Investing | Article

Does the US Presidency Determine the Fate of the Economy?

by Sophia | 21 Jan 2021 | 7 mins read

Some say we’ve got to leave our politics at the door when it comes to investing. After all, for us non-Americans, whoever takes the White House – whether Democrat or Republican – won’t impact our day-to-day lives.

But others say that if we’re diversifying our portfolios into foreign markets – especially the US market – then whoever becomes the US president should matter to us. Why?

Well, people seem to think that whoever’s in charge at the White House can have a huge influence on the economy and the stock market. But, does this argument hold any water? Should we even base our investment decisions on who ends up in the White House? Let’s find out.

The Argument for Republicans

You’ll come across a lot of opinion pieces about how Republican presidents are more business-friendly than Democratic presidents, and therefore, are better for the stock market. Think Trump’s corporate tax cuts.

Meanwhile, Democratic presidents, like Biden, seem to hold more promise for long-term environmental and social improvements. So, a Democratic president could only benefit industries like alternative energy but be bad for businesses like oil companies.

So, Republican = good for the market, and Democrat = not so good, right?

Well, it’s not quite as clear cut as that – or completely true, for that matter.

Which Party Is Better For My Portfolio!?

It’s commonly believed that Democrats aren’t as fiscally conservative¹ as Republicans. But that’s not necessarily true for every Democrat out there, and it also doesn’t mean that the stock market is doomed whenever a Democratic president takes the stage.

In fact, historical data on stock market returns over the years seem to tell us an interesting story. Apparently, the stock market performs just as well (or if not, better) under a Democratic president as it does under a Republican president.

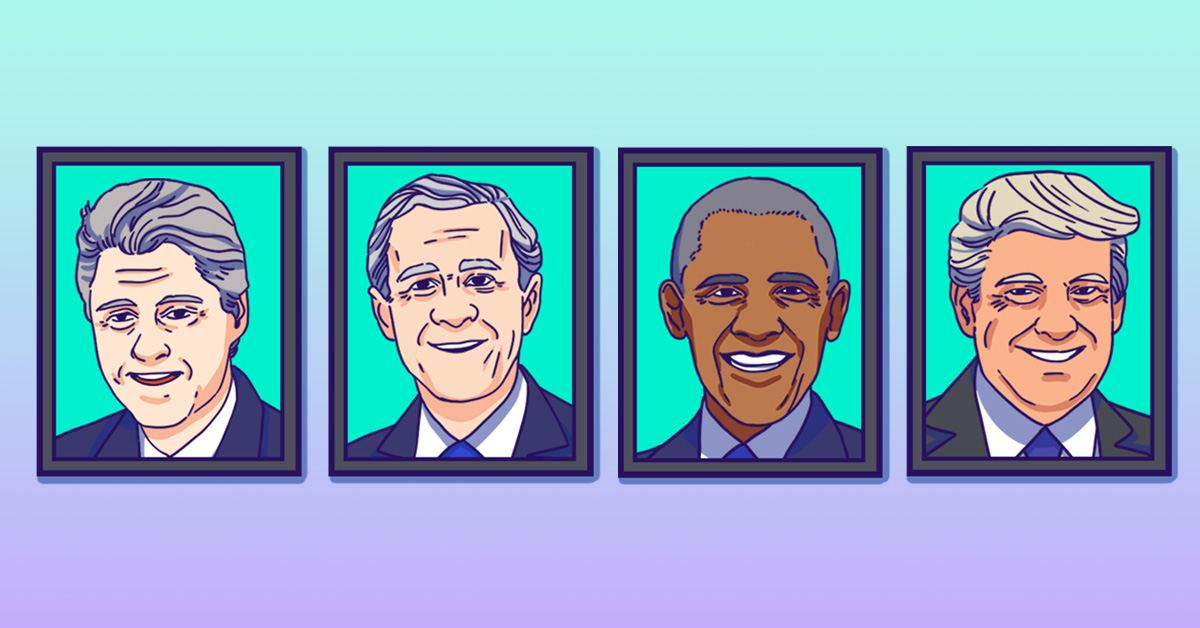

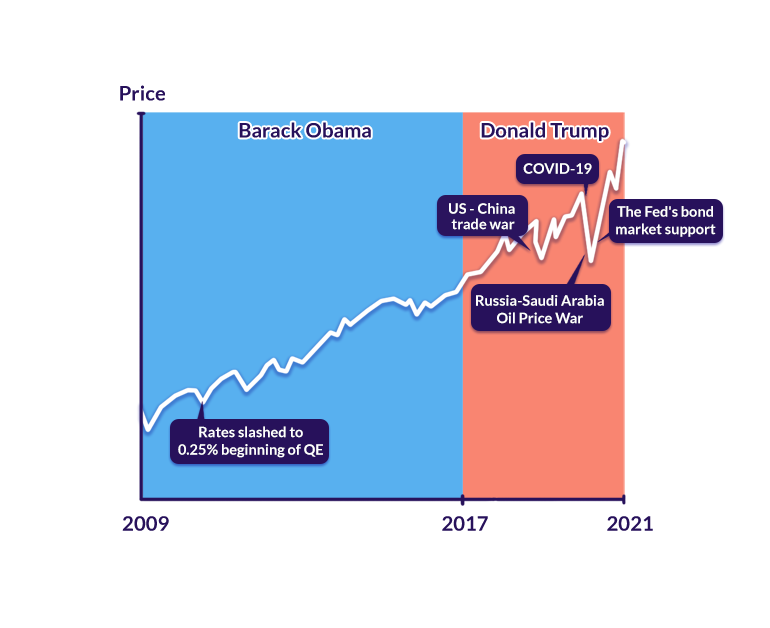

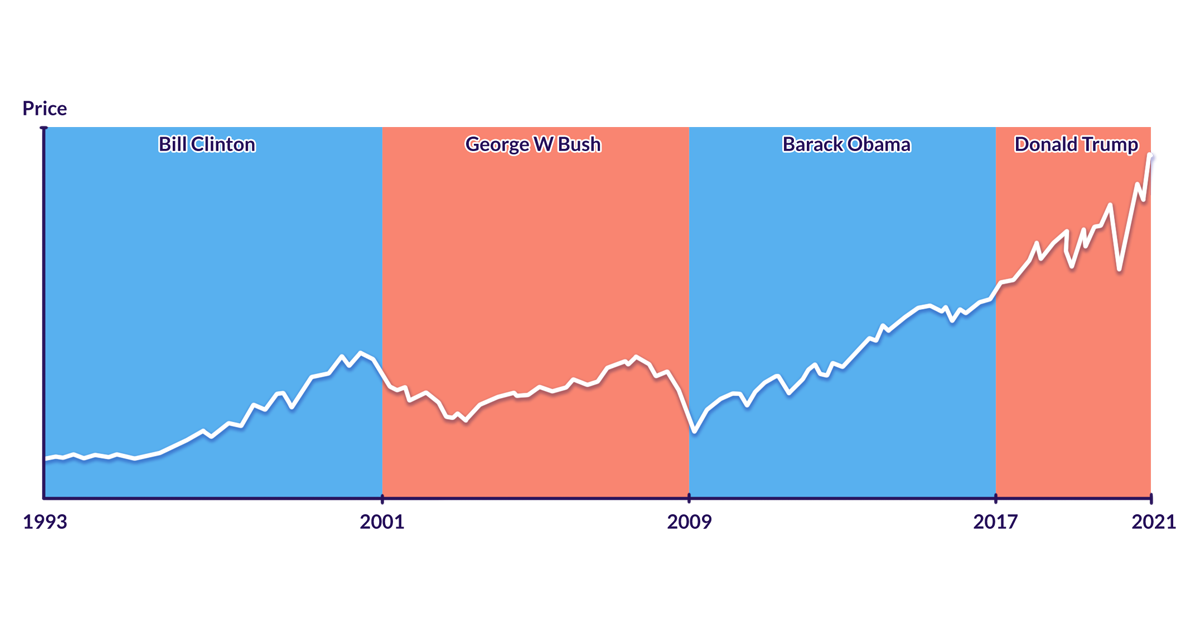

Let’s look at the S&P 500 Index, which tracks the top 500 companies in the US market, under the last four presidents: Clinton (Democrat), Bush (Republican), Obama (Democrat), and Trump (Republican).

During President Clinton’s time in office (1993 to 2001), the S&P 500 went up by 210%. In his first term alone, the index saw an increase of 79%.

His successor, President Bush, didn’t see as much market success during his tenure. The S&P 500 took a 40% nosedive in the final quarter of Bush’s tenure, in 2008. During this time, the annual GDP in the US also dropped by 8.4%.

The Obama era saw the longest bull market in history, where the S&P 500 nearly tripled. In President Obama’s first term (2008 to 2012) the S&P 500 jumped by 85%.

But wait – this bull market continued well into President Trump’s tenure. Trump even finished his run with the market in a better position, with the S&P 500 up by 67% by the end of his term just a few days ago, on January 19.

Okay, so it seems that markets do perform well under Democratic Presidents, despite what those opinion pieces say. But four presidents make up a pretty small sample size for us to draw any conclusions. We need more data!

This Forbes article dove even deeper and assessed the stock market’s performance since 1945, under 13 different presidents. It found that the stock market seemed to perform better under a Democratic president than a Republican president most of the time.

So what’s the deal here? Are Democrats actually better for the stock market than Republicans, contrary to popular belief?

And does this mean that the stock market will soar now with the newly inaugurated President Biden in office?

Well, guess what, it actually doesn’t matter who’s president!

One (Wo)Man Can’t Possibly Have THAT Much Power

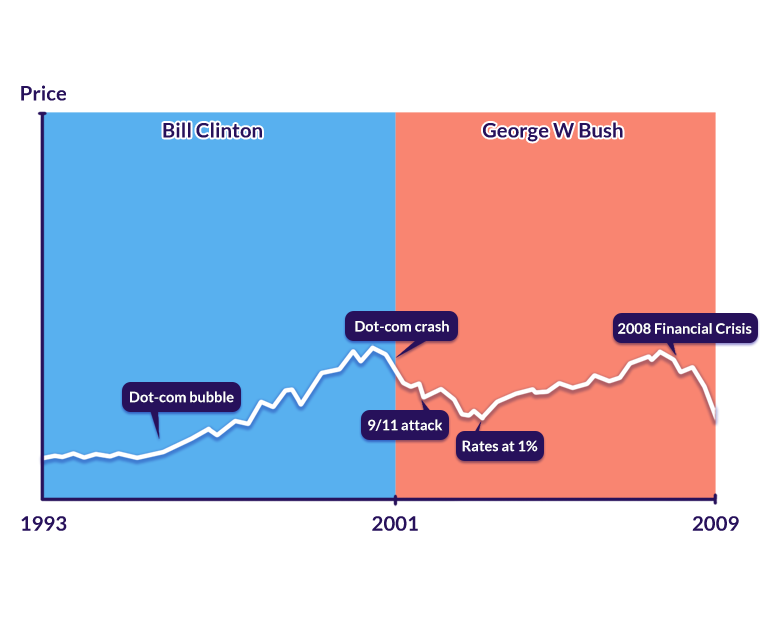

History tells us that, more often than not, business cycles and the Federal Reserve’s actions² have a much larger influence on the market than the individual actions of any sitting president

And these business cycles and the Fed’s policy decisions often coincide with significant market events, like the 2008 Financial Crisis.

Though the market did well during President Clinton’s era, he took office right as Internet companies were booming in the 90s. The dot-com boom was what, ultimately, led to the best years of growth for the S&P 500 in 1995 and 1997.

Unfortunately for President Bush, that dot-com bubble burst during his first term. Subsequently, the market dropped in 2001 as a result of the 9/11 attacks. In his second term, the markets also crashed because of the subprime mortgage crisis.

As for Obama, he entered the White House right when the Fed slashed interest rates and started quantitative easing. The Fed’s actions led to the market’s recovery – and that recovery continued well into Trump’s time in office.

Even with Trump’s antics while he was in office – the US-China trade war and his mishandling of the COVID crisis – the stock market still performed well by the end of his tenure. All thanks to the Fed’s policies that helped to prop up the market.

In essence, when it comes to the markets, there are a lot more factors at play than just a president and his policies. By the way, even if a president wants to pass a bill, he still needs a majority vote in the Senate; effecting change isn’t as easy as it looks!

So if you’re thinking of jumping in or out of the market just based on who’s the US president, you might want to think twice. Do a bit more homework and understand what you’re investing into. Don’t base your decisions on the assumptions and opinion pieces about who’s in power and his (or her) individual actions.

¹ a fiscally conservative government, in theory, tries not to spend beyond its means so that it doesn’t need to raise taxes to reduce debt and deficit spending.

² The Federal Reserve, the central bank in the US, dictates whether interest rates go up or down. Interest rates, in turn, influence business cycles and the stock market.