Investing | Article

Understanding Funds: What Am I Investing in When I Invest in Funds?

by Cherry | 25 Apr 2022 | 10 mins read

This article was brought to you by Futu Singapore Pte. Ltd. (moomoo trading app trading app).

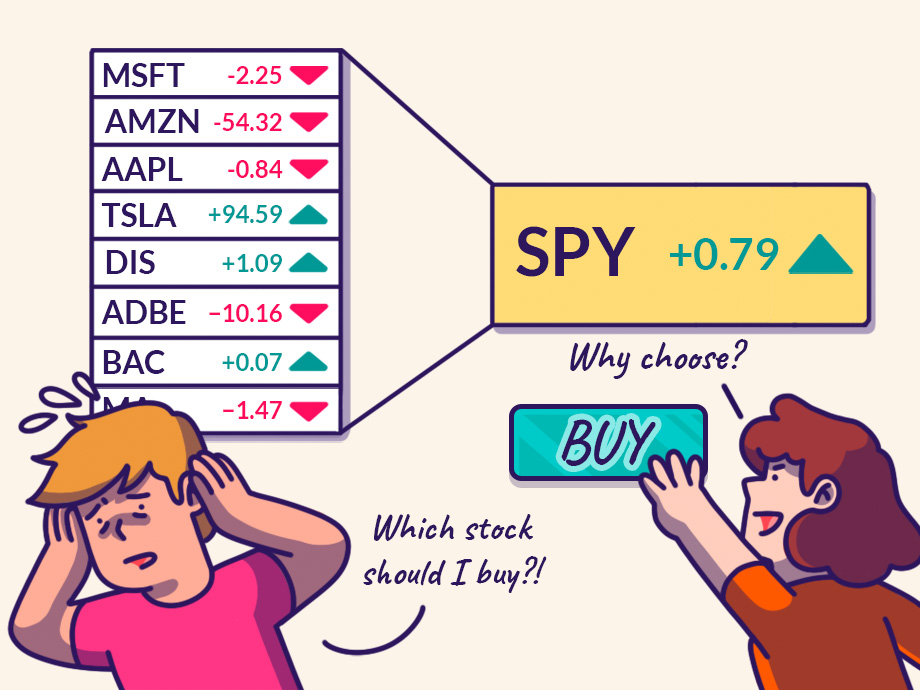

When investing, one of the biggest decisions is deciding what to put your money in. After all, there are many different assets you can invest in such as stocks, bonds, gold, or even corn to name a few.

Even within each asset class, there are many options to pick from — which company’s stock or what type of bond do I choose?

If you‘ll rather not pick and choose between assets or would like a hassle-free way of investing in various assets or companies at one go, you may want to consider putting your money in an investment fund, also known as a mutual fund.

How exactly does an investment fund work?

When you put your money in an investment fund, your money is pooled together with other investors’ money. Then, a fund manager invests the pooled money in different types of assets on your behalf such as stocks, bonds and even fixed deposit accounts. The mix of assets the fund invests in determines how much returns you can potentially earn as well as the potential risks of losing your money.

The clear advantage of buying into an investment fund is that you don’t have to spend time researching and choosing what assets to buy. Investment funds are managed by licenced professionals who are skilled in finance and are often regulated by authorities in the countries that these funds operate in, which should give you a peace of mind.

Investment funds also often get access to assets that may be difficult for you to invest in because certain assets are too expensive to purchase outright or they aren’t available to individual investors.

Related

What types of funds can I invest in?

At the end of 2020, there were approximately 126,457 regulated mutual funds with investments worth USD63.1 trillion worldwide. And while these funds are all run differently and have different risks and consequently, different expected returns, they can be broadly grouped by the assets that they invest in.

Stock/Equity Funds

As the name implies, equity funds (or stock funds) invest the pooled money in stocks traded on a stock exchange. The type of companies that a fund invest in depends on the fund’s investment goal. For instance, some funds have an aggressive growth strategy, which means that they may invest in high-risk growth stocks such as tech stocks.

Equity funds could also invest in a variety of stocks from different industries, or countries or focus on a specific sector or country.

For instance, there are funds that invest in a broad range of stocks in Asia, funds that invest only in energy companies in Singapore, and funds that invest in energy companies across Asia.

There are also equity index funds that are designed to mimic underlying indices such as the Straits Times Index ETF.

Generally, equity funds are riskier than other funds like money market funds and bond funds, which means that equity funds are more volatile in the short term. This is because stocks are shareholdings in companies, and companies are subjected to multiple business and economic risks. But equity funds tend to also have higher returns compared to bond funds or money market funds.

For people looking to grow their wealth over the long-term and for people who don’t mind taking added risk to earn a potentially higher return.

Debt/Bond/Fixed-Income Funds

Bond or fixed income funds are made up of bonds or other fixed income assets such as sukuk, and Treasury bills. These assets are called fixed income because you get a steady stream of income until the asset matures.

Just like equity funds there are bond funds that invest in bonds of companies in a specific country, sector, or market and funds that invest in a variety of sectors and markets.

Fixed income funds may be considered less risky investment compared to equity funds because of the regular payouts but they also tend to have lower returns compared to equity funds too.

Fixed income funds may be more suitable for people who are risk adverse and people who want to preserve their capital while earning moderate returns on their investments.

Cash Management Fund/Money Market Funds

A money market fund would invest your money in very short-term (less than one year) and liquid assets such as certificates of deposit, fixed deposit accounts and very short term and high-quality government debt instruments.

They may be considered one of the safest investments among the different types of investment funds but they also give you one of the lowest rates of return on your money, which is slightly higher than your regular bank savings account.

For people looking to earn extra return on their spare cash meant for short-term goals, a money market fund could be a possible avenue for them that won’t lock up their funds.

However, money market funds may not suitable for long-term investment goals, like retirement planning, because they don’t offer much capital appreciation.

Balanced funds

Balanced funds, also known as hybrid funds, invest in a mix of stocks and fixed-income securities. This type of fund aims to balance the risk-reward ratio, that is these funds try to maximise your returns while also minimising your risk.

As a balance fund invests in stocks, you get to enjoy gains that could come from the stocks going up in price. On the other hand, the fixed-income portion of the portfolio gives predictable fixed returns so when stock prices go down, the fixed income portion of your portfolio is still generating returns.

Generally speaking, the prices of stocks and bonds also tend to move in opposite directions, so when you have both assets in a fund, you potentially can reduce the fluctuations in the value of your portfolio.

There are aggressive funds that invest more stocks and fewer bonds, and the conservative funds hold fewer stocks compared to bonds. A typical balanced fund invests 60% in equity and 40% in fixed income.

Balanced funds tend to be lower in risk compared to equity funds but can potentially give you more return compared to bond funds. These funds may be suitable for people who want to grow wealth while earning a steady income stream.

Related

What are the benefits and downsides of investment funds?

Instant diversification

Instead of holding a few stocks or bonds, investment funds give you more exposure to a diversified basket of investment products because they invest in a vast range of companies and industries. This helps to lower the risk if one company fails, or if an economic sector performs badly.

Diversification reduces your potential losses.

There is something that suits everyone’s financial goals

One of the biggest advantages of investing with funds is the wide variety of funds to choose from based on your risk tolerance and investment time horizon. Regardless of your income level, risk-return expectations or what your financial goals are, there is an investment fund product that possibly fit your requirement.

Affordability

When buying individual stocks, you may need to save up more money before you can buy the stock. But investment funds benefit from what is called “economies of scale” because they can invest the large pool of money from all their investors into assets that could be more expensive to buy as an individual.

Liquidity

In case you need the investment money in a hurry, unlike holding a property, you can withdraw your investments easily at any time. When the stock market goes down, an investment fund can usually absorb financial market shock better because it is a portfolio of diversified securities. This means that you’re less likely to be caught with huge losses compared to owning individual stocks if you need to sell your investment quickly.

Professional Management

All funds are professionally managed by fund managers who are licensed to do the job. Before investing, fund managers and a team of financial analysts always research the market conditions and the securities.

They are professionally trained to decide the best stocks, bonds, or other securities to generate as much income for the fund’s investors. Not only do they select the securities, fund managers also are meant to monitor the performance of your investments.

So, for people who don’t have the time to research and monitor the market, an investment fund could be the way to go.

Some investment funds have financial advisors who are also qualified to advise and find you the best fund to fit your financial goals.

Related

Disadvantages

High management fees

Because the funds are managed by professionals, when you invest you must pay the fund company a management fee. This fee is typically higher than the brokerage fee you’d normally pay to buy and sell stocks. Some fund companies also charge an exit fee when selling your fund units.

Locked in Clause

There are usually two different investment fund structures. The first allows you to buy and sell at any time such as index funds and cash management funds. The other one, there are funds where your investment may be locked in for a certain period and if you take your money out earlier, you must pay a penalty.

Before you invest in a fund, check if there is an exit clause – how long you’d have to keep your money invested before you can withdraw it without a penalty. If there is a penalty, find out how much you need to pay.

Always do your research before you invest

While investment funds are convenient, affordable, and professionally managed with built-in diversification, it’s still crucial to read the funds’ prospectus to understand what you’re putting your money into. The prospectus will tell you the fund’s investment goals, asset allocation, risk level, fees, and past performance.

Content sponsored by Futu Singapore Pte. Ltd. (moomoo trading app). This article has not been reviewed by the Monetary Authority of Singapore.

You can start investing in different types of investment funds via moomoo

You don’t have to pay any fees to buy into any fund on the app and the fund management fee is deducted from the fund assets.

From now until 31 May 2022, 23:59 SGT, complete Fund-related tasks below to get rewards:

- Learn about moomoo’s Money Plus and watch the explore page to get a 3-day 15% fund coupon and 800 moomoo rewards points.

- Set up an automatic investment plan to get a 3-day 15% fund coupon and a SGD 8.80 cashback coupon.

- Subscribe to a non-MMF (money market fund) above SGD 100 to get a 3-day 15% fund coupon and SGD 5.80 worth of stock cash coupon.

- After completing all tasks, new users can unlock an exclusive gift package, which includes three 3-day 15% fund coupons, 1,500 moomoo rewards points, and a SGD 18 fund cashback coupon.

Also, if you don’t have an account with moomoo yet, you can sign up here and get the welcome rewards.

Moomoo is the first global digital brokerage to offer $0 platform fee, $0 market data fee and lifetime $0 comission for US stocks!* This promotion is valid till 30 June 2022, 09:59 SGT.

Account Opening Reward:

- Lifetime comission-free trading for US stock market*

- 1-year free platform fee for US stock market

- SGD 40 Cash Coupon (SGD 10 Stock Cash Coupon and SGD 30 Fund Cash Coupon

- Free access to real time Market Data Lvl 2 for the US stock market, Lvl 1 Market Data for the SG stock market and Lvl 1 Market Data for China A Shares market

First Deposit S$2,700 Reward:

- 1 change to spin the wheel and get 1 free share* worth between SGD 20 to SGD 1,000 (this includes stock from Apple, Facebook, Tesla and more)

Begin your investment journey today with moomoo. *T&Cs apply.