Financial Planning | Personal Finance | Article

Greed, COVID-19, and You

by Sophia | 24 Feb 2020 | 5 mins read

Earlier this month, DORSCON Orange sent the entirety of Singapore into a tizzy. As mass hysteria and fear swept across the island, another large force was sweeping through local supermarkets and clearing out the shelves of toilet paper, instant noodles, and surgical masks.

While some were going in out of fear, but some went in due to another strong motivator: Greed.

Shortly after the shelves were swept, platforms like Carousell became hot marketplaces for these basic necessities at insane prices.

Ridiculous and unethical, you might think. But greed is a very strong motivator.

What can we learn from these profiteers, and how could it all possibly relate to our financial lives?

The Great Toilet Paper Rush of 2020

If you search online, you can actually find toilet paper jacked up to $5 per roll on Carousell.

Let’s presume that people actually buy toilet rolls at these multi-plyed prices.

Onlookers may think, hey, this toilet paper reselling business is a gold mine! In a very short amount of time, toilet paper prices will go up to $50 per roll.

Now everyone’s in on the toilet paper reselling business — your uncle, your neighbour’s dog. Even your mother is telling you: Stop sitting on your ass and get in on this toilet paper action!

Prices are driven up to insane levels and hey presto! We have a bubble — one fuelled by greed.

This scenario is not far from the truth, just look towards Hong Kong, where toilet paper has become such a hot commodity that risking jail-time — for rolls of toilet paper, no less — has moved into the “Hey, that’s a good idea!” portion of the risk-reward matrix.

Locally, you might even have seen friends or acquaintances selling sanitiser and masks as a side-gig on social media.

But other than mindless profiteering, what does this have to do with personal finance? What’s it got to do with you?

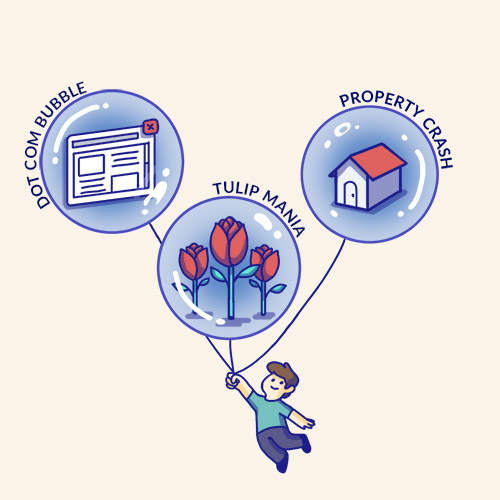

Well, greed-fuelled bubbles like this have happened many times in the economic markets, from the financial to even the housing markets.

One of the freshest incidents in Singaporean history is the property bubble of 2008, runaway demand caused prices to rise in an unsustainable fashion.

But many were willing to pay the elevated prices, assuming it would keep rising — but of course, the music had to stop.

It was like a game of pass the parcel, but with 6-figure sums at stake. Finally, someone was left holding the bomb.

Crazy, you might think, but the amazing thing? This happens a lot in the wider economic markets. Unsustainable bubbles, driven by mania and greed, have grown and popped all the time, from alternative investments — Bitcoin’s crash in 2018 — to the investment markets — the 2000 dotcom bust.

And of course, the property market bust as we have outlined above in 2008 — since 90% of Singaporeans own home, so even if you don’t invest, you might possibly be exposed to such a price bubble in the future, tempting you to sell your BTO.

Greed Drives Us

So the fear and greed brought about by COVID-19 are not new; the panic and rush are similar to what you’ll find in markets.

In the case of the coronavirus, our supermarkets can be analogous to these economic markets, with frenzied investors hurriedly “stocking up” because everyone else is.

Okay, it isn’t really directly comparable in this instance, as the panic-shoppers seem to be more driven by fear for their safety, but the point is that these emotions spread quickly; Fear drove shoppers to protect themselves — then came the second wave that clears out the shelves because they don’t want to lose out.

Greed works the same way, the first-mover profiteers manage to make a quick buck — then comes the FOMO-driven second wave.

While you might have not joined in during this virus episode, but hand on heart, will you not be tempted to join the fray if you one day learn your BTO’s selling price has jumped two-fold within a year, and all your neighbours are choosing to sell their flats?

Don’t get us wrong, greed can be good, after all, it can drive you to be more productive to get a higher salary, or spur one take the risk of opening a business. But learn to spot bubbles fuelled by rampant greed and speculation.

The Five Steps of a Bubble

Economist Hyman P. Minsky identified five stages of economic instability — or the pattern of a bubble.

These stages are summarised by investopedia:

1. Displacement: Investors start to notice a new paradigm — like a new product or technology, or historically low-interest rates. Basically, anything that gets their attention.

2. Boom: Prices start to rise at first, then get momentum as more investors enter the market. This sets up the stage for the boom. There is an overall sense of failing to jump in, causing even more people to start buying assets.

3. Euphoria: When euphoria hits and asset prices skyrocket, caution is thrown out the window.

4. Profit-taking: Figuring out when the bubble will burst isn’t easy; once a bubble has burst, it will not inflate again. But anyone who looks at the warning signs will make money by selling off positions.

5. Panic: Asset prices change course and drop as quickly as they rose. Investors and others want to liquidate them at any price. Asset prices decline as supply outshines demand.

As we mentioned, these bubbles typically will leave some burnt. True, some will win and make a killing, but if there is a winner there will be a loser — do you want to take that chance with your hard-earned money?

So when others might recklessly invest in pure sentiment, we hope you’ll do what you did during this episode: Instead of giving in to emotion, stop for a minute — and just assess the situation with a rational mind: is the price increase you are observing justified?

And luckily for us, in this case, there is enough toilet paper to go around.