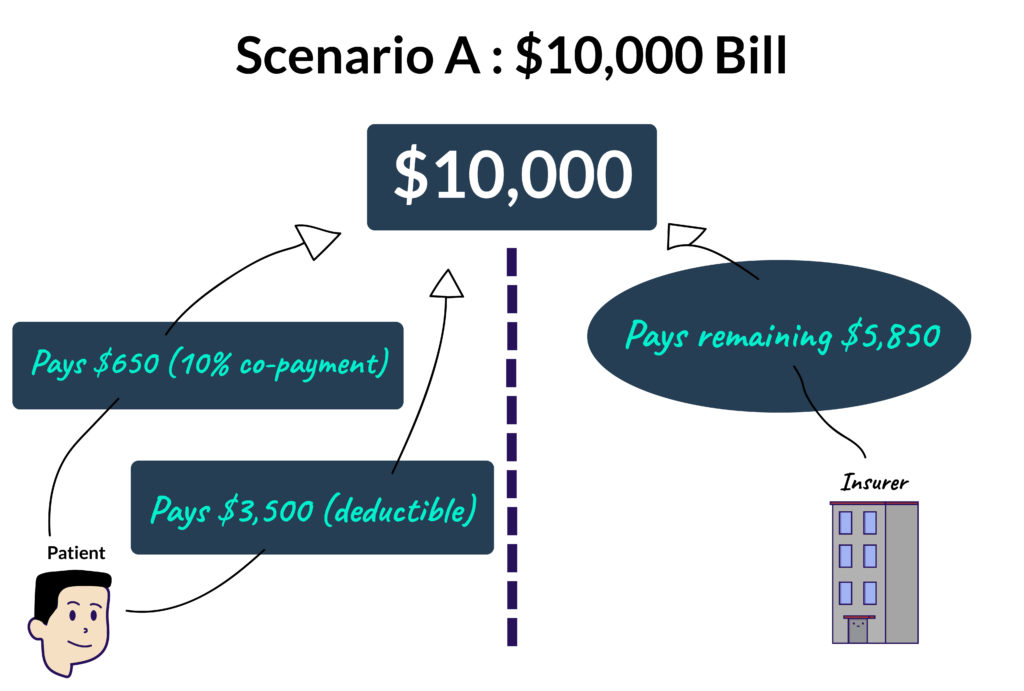

So how much does one have to pay? Let’s use this example:

- Class A ward IP

- $3,500 deductible

- 10% co-payment from the insured

Scenario A: $10,000 bill

A patient will have to foot the first $3,500 of the bill and 10% of the remaining $6,500 ($650).

This means he/she pays $4,150 out of their pocket while the insurer covers the remaining $5,850 of the bill.

Thankfully, you can use your MediSafe to pay for your co-payments and deductibles.

Riders to reduce co-payment and deductible costs

There are riders, or upgrades, to reduce the cost of co-payment and deductibles. You can find riders that cover up to 95% of the deductible, and reduces co-payments to 5%.

These riders can also cap co-insurance expenses to a maximum of $3,000 a year. Let’s go back to the same example to how this plays out.

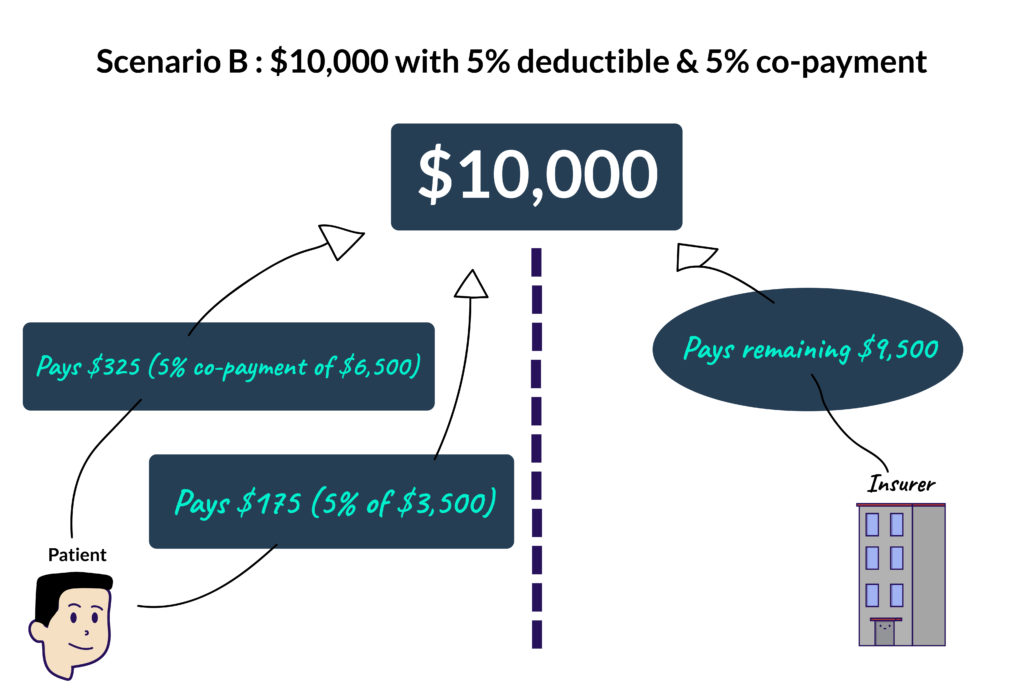

Scenario B: $10,000 with 5% deductible & 5% co-payment

A patient will have to foot the first $175 (5% of 3,500) of the bill and 5% of the remaining $6,500 ($325).

This means he/she pays $500 out of their pocket while the insurer covers the remaining $9,500 of the bill.

Rider costs

The catch is these riders can only be paid with cash. Rider prices depends on your main plan, for example, if you choose a Private Hospital Integrated Shield plan, you will need to get a Private IP rider – which is the most expensive option.

To get a sense of how much one might need to pay for these riders, ValueChampion reports that Integrated Shield Plan riders cost upwards of $230 per annum, from the age of 25 and can rise to over $2,300 by age 75.

Combined with a Private IP, a 75 year old could be paying over $400 a month in cash premiums to maintain coverage.

Other benefits that come with riders include coverage for ambulance and taxi rides as well as alternative treatment options.

Insurer’s panel

All insurers limit their rider coverage to a pre-approved list of doctors, or a panel. So if you have a preference for a particular specialist or hospital, do check out each insurer’s panel of doctors.

However, this is not to say you will not be covered if you visit a doctor outside of the panel, but you will need to get prior approval from the insurers before you proceed for treatment, this is called pre-authorisation.

Some require the policyholders to call a hotline, or fill up a form, obviously this is not the best option in emergency treatment situations. So in those scenarios, it might be advisable to stick with the insurer’s panel.

Last things to consider

Choosing private health insurance for oneself can be tricky, since the devil’s in the details, but taking some time to read through different plans from various insurers can go a long way in securing the most suitable plan.

Here is a complete list of available IPs compiled by MOH.

Remember, with age comes an increase in premiums – so it’s time to start making informed decisions as soon as possible. If you’re on a plan that you might think is too expensive, don’t fret, most insurers allow entry into their plans up to the age of 75, so switching is still an option.