Investing | Article

Winners and Losers of Crypto

by Sophia | 30 Jan 2019 | 9 mins read

If Bitcoin were a person, it would be a Gen Z kid today. Born in 2008 — on Halloween, no less — Bitcoin has had a rather interesting life with its fair share of ups and downs while you and I were busy grappling with the first years of secondary school.

But if you’re anything like me, you would’ve only had a shallow impression of the concept of “alt-currency” — much less blockchain technology.

So here’s a TL;DR version of the history of crypto, one of the biggest alt-currency forms around:

- On 18 August 2008, the domain Bitcoin.org was registered.

- In October 2008, Satoshi Nakamoto released the paper “Bitcoin: A peer-to-peer electronic cash system.”

- The first Bitcoin transaction happened on 12 January, 2009.

- On 3 February 2010, 10,000 Bitcoins were used to buy two pizzas.

- The following year, cryptocurrency competitors emerge in the market.

Why is cryptocurrency so revolutionary?

Talk about crypto and you’ll have to bring up blockchain technology. Blockchain is the new kid on the block — and everyone wants a piece of them. “Why?” you might ask. Well, because of what blockchain can do!

Blockchain enables the existence of a decentralised platform where information can be freely exchanged in a trustworthy way.

Think of it like using Google Sheets to edit a financial table for a group project. You’ll work on the document with three other people. Whenever a change is made to it, everyone will see it.

In a data-heavy world, protecting sensitive information and preventing corruption is key at every turn. This is what blockchain can do for individuals, businesses and industries all around the world: offer integrity, security, and transparency.

Cryptocurrency is built off this technology. Essentially a world-wide, peer-to-peer digital currency with blockchain’s security benefits.

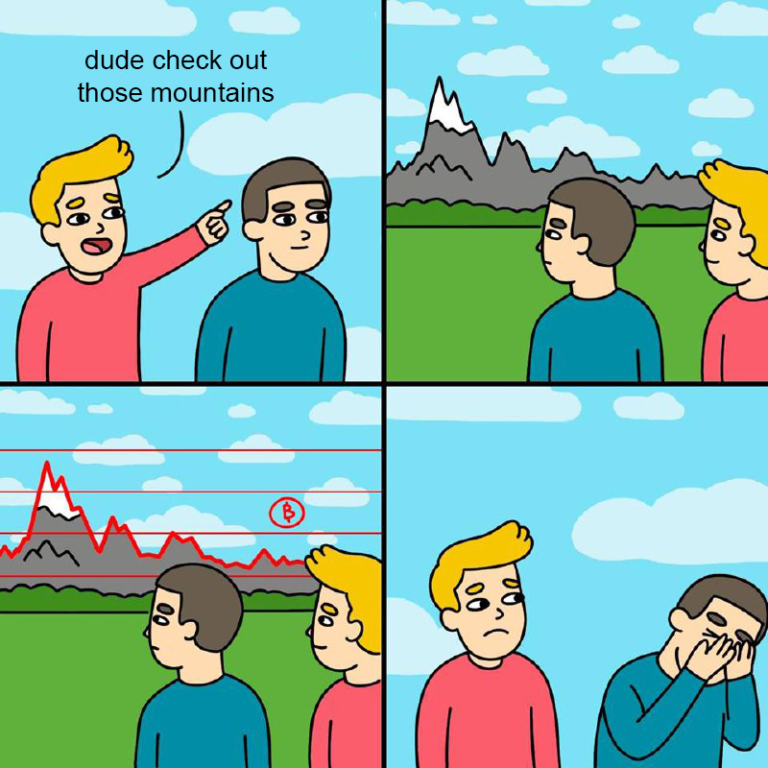

That, and cryptocurrency was lucrative, really lucrative.

At the height of its growth, crypto held the power to make heaps and heaps of money for investors who were willing to ride the wave, (or those who were overcome with FOMO).

Early adopters invested into early cryptocurrencies, namely Bitcoin and Ethereum, because of their potential to disrupt the traditional financial systems.

Imagine not having to pay merchant or bank fees, or even currency conversion rates. Yet, still transacting safely and conveniently, because of the underlying blockchain technology.

But, actually happened next was an influx of FOMO investors who wanted to make a quick buck.

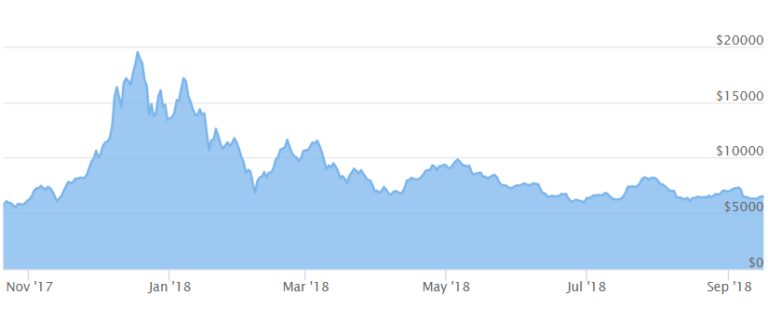

In 2017, Bitcoin’s valuation rose higher than a single ounce of gold.

End 2017? The frantic market peaked, a single bitcoin went for USD$19,783.

Even then, many believed the train would not stop, The cryptocurrency wave seemed to be an unstoppable juggernaut.

But as with any kind of investment, an outsized possibility of profit will always be matched by the same level of risk.

Living the crypto dream

Jacob, 32, works in B2B sales. For him, the secret to success happened over a period of seven months after he started investing in cryptocurrency in September 2017.

Right before crypto’s peak.

But he wasn’t initially interested in crypto or blockchain — that is, until his colleagues hyped it up.

“Colleagues started investing in Ethereum,” Jacob told me. “Then I looked up the concept of blockchain tech. It was revolutionary; the more I read, the more interested I became.”

Sometimes following the noise might lead you somewhere good. But Jacob didn’t start off the same way with everyone else and invest his money into the popular, and more established coins, such as Bitcoin or Ethereum.

“I’m more of a risk taker,” he said, “so I looked at Initial Coin Offerings (ICO). They’re like Initial Public Offerings but for blockchain companies.”

When a company wanted to launch a new cryptocurrency (or alt-coin), they used ICOs to raise money — essentially selling their new crypto-tokens in exchange for the established and more valuable Ethereum and Bitcoin tokens.

And for a time, people were making good money out of it. The limited ICO tokens sold at a discount on launch, rewarding early investors for taking a risk on them.

Then prices would rocket on some ICO tokens, as FOMO investors came in later, clamouring for a slice of the action.

The initial ICO investors, who bought the tokens a discount, would resell the tokens to these later investors for a profit.

The good thing was that money wasn’t the only thing that interested Jacob; he was really into understanding blockchain technology and the crypto space as well. So he had an inkling of which ICOs to back, and make a profit off.

When asked about how much he poured into his initial investments, Jacob said, “A lot of my savings. It was risk-taking — and I didn’t have any financial obligations so the money went into cryptocurrency.”

The fruits of his labour came months later, around March to April 2018. How much did he earn off crypto? “400% returns,” was his revelation.

Imagine investing $10,000 and getting back $40,000 in just a few months.

Winning the market: Was it skill or luck?

Jacob admitted it was “definitely luck” that bagged him such a huge win during the crypto craze. In 2017, Bitcoin’s valuation rose higher than a single ounce of gold.

“It’s not skill [that helped me] in a traditional sense, like tech and fund analyses,” he said. “ICOs are like startups— so there are no strong financial numbers or indicators telling you if they’ll work or not.

“What I did was join mastermind groups. I had a good mix of people who understood the tech and did company research,” Jacob shared, when asked about how he got hold of the right information to make good investments.

“There were a few indicators [we used] to guesstimate as well. And at that time, a lot of money was being poured into crypto.”

Jacob rode the crypto and alt-currency wave — but didn’t stay for the whole ride. “I intentionally liquidated around [March or April] because I was making good money. It was super risky — the market was showing signs of weakness. So I took the money out and used it for property.”

The dreadful downside: An investor’s staggering loss

Others in Jacob’s circle weren’t so lucky, because no one else thought to pull out of the market like he did at the time. Some friends borrowed money from banks and mortgaged their houses in the US to invest in crypto.

“A lot of friends were burned,” he revealed. “There’s a lot of anger and frustration in the crypto circle because of all the money that was lost. It’ll take you years to forget about it.”

After speaking with Jacob, I got in touch with another investor, Cedric (who runs SeniorCare, an online store catering elderly products), through the 5,900-strong CryptoSG group on Telegram to ask about his experience with crypto.

In private messages, Cedric revealed his day job: an e-commerce business owner. He ventured into crypto as a “newbie,” and began by attempting mining and staking.

“I have about 30 GPU cards mining Ethereum. I also mined in Indonesia, but those attempts soon gave way to simply buying crypto to hold “because [mining and staking] were too complicated, when Ethereum went below $200, we all stopped mining.”

When asked about his initial investment in alt-currency, Cedric shared, “I started out with $20,000 USD before gradually pouring in $10,000 to $5,000 at a time.”

To date, his investments total at a gigantic amount: $135,850 SGD.

“I started at the beginning of 2018. Ethereum was around $700 and rising,” Cedric recounted. “It later rose to $1,300 then began to fall, dropping till it hit $400. I made a big purchase at that time. It was my last purchase.”

It was alternative investment money I could afford to lose,” Cedric mentioned. “But of course, I’d be a lot richer if I’d kept the money in Fixed Deposits or stocks instead.”

This was not a loss easily forgotten over the span of a few weeks. Today, Cedric is still holding onto the crypto he bought. Despite the burn (and presently investing in stocks and properties), he still has hope for alt-currency. (Similarly, Jacob is still holding onto some crypto.)

“It’ll probably take two or three years for it to climb again,” he said. “It probably won’t be as hyped up, though.”

Jacob echoed a similar thought during my chat with him: “Investing will be quiet for a while, but blockchain is still around. Crypto is a small subset of blockchain — but it will evolve.”

Updated June 2019

As of 2019, bitcoin prices seems to be ‘mooning’ again – rocketing from stagnation and more than doubling to $12,000 within 3 months. Again, the surge seems driven by speculation, not real-world demand. Anyone thinking of hopping on the bandwagon has to be prepared for another rollercoaster ride.

Don’t go in blind with alt-currency or crypto

Despite experiencing vastly different outcomes from their time with crypto investment, Jacob and Cedric both had similar pieces of advice to share, one jumped out the most:

Don’t invest money you’re not prepared to lose.

After all, the main difference between Jacob and Cedric was a mere matter of timing and luck, with vastly different results.

“I could afford to lose the money because I’m young and dared to take the risk,” Jacob said. “But don’t play with fire if you can’t deal with the consequences.”

Cedric advises starting out with “small amounts of money,” and cautions that new investors should only look at main alt-currency forms like Bitcoin and Ethereum. “Don’t participate in ICO unless you truly understand what’s in it,” he added.

As they say, knowledge is power. Getting into something as new and revolutionary as crypto can be exciting as hell, but don’t be so quick to jump the gun. Making a quick buck comes with its risks — and any wise investor knows recklessness is not how they should play the game.