Investing | Article

Navigating a Volatile World with Diversified Income

by The Simple Sum Team | 3 Oct 2023 | 11 mins read

This article was brought to you by Fidelity International.

Everything (yes, everything) is getting more expensive these days.

Your chicken rice used to be $3, now it’s $4. Your rent is now $1,000 higher. And if you are on the market to buy a house, you’ll find that you might now need to fork out extra money for the down payment.

These instances point to one simple fact – almost no one has escaped the impacts of inflation.

In a bid to tame this inflation, central banks have hiked interest rates, resulting in higher mortgages rates, and along with the increased cost of living and cost of borrowing, many people are feeling the strain on their wallets.

In a bid to tame this inflation, central banks have hiked interest rates, resulting in higher mortgages rates, and along with the increased cost of living and cost of borrowing, many people are feeling the strain on their wallets.

Even investors are feeling the pain. The interest rate hikes have caused plenty of ups and downs in the stock market, and talks of an impending recession, particularly in the US have kept investors on edge.

But as they say, amid chaos, there is opportunity. No matter where we are in the market cycle, there’s always a suitable investing strategy that you can employ for your money to beat inflation and grow over the long-term.

One such strategy you may not have heard of is income investing.

What is income investing?

A simple way to describe income investing is this: Invest your money wisely in an asset that has the potential to provide you with a reliable and consistent income stream as long as you hold on to it for a certain time period.

That asset could be a blue-chip stock – a very large, reputable company with a track record of consistent profits. Some of these companies pay out a portion of their profits as dividends to shareholders on a regular basis (often quarterly or half-yearly). Just by the very fact of owning these stocks, you could earn additional income and potential capital growth when the companies’ stock prices increase in tandem with the companies’ growth.

And you’re not just limited to blue-chip stocks. You can earn income from buying bonds and getting a regular payout – normally called a coupon. However, it can be difficult to buy bonds directly as investors typically require a big sum of money accessible only to wealthy investors. Hence, one way to overcome this is to buy a fund that invests in these bonds or fixed income assets.

In today’s uncertain economic climate, income investing could help combat inflation, and help build a resilient portfolio that can withstand market volatility while allowing you to secure a consistent income stream so you can benefit from both potential long-term capital gains and regular pay-outs.

A steady cash flow no matter what happens in your life through high quality assets

Most of us have a day job, and maybe even a side hustle to provide for ourselves and our family needs.

With income investing, your money is invested with the aim of making more money for you. By buying into income-generating assets, you could receive a regular payout regardless of what’s happening in your life.

This is one of the primary benefits of including income-generating assets or funds in your portfolio – it’s another layer of regular income you could earn effortlessly on top of your day job, business, or side hustle.

Moreover, for an asset to produce a regular stream of income, they typically need to have strong fundamentals.

Think about it, how can a company pay out dividends to its shareholders if it is not making money? The answer is, it can’t.

Part of the appeal of an income investing strategy is being able to own high-quality assets that can reliably generate stable returns year after year. Even when market sentiment shifts from optimistic to pessimistic, high-quality assets tend not to fall out of favour as much as speculative assets in the long-term.

In scenarios where money (and credit) is tight, investors start shifting their assumptions of future earnings, relying less on what ifs and more on the current fundamentals of a company, which explains the importance of owning high quality assets.

Regardless of your investing strategy, owning high-quality assets in your portfolio helps you manage your portfolio risk, especially during market downturns. Moreover, having a steady stream of income from income investing can also give you more options as you can put it towards your short-term goals like padding up your travel fund to Japan and long-term financial goals such as your retirement, or your kids’ university fund.

Related

Reduce portfolio risk through diversification

Many people “won” in the markets over the last couple of years because stock markets and crypto markets were on the up and up.

If you bought GameStop, Bitcoin, or had invested in a basket of tech stocks when they were soaring, you would have made a pretty decent return.

When markets started to turn eventually, many people “lost” in the market. The S&P 500 lost 18.1% of its value in 2022, and the Nasdaq 100 declined by about 32.4% last year. In some cases, people who went all-in on an alt-coin or trending stock with too much exuberance lost a chunk of their funds when these investments went sour.

These alarming stories of investment loss serve as another reminder to manage your risk in investing through diversification.

Diversification spreads your money across different assets, asset classes, sectors, and regions, and this helps reduce risk in your portfolio. This means that if one investment underperforms, it won’t have as big of an impact on your portfolio as a whole.

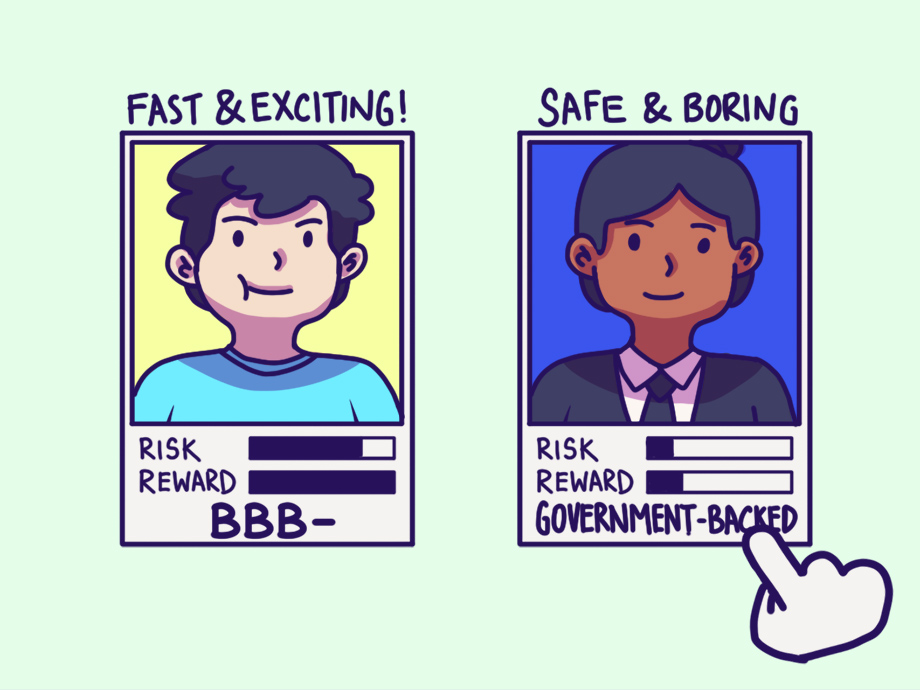

One tack investors have taken is to balance the higher-risk more volatile assets they have in their portfolio with allocations to income-generating assets such as bonds or dividend stocks.

High quality bonds are generally known for their stability and predictable returns, and can help mitigate portfolio volatility. Equities with strong underlying fundamentals, on the other hand, provide opportunities for capital appreciation and dividend gains. With income investing, you have the advantage of building a diversified portfolio with various assets, adding an additional layer of defence to your portfolio.

Related

Investment Calculator

Find out how much your money can grow with the power of compound interest if you start investing early.

Consider these in your income investing strategy

However, just like the risk of injury in any sport, different investing strategies also entail their own distinct risks. So, it’s important to know what risks you may encounter when taking on a specific strategy.

Here are some considerations to keep in mind when taking the income investing approach.

Consistent income versus capital growth

As a long-term investor, you’re always in a balancing act between risk and return. While you may want to achieve the highest possible return while minimising risk, the reality is that high returns usually come with high risk.

Hence, you need to find the balance between risk and return that aligns with your investment goals and your risk tolerance through diversification. This may mean having an allocation towards income-generating assets in your portfolio to increase its defensiveness and reduce your portfolio’s risk to a level that you’re comfortable with, while still giving you the ability to earn a return that can meet your investment objectives.

It’s not just about the yield

When selecting assets to include in an income portfolio, you might be drawn to assets with the highest yield. While a high yield may seem appealing at first, there are other factors to consider to ensure the long-term success of your portfolio such as the sustainability of said income over time.

To evaluate the sustainability of the income stream, look at the quality of the asset, the stability of the industry or sector it belongs to, and the potential threats or challenges that could impact the income stream in the long-term.

Interest rate impact

Interest rates have a significant impact on income assets because they can affect the value of bonds and other income-generating holdings.

As rates rose the past year, we saw bond prices go down. While the value of bonds has little impact if you intend to hold them to maturity, it’s vital that you consider how interest rates affect your investment strategy and adjust your portfolio accordingly.

By keeping an eye on interest rate movement, you can make an informed decision about your investments and manage any potential risks in your portfolio.

Related

Income investing: A viable way to build wealth

With all these considerations in place, income investing can be a viable strategy for building a resilient, defensive and diversified portfolio that generates consistent cash flow. By focusing on income-generating assets, such as dividend-paying stocks and bonds, investors potentially benefit from long-term capital gains and dividends.

This approach not only safeguards your investments against the erosive impacts of inflation but also provides a buffer against market fluctuations, and may also offer a dependable income payout, allowing investors to navigate both the current landscape and reap the rewards of sustained growth and dividend distributions.

Nevertheless, just like with any investing strategy, it’s important to stay focused on your investment objectives and stay the course, even when markets are volatile.

As you keep your eye on your investment goals, also remember that the ever-evolving market and economic conditions can impact your portfolio’s performance. So, you need to be agile – stay informed, adjust your portfolio as necessary, and most importantly, have patience. If monitoring your portfolio and making adjustments sound like too much work for you, you can consider seeking out experts to help you.

By taking these actions, you will be better equipped to weather the ups and downs of the market and achieve your financial goals.

Content sponsored by Fidelity International

There is a lot of work that goes into building an income-generating portfolio – finding the right assets to include, calculating the yield, monitoring your portfolio’s performance and making adjustments accordingly. Shortcut this process by investing in income funds. These funds are actively managed by investment professionals whose full-time job is to research and study stocks, bonds, market trends, etc.

Fund managers like Fidelity International have a large ‘on-the-ground’ research network with deep local insights on emerging and developed markets. In fact, Fidelity has a global network of more than 550 investment professionals in more than 25 locations worldwide, making them one of the largest investment teams globally that analyses more than 95% of the companies in the MSCI World Index.

With global reach and local insights, Fidelity’s rigorous investment process analyses more than 15,000 companies each year with insights shared across all asset class specialists for a 360 view. Bringing together research insights, experience and expertise, a fund manager like Fidelity has the knowledge and agility to generate income over different market cycles^.

Learn more about Fidelity’s income solutions here.

^Information on Fidelity International provided as of 2023.

This publication is prepared on a general basis for information only. It does not have regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive it. You should seek advice from a financial adviser before investing in the fund(s). If you choose not to seek advice from a financial adviser, you should consider whether the fund(s) in question is suitable for you. Views expressed are subject to change, and cannot be construed as advice or recommendations. This publication has not been reviewed by the Monetary Authority of Singapore.

FIL Investment Management (Singapore) Limited [“FIMSL”] (Co. Reg. No.: 199006300E) is the representative for the fund(s) offered in Singapore. Potential investors should read the prospectus, available from FIMSL or its distributors, before investing in the fund(s). The value of the shares of the fund(s) and the income accruing to them, if any, may fall or rise. The fund(s) may use financial derivatives, which entail specific risks as described in the prospectus. Past performance of the manager and the fund(s), and any forecasts on the economy, stock or bond market, or economic trends that are targeted by the fund(s), are not indicative of the future performance.

Fidelity, Fidelity International, and the Fidelity International Logo and F Symbol are trademarks of FIL Limited.